by Team AllYourVideogames | Oct 6, 2022 | Technology |

If you already have or intend to open a business, a credit card machine can be very useful for your business.

And one of the most consolidated companies in the market in this field is SumUp.

Therefore, throughout the text everything will be explained about the SumUp Machine.

In this post, you will check all the SumUp maquininha models, the fees charged by the company, the accepted flags, the positive and negative points of the service, how to request the tool and some more important information to let you know about this subject.

To SumUp company

SumUp is a company with German origin that started its activities targeting the public of small entrepreneurs who wanted to start their commercialization allowing customers to pay for products via credit card.

Today, the company has three different types of machines, each one designed for the economic profile of the entrepreneurs.

So, get to know all the models to find out which one best fits your business.

SumUp Machine: Models

SumUp has a more basic machine, suitable for small entrepreneurs and freelancers who are starting a simpler business and want to use their credit card as a form of payment.

Another model of device for small businesses that aims to achieve certain stability and freedom in payments, without the need for a cell phone.

And a third machine for entrepreneurs looking for a complete solution, with printing of transaction receipts and multi-connection.

In this way, check the details of each of the SumUp maquininha models below.

SumUp Maquininha Top

SumUp Top is the company's entryway machine.

It is the cheapest alternative among the three tools, which makes it ideal for people who are starting a business and do not yet have the capital or need to buy a more powerful machine.

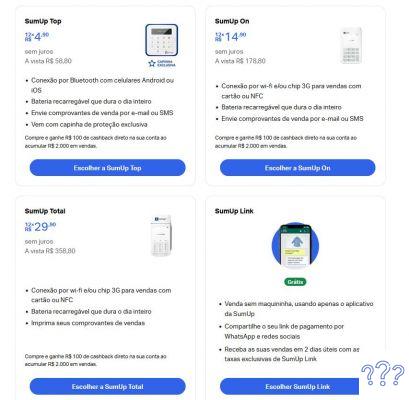

Thus, if you want to buy Top, you will need to pay 12x R$4,90 without interest or pay R$58,80 in cash.

For this price, it is one of the cheapest machines that can be found on the market.

Receipts are issued via SMS and e-mail, but it is not possible to make a typed sale, that is, without using a physical credit card.

You need to keep in mind that for SumUp Top to work, you must have a cell phone.

Therefore, it is necessary to download the SumUp application on your smartphone and pair it with the machine via Bluetooth.

The app is available for Android and iOS devices.

Remembering that the application requires Android from version 4.1 and IOS starting from version 7.

Another requirement to use the machine is to turn on the cell phone's GPS when making the sale.

Cell phone use is mandatory because Top needs to connect with your smartphone to use the internet connection, whether 3G, 4G or Wifi, and carry out transactions.

After installing the application on your cell phone and pairing the devices, the sales operation is very easy: you just need to enter the sale information in the app, such as the product value, debit or credit and the number of installments.

After that, just insert the card in the machine and ask the customer to enter the password and, finally, send the receipt by email or SMS.

Even if you have doubts about how to use the machine, you don't have to worry, when you request the tool a manual comes with it.

In addition, you can also refer to the PDF version manual.

SumUp Maquininha On

SumUp On is the company's mid-range model.

It costs 12 installments of R$14,90 without interest or R$178,80 in cash.

And one of the advantages of the On in relation to the Top is that, in this model, it is not necessary to use a cell phone, in addition to having a free data package.

Among the benefits of Maquininha On, the device comes with its own chip from the factory.

Because of that, the user gets a free 3G and wifi data package.

Here, the proof of sale can be sent by SMS or email.

And about the device, it is also worth mentioning that it has a color display and the battery has an average duration of up to 20 hours in standby mode.

These aspects make the On a good product for street vendors as the device is practical, small and does not require a cell phone.

In addition, this model is also good for medium-sized businesses that require a device capable of handling the amount of daily sales.

In this way, its use is very similar to Top.

The difference is that you enter customer data directly on the machine, not on the cell phone.

You still have the option of making the entire sales operation using NFC technology.

If you have any questions, you can consult the physical manual that comes with the machine or download the PDF version manual.

SumUp Total Machine

And to end the company's machine models, we have SumUp Total, the most complete device among the three versions.

With Total, there is also no need to use a cell phone, because it already comes with a chip and the data package with 3G connection, wifi and NFC technology.

The great advantage of SumUp Total is that it can print receipts, which can be useful for businesses where customers are used to or prefer physical receipts.

Even with this feature, it is still possible to send the receipt to email or SMS.

