by Team AllYourVideogames | Aug 2, 2022 | Shopping |

Did you know you have how to pay bills with credit card? That's right you read! Although not very well known and used, this alternative can end up being an excellent alternative.

Furthermore, depending on the situation, it may be more advisable to know how to pay slips with a credit card than on a regular basis, such as going to the bank, for example.

There are some advantages when using this alternative, such as a longer period for paying bills, ease of accumulating miles and points for travel and even cashbacks.

And the best thing is that in most cases, there are no fees.

In this post, we will teach you how to pay boletos with a credit card so that you have several benefits and payment alternatives, in addition to internet banking.

Learn More: How to make a Flamengo credit card?

How to pay a bill with a credit card

Basically, there are two ways to pay a bill with a credit card, they are:

- With the bank that issued the credit card;

- With digital wallet applications, also called fintechs.

1. Through the issuing bank itself

The first alternative to pay bills on your credit card is directly at banks, where you will choose the option to use your card limit when paying online.

However, it's good to check first if your bank offers this type of service, if the payment will also score the bank's loyalty program and if there will be any fees applied.

In most situations, we do not recommend this type of operation, as most banks adopt high fees, in addition to charging the tax on financial transactions (IOF).

So, if you use this option just to accumulate miles and points, it would probably end up being more expensive than buying the points and miles directly from frequent flyer programs or with partners.

So, it's good to get informed and always do these maths now that you know one of the ways to pay slips with a credit card.

2. With digