by Team AllYourVideogames | Sep 1, 2022 | Shopping |

For those who live, study, visit or exchange in another country, one of the most important points to pay attention to is the sending and receiving of money.

To have a good experience, it is necessary to research the best platform or bank that provides this type of service in relation to cost benefit, fees, speed of operation and security.

Therefore, among the different ways to send money abroad, one of the oldest institutions that provides this service is the Western Union.

In this post, you will see how Western Union works, the operations that it is possible to do, how to send and receive money from abroad, fees, limits, advantages and disadvantages and some other important information.

Before approaching the services that Western Union offers to its customers, check out a brief historical context of the institution that has been in the market for over 160 years.

Western Union and its history

Western Union began operations in 1851 in Rochester, New York, in the United States.

The first services provided by the institution were with telegrams.

Over time, the company grew, so much so that in 1861 the first transcontinental telegraph line was completed.

In 1865, he launched the Russian American Telegraph Company, which had the objective of carrying out services from the United States to Europe.

Only 20 years after its founding in 1871, the institution began to offer bank money transfer services.

Thus, entering this market was successful.

In the 1980s, the institution began to focus all its efforts exclusively on sending money abroad.

In this way, Western Union has managed to become a consolidated institution in the market, with the opening of services throughout the world.

The institution offers its services in more than 200 countries, working with almost 130 types of currencies in its operations.

Today, the headquarters of the financial multinational is in Englewood, Colorado.

Our country has more than 13 thousand establishments with Western Union services. These points serve as support for those who want to send money to another country.

To find out if there is a branch near you, simply access the Western Union website and enter the requested information on the website.

In addition to the branches, the company's users have a broader service in some cities across the country.

That's because stores like Riachuelo also offer Western Union service through a partnership.

Some exchange, tourism and lottery agencies are also authorized to be part of the institution's network.

You can see that the company is more than centenary and has a good name in the market, managing to attract customers through its credibility.

But after all, how does Western Union work?

Western Union and the services offered

Western Union can be defined as a money intermediary between several countries.

This means that people can send remittances abroad, either to their own account or to the account of other people.

These operations can be carried out at the company's branches in person, on the website, in an application available for Android and iOS, and even by phone.

In this way, in addition to being able to send money abroad, Western Union offers the following services to its customers:

- Transfers within the national territory: to carry out this operation, it is necessary to present documents and bank details, and it is also necessary to have the identification of the person who will receive the money;

- Redeem remittances coming from another country. Be aware that the redemption location is unique and must be indicated at the stage of filling out the form by the person who will send the money;

- Trading in foreign currencies: the company user can sell the most sought-after currencies, for example, the dollar and the euro. Other coins that are not used as often need to be ordered upon request;

- Prepaid Card: Western Union offers its customers a rechargeable card to use for multi-currency travel, which can be loaded with up to six different currencies (Euro, Pound, US Dollar, Canadian Dollar, Australian Dollar and New Zealand Dollar). It is worth mentioning that the card has the MasterCard brand and to have it you must go to a physical branch of the company. In addition, another relevant point is that, in the same way as with credit cards, the IOF is also charged.

And speaking of IOF, a very important point that needs attention when making international remittances is the fees charged by platforms specialized in this service.

So, see what fees Western Union charges its users.

Western Union and overseas remittance fees

Western Union offers cheaper rates than conventional banks and is also able to compete against other platforms that offer this type of service, such as Remessa Online and Wise.

In this way, the company works with the exchange rate of the currency quotation at the time of the transaction.

In addition, the cost of operation is variable and the fees will depend on the following aspects:

- The amount of money sent abroad;

- The method of transfer: whether to redeem the remittance at an agency, a partner store or through a conventional bank;

- The way in which the transfer payment was made;

- The country of the one who sends and the one who receives the remittance.

In addition to the aforementioned charges, it is important to remember that there is also the cost of the Tax on Financial Operations (IOF), which refers to a mandatory tax imposed by the Federal Government on international transfers.

Thus, regardless of the platform or bank you use to make transfers abroad, this tax will always be charged.

The IOF can be 0,38% if you send money to someone else, or 1,1% if you send the money to your account in another country.

To be clear, the shipping costs for remittances made on Western Union are added in addition to the money the user sends abroad.

That is, the cost is not deducted from the value of your shipment.

So the operation has to be paid separately.

Another important point is that Western Union does not inform the exact cost of the exchange rate applied, which may change the amount to be paid to carry out the operation.

Therefore, to know exactly the costs charged, it is necessary to simulate the shipment until the last phase of the entire process.

So, before sending your shipment, it is recommended that you do a simulation during the shipping stage.

Still on the exchange, check the rules that refer to this subject in more detail below.

Western Union and the Cost of Foreign Exchange

The commercial exchange used by Western Union is similar to the tourist exchange.

So, to understand this issue it is necessary to know the differences between the exchange rates.

Commercial exchange rate is the value of the currency during the execution of a transfer, whether it is sent to another country or to be received in our country.

For example, the dollar at the exact moment of writing this part of the post was R$5,17.

Tourism exchange is nothing more than physical currency, which are traded in exchange offices.

It is worth mentioning that the tourism exchange has a higher value than the commercial exchange, because some costs are attributed to it, such as taxes, administrative expenses, logistics, among other expenses.

Another relevant point is that Western Union earns revenue from the exchange, and that it may have different amounts, according to the service channel that the customer uses.

Therefore, it is also worth mentioning that the person receiving the remittance does not need to pay the platform fees.

The costs are borne by the person making the shipment.

Learn More: What is the best digital bank to store money?

Understanding the fees costs, now you need to know the limits established by Western Union on sending remittances.

Transaction limits

Western Union limits sending money abroad to €1 per transaction just by registering on the site.

Values above that, with a limit of up to €5, you must identify your identity.

The minimum transfer amount is R$5. A negative point is that the site does not inform the monthly or annual limit.

Being aware of all the information shown so far, the time has come for you to know how to send money abroad using Western Union.

How to send remittances abroad by Western Union

Remembering that you can send money abroad using a phone, over the internet using the website or app and also at an agency.

So, the tutorial that you will see right away will be using the website, but the operation follows exactly the same molds in the application.

And a little further down it will also be explained how to make the remittance in a face-to-face point.

Through the Internet

First of all, you need to create an account on the platform.

To do so, simply access the Western Union website, click on “Register” in the upper right corner, and then enter your first and last name and a password. Once this is done, you will receive an email confirming the creation of your account.

With everything right, see the step by step below on how to send money to another country using the platform.

Step 1: Go to the Western Union website;

Step 2: On the home page and with your account already created, click on “Sign in”. On the page that opened, enter the data to login. After logging into the account, you will be directed to the page that will start making the transfer operation;

Step 3: On the send money page, choose the country where the beneficiary is;

Step 4: Now enter the value of your shipment. After that, you need to choose how the recipient should receive the money, whether it's in a store or in a bank account. You also need to inform how you are going to make the payment, whether it will be by bank transfer or at an agency;

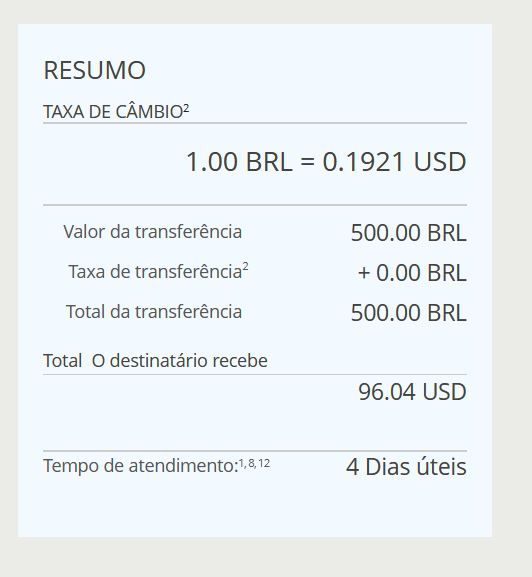

Step 5: After filling in all the information, take a look at the summary in the right corner of the screen.