According to SumUp, the battery of this device lasts up to 20 hours, which makes it the best device in this regard in the market of little machines, considering all the features of the device.

It is also worth mentioning that there is the ability to print sales reports directly from SumUp Total, being able to choose by modalities: credit, debit and installments.

To have a machine like this you have to pay 12x R$29,90 without interest or the cash value of R$358,80.

When purchasing this device, you still receive four coils, a wall charger, counter display and flag stickers.

And just like in the other models, did you have specific doubts? Take a look at the physical manual or the PDF manual for the version.

What are the fees charged at SumUp Maquininha?

SumUp offers two alternative plans: Economic Plan and Early Plan.

Let's understand each of them.

In the Economic Plan, the merchant receives the balance of sales in debit in one business day, payment in cash in 30 days, and in installments every 30 days depending on the number of installments.

Thus, the rate charged in this plan is 1,9% for debit, 3,1% in cash and 3,9% in installments.

For example, if the person makes a sale for R$50 in cash, the discounted rates will be 3,1% and the seller will receive R$48,45 in 30 days, counting from the date of sale.

In the case of sales in installments from 2 to 12 installments, the tariffs will be 3,9% of the total value of the sale.

Still using the example of R$50, in this case, the person receives R$48,05 in installments, every 30 days.

Now, in the Advance Plan, all sales proceeds are received within one business day, regardless of the payment method.

In this plan, the debit fee is 1,90%, 4,6% in cash and 4,6% in installments plus 1,5% per installment.

Knowing that the collection rate is 4,6% in cash payments, in a sale of R$50, the person will receive R$47,70 within one business day.

Continuing with the example of R$50, if the customer divides the purchase amount into 5 times, the fees will be 4,6% plus 1,5% for each installment.

This means that 10,6% of the total sale will be discounted (1,5 x 4 + 4,6 = 10,6).

So, in this case, the merchant will receive R$ 44,70 within 1 business day.

The Economic Plan offers lower rates, but you will need to wait for the money to be received.

In the Advance Plan, the sales balance is deposited faster, but at a higher rate.

With this, the most ideal plan is the one that best fits your cash flow and the speed at which you need to receive the money.

Remembering that you choose one of the plans when you register to request a machine.

In addition, you can change your plan whenever you want by accessing the SumUp website.

That is, there is no need to ask for assistance with support.

SumUp customers receive a lower transaction fee for the first three months of using any machine.

Find out how this benefit works.

Lower rates for the first three months of using the SumUp maquininha

SumUp offers an advantage to encourage the company's new customers: debit and credit rates decrease to 1% in the three months with the machine.

However, the benefit does not apply to installment sales.

Just be aware that the reduced rates are only available for three months or until you reach R$20 in debit and cash sales within that period of time.

When this period has passed or the determined amount has been reached, fees will begin to be debited following the normal price of the plans.

Remembering that the period of three months starts from the moment the customer receives the machine.

Flags accepted at SumUp maquininha

All SumUp machines accept the same flags, which are:

- How much;

- American Express;

- Hyper and Hipercard;

- Visa;

- MasterCard;

- Maestro;

- Visa Electron.

It should also be noted that these machines do not accept meal cards, which can be a disadvantage if you work in the food industry, such as restaurants, cafeterias and bars.

In addition, as you do not accept so many card brands, you need to know which are the most sought after by customers who visit your store.

On the other hand, SumUp maquininha passes cards from all banks, including those from other countries.

This is a great benefit for those who constantly receive tourists from abroad.

In addition, it is also possible to pass a chip and magnetic stripe.

SumUp Machine Security

When it comes to money, personal data, purchases and sales, you can't be too careful, right?

In this way, see what methods SumUp uses to protect you and your customers:

sales analysis

To provide security in sales, SumUp monitors the operations carried out.

When some activity appears to be suspicious or strange, the company can ask the seller to prove the legitimacy of the sale.

When this happens, the person will need to show some document, for example, an invoice or receipt with a signature of you and the customer.

This situation can occur when:

- The sale value is much higher than usual;

- The machine is used in transactions involving airline tickets, medicines, firearms, drugs, among other illegal products or subject to legal verification;

- The machine is transferred to a third party, without the SumUp company having received any notice;

- The registration was carried out using a CPF or CNPJ that is not the entrepreneur's;

- The card used belongs to the seller himself or a relative.

If the person falls into any of the situations described, SumUp may stop the account until the entire case is clarified.

According to the company, these situations are identified as urgent.

In order to normalize the case, it is necessary to follow the guidelines that will be passed on by SumUp.

purchase reversal

SumUp has specialized anti-fraud teams to support machine owners in case the customer does not recognize the transaction and asks for a chargeback, also known as chargeback.

This feature is provided free of charge to all SumUp customers and aims to research and question this situation.

Advantages and Disadvantages of SumUp Machine

With everything that has been shown so far, in the topic below you will see a summary of the main advantages and disadvantages of the SumUp machine:

Advantages

- Competitive Debit Rate;

- Variation of machines for different financial profiles;

- Benefit from the 1% tariff in the initial three months with the machine;

- Great service and with a great reputation;

- Try it for 30 days or get your money back;

- Long-lasting battery;

- Support in chargebacks;

- International card acceptance.

Disadvantages

- Vouchers cannot be used: food vouchers and meal vouchers;

- Limited number of accepted flags;

- You must have a bank account, either checking or savings.

How to order a SumUp machine

After you already have in mind which machine you are going to buy, learn how to request the device.

The whole process is very simple.

Just access the company's website and create an account by filling in your e-mail, password, personal data such as full name, telephone, address and bank details.

After creating your account and logging in, you need to access the SumUp Shop website, choose the machine you want to buy, and click on “place order”.

Then choose the payment method and fill in the address details.

After that, just click on “Confirm Order”.

The next screen will show the order receipt.

Just be aware that at any time, the company may ask you to send some documents for security reasons, such as a photo of your identity, proof of residence and receipt of activity.

Remembering that both Individuals and Legal Entities (PJ) or MEI can order a model of the machine.

Therefore, if you do not have a CNPJ or are a MEI, it is possible to receive your payments in your Individual Account without bureaucracy.

But if you have registered your account with the CNPJ, you will receive your sales in the PJ account.

Other information about SumUp maquininha

It is important to make it clear that there is no charge for rent, monthly fees, membership, or fees for bank transactions.

The sales deposit goes straight to your bank account.

There is no need to spend time asking for a transfer, as some SumUp competitors may have.

One of the most praised features of SumUp's customers is their customer service.

To give you an idea, its reputation on Reclame Aqui has the RA 1000 Seal and an overall rating of 8,8 in customer service, with a 95% solution rate, with a consumer rating of 7,92, which is high. .

That way, if you have any questions about the company's machines, the first step is to visit the SumUp FAQ.

If you haven't found what you were looking for, another option is to go to the Service Center.

Even so, it is possible to request assistance from a company employee at the following number: (11) 4003-6338.

Opening hours are from Monday to Friday from 8 am to 21 pm and on Saturdays from 9 am to 18 pm.

You can contact SumUp by WhatsApp: (11) 3080-7797.

In this case, the opening hours are from Monday to Thursday from 7 am to 01 am and on Friday and Saturday from 7 am to 23 pm.

The company also has SumUp Bank, a digital account.

When purchasing any SumUp machine as an Individual or MEI, the person will have immediate access to bank resources at a low cost.

In this way, SumUp Bank offers the following functionalities:

- Checking balance, extracts and monitoring sales;

- Settlement of bills and slips;

- TED transfers;

- Transfers via PIX;

- Recharge your cell phone;

- Sacks.

All these operations can be used and seen in the company's app, which can be downloaded from the Google Play Store or the App Store.

About the values, users can make up to 5 TED transfers for free per month.

If you need to exceed this number, you will have to pay R$1,50 for each new transfer.

You can also make withdrawals at Rede Banco 24Horas ATMs in the amount of R$5,90 each.

There is still the option to transfer via PIX.

The other features are free.

It is still possible to request a prepaid card that makes it possible to make payments with the balance that is accumulated from transactions made through SumUp.

The SumUp card uses the MasterCard brand and must be used in the credit function.

The purchase and withdrawal limit is the same amount you have in your digital account.

And finally, the last resource to address is the SumUp Link.

With it, it is possible to accept payments via credit card in cash or in installments using your cell phone, without the need to use a machine.

Learn More: TapTon: How to turn your cell phone into a machine

To be able to use this feature, you need to download the company app.

When you make a sale, you will enter the value of the product in the application and the payment link will be prepared automatically.

Afterwards, you will be able to send the link to your client via WhatsApp, SMS, email or social network, such as Facebook, for example.

If you choose to receive the balance within 30 days, the rates are the same as the machines.

But if you choose to receive it in two days, the spot fee is 4,9%, where you need to add another 1,5% per installment.

If you want to know more about this subject, visit the SumUp page.