by Team AllYourVideogames | Aug 16, 2022 | News |

Did you know you have how to pay off a loan faster and pay less interest? Yes! It's possible and amazing: the amount of interest you pay on top of your debt is almost 3 times greater than the amount you owe.

For example, let's say you took out a loan of R$200.000,00 in 360 installments (30 years), leaving a monthly installment of R$2.000,00.

Banks don't write off those R$2.000 from the amount you owe. In fact, they only slaughter about 30%. So, you pay R$600,00 of the debt, and the other R$1.400,00 stays with the financial institution.

In short: you lose twice as much money as you should.

But the good news is that you have the means to resort to a fairer value, and you will be surprised at how much you can save with this.

How to pay off a loan and pay less interest

You must be asking yourself: How do I pay off my loan and pay less interest? Many people still don't know how to stop paying their debts at absurdly high rates. But we are here to help with that mission.

First, you must understand the Selic Rate and how it directly influences your pocket. The Selic rate is the basic interest rate and is the basis for charging interest on your financing.

If the Selic goes down, automatically the amount you pay should go down too. But that's not what happens in practice, as banks don't let you know about it, because the higher the amount you pay while interest rates are low, the more profit will go to them.

Of course this will depend on the financed amount you have and your interest rate. Study and evaluate the value of your loan and all its fees, and then take action.

How to pay less interest with the Selic Rate

Suppose you took out a mortgage with an interest rate of 8,1%.

It is essential to keep an eye on the current Selic rate and know how much it was worth at the time of financing, in order to try to renegotiate with the bank.

If you manage to reduce it to 7,2%, you get a discount of approximately 10%, which generates great savings if you put it on the tip of the pencil.

To check the current Selic rate or at some previous time, just access the website of the Central Bank of our country.

If there is a reduction in the basic interest rate, you can and should try to renegotiate with your bank. And this tip applies to any type of financing: property, car, payroll, among others.

When you manage to reduce the interest rate, in addition to reducing the total amount, you also increase the savings generated month by month, being able to invest that money, save and generate a reserve for future application.

When you reduce your cost of living, reducing the value of the installments, there is money left to invest.

And if your bank doesn't agree to reduce the interest rate, don't settle! Look for another bank that offers better deals and do the portability.

But what is portability? You basically transfer your debt from your current bank to another that offers you better values, without losing your loan.

Your bank cannot refuse the portability request. This request will be made by the new institution, which will be responsible for settling the debt and soon after, you will have a debit balance in that bank.

The Consumer Protection Code guarantees that “Every consumer who purchases a financial product has the right to transfer the debt from a financial institution to another financial institution without any type of charge by the financial system”.

Therefore, it is your right to pay a fair amount and to achieve this without unjustified impediment or fees for such service.

How to pay off a mortgage and pay less interest: portability

First, get to know the CET (total effective cost) of your financial institution. The bank is obliged to give you this data.

The value of a loan is made up of the amount you borrowed with the interest rate percentage, plus the administration fee and life insurance.

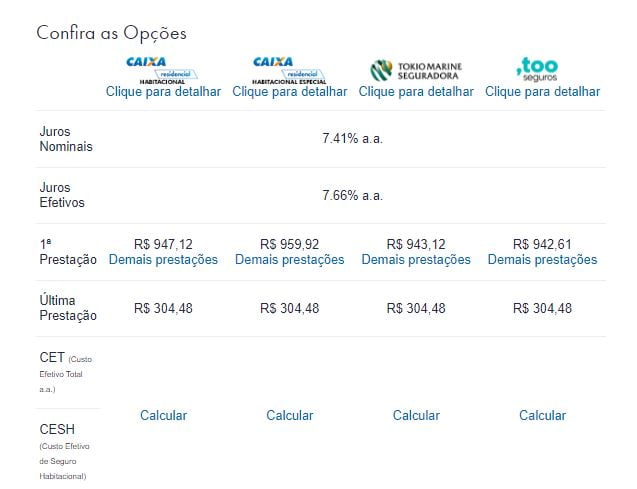

The second step is to perform simulations in as many banks as possible and build your image as a good payer and make clear the reasons that led you to want to go to the institution and evaluate what it has to offer you.

The bank you want to leave is obliged to grant portability. But the bank where you made a simulation has discretion to accept you as a customer or not.

Know what you are and are not required to pay. For example, you should not pay a larger installment or change the number of installments. The same conditions must remain, compare the total effective cost.

You are also not required to open a checking account at the bank where you will finance.

Beware of the services offered and that charge high fees, know that the practice of tying is prohibited. If you come across such a situation, contact Procon or the Central Bank immediately.

Finally, look at the costs of porting.

For example, Caixa Econômica Federal charges BRL 3.100,00 to carry out an appraisal of the property.

There are also the costs of transferring the property. They can vary from bank to bank.

How to pay off a loan and pay less interest: Amortization

The other tip is to pay off your financing faster, through amortization, which can be done by reducing the term or reducing the installments.

Reducing the deadline is the best option. You may, for example, be able to reduce your loan from 30 years to 3 years.

On the Caixa Econômica Federal website, a leading bank in the real estate market, a housing simulator is available so you can have more details about terms and conditions.

Here's a practical example, so you can understand how it works.