See an example of how much would be a remittance of R$500 sent to the United States:

Step 6: If everything is ok, click on “Continue”;

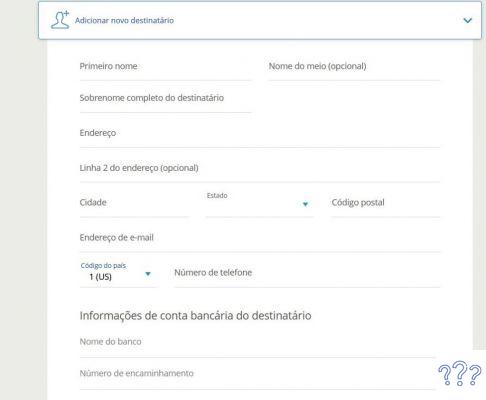

Step 7: In the tab that opened, you need to enter the data of the person who will receive the money. Later on, you will also need some information about yourself, such as your RG, passport or some document with photo and proof of residence. After filling in all the data, proceed to the next page;

Step 8: At the end of the operation, the site will show the exchange rate, the tariff values and how much the recipient will receive in their account;

Step 9: Now you just need to make the payment and wait for the money to fall into the account of the person who is abroad.

Be aware that after making the payment, the Money Transfer Control Number (MTCN) will be generated, a code of 10 numbers, which must be notified to the person who will receive the remittance, as this code allows the person to track the operation when it is made on the website or in the app.

With the code already in hand, to track the shipment, simply inform the MTCN of Western Union.

In addition to this code serving as tracking of your shipment, it is essential for the recipient to be able to withdraw the money if the sender has chosen to send the shipment to a physical agency.

A very positive point at Western Union is that the beneficiary does not necessarily need to have a bank account, as he can withdraw the money at any partner store or at the company's branches.

Remembering that to use this benefit, you must choose to receive the money at a physical establishment at the beginning of the operation.

Now, if you prefer to do the entire operation without using the internet, see how to send money abroad at a physical branch.

by agencies

To send remittances abroad using Western Union in person, you just need to go to one of the company's branches or partner stores, fill out the form that will deliver you and pay the fees.

Don't forget to bring a photo ID and your CPF.

And if you are a foreigner, but you are in our country, in addition to a photo document and CPF, you also need to present your valid foreign registration (RNE).

Western Union earns revenue from the exchange, and it can happen that it has different values, according to the service channel that the customer uses.

Therefore, it is also worth mentioning that the person who receives the shipment does not need to pay the platform fees, the costs are borne by the person who sends it.

Understanding the fees costs, now you need to know the limits established by Western Union on sending remittances.

Learn More: How to send money abroad?

Western Union: Advantages and Disadvantages

Western Union offers good services to its customers, but there are some points that need improvement.

But first, let's talk about the advantages of the platform:

Advantages

- Good amount of options to carry out remittances abroad: operations can be carried out through the application for mobile devices, website, telephone or at one of the 13 thousand agencies spread throughout our country, in addition to partner stores;

- Security: the company has excellent credibility and is consolidated in the market in which it operates;

- You don't need a bank account, which is a big benefit for people who are just traveling in another country;

- Transactions can be carried out by both an individual and a legal entity (PJ).

Now that the main advantages have been highlighted, learn about the disadvantages of the services provided by the company:

Disadvantages

- As the rates vary according to the country of sending and receiving the shipment, some operations can end up being very expensive, which is disadvantageous for the customer;

- The exchange value appears with a value at the beginning of an operation, but at the end this exchange value changes, which can end up confusing customers;

- Western Union offers a much lower limit for sending money abroad than other competing platforms such as Wise and Remessa Online, and even traditional banks;

- Some information is not available on the website, such as the monthly and annual remittance limit.

With everything explained, make comparisons of the positive and negative points of Western Union.

Before transferring money abroad, research as much information as possible about the platform you are going to use and be sure to look at the largest number of specialized services to find out which platform you like best.

And finally, if you have any questions, be sure to look for answers and clarify everything before doing any operation using the remittance shipping platforms abroad.

In the case of Western Union, you can seek assistance from a physical branch, or through the following telephone number: 0800 707 9330.

If you prefer to send messages by email at customerservice@westernunion.com.