How to pay off a loan and pay less interest: simulation of amortization by Caixa

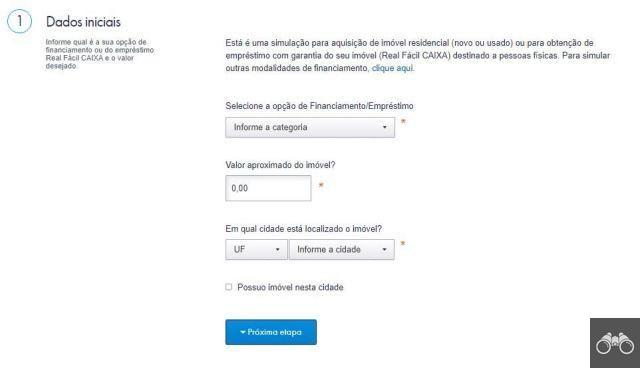

1. In the Caixa simulator, you will enter the information about what you want to finance. We use hypothetical values only to demonstrate;

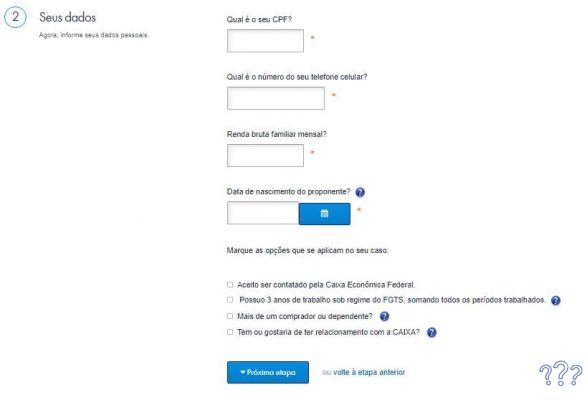

2. Then enter your data;

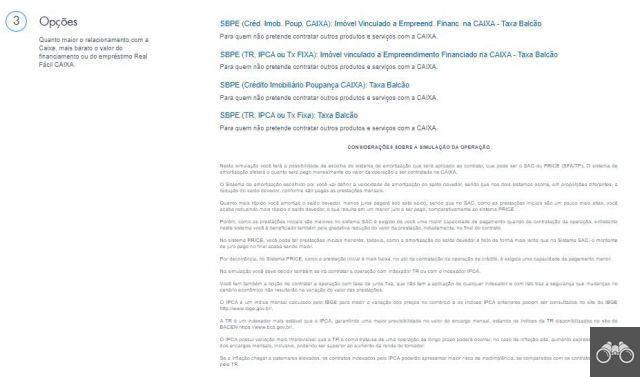

3. Choose the mode;

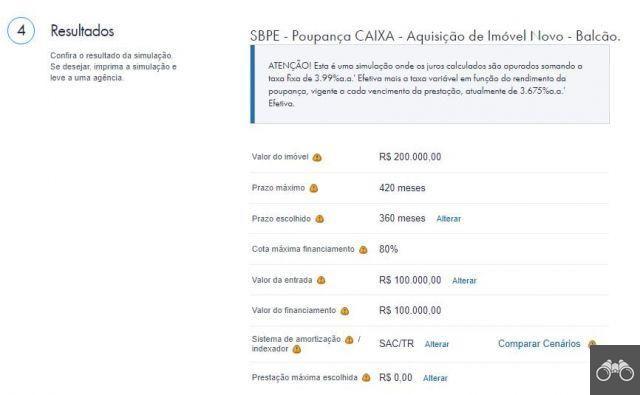

4. Check the results and conditions;

In this case, if the first installment is paid, the outstanding balance would decrease a little, since, as we mentioned earlier, more than half of the amount goes to fees, interest and insurance.

Therefore, you will not pay off almost any of your debt, you will only pay a very high interest. That's why, if you take 360 months to pay off the loan, you'll pay double what you really owe.

The SAC amortization system, used in the example, has as its main characteristic the fact that the monthly installments are decreasing. They start at a higher value and go down over time.

But, taking the 30 years to pay, you will take a loss. Thus, the best option is to amortize these installments, using the option to shorten the term.

You can go to your bank in person or do it through the app itself. Just look for the housing finance part and then for amortization.

By choosing to shorten the term, the following happens: when you amortize this financing, the amount you have to pay will deduct from those last cheaper installments.

The last installments are cheap because they are almost without interest or fees, so the money will pay off your main debt, without you losing more than half of it in interest.

In this way, if you manage to organize yourself financially and gather an amount of money to invest in amortization, you will be saving your money and effectively paying your debt, making your financing fairer.

The simulation done above serves as your early discharge calculator. Let's assume that you manage to raise R$8.000,00. With this amount, you can already kill approximately 24 installments, thus eliminating 2 years of your financing.

The more money you can save, the less time you'll be able to pay off your debt and pay less interest.

It is worth noting that this does not only apply to paying off Caixa financing. It works for all banks, whether to pay off Santander financing or to pay off Bradesco financing, for example.

It's a strategy that no financial institution wants you to know, after all, the more interest you pay, the more profit they will have on top of your money.

Learn More: Personal Financial Planning: The 5 Best Apps

How to pay off vehicle financing and pay less interest

Amortization is not limited to real estate loans. It can also be done when it comes to vehicle financing, which also tend to charge high interest rates.

First, find out what your bank or finance company is. Download the application or enter its respective website. Search for “amortization” or “eliminate installments” and run a simulation to analyze how much you can afford.

Do you have extra money? Do not pay two of the first installments in a row. Pay the current one and with what is left amortize the last one.

But we emphasize that, in this case, this applies only to CDC (Consumer Direct Credit) financing.

Abusive interest rates

Keep an eye out, as many financing ends up covering fees that shouldn't be there.

Abusive interest is the first on the list, while it should be charged about 1,5%, 4% is charged and many people don't have this information.

When you make a purchase, the merchant takes a commission, but you are not required to pay that commission, as is often the case.

It is also an abusive and illegal practice to charge for the issuance of the ticket. It may seem like a small amount but it's not! As well as the account opening fee, which is also prohibited by law.

What to do in a situation like this? Call your finance company, renegotiate and ask for an interest rate reduction.

You also have the option to make the portability, as in the case of real estate financing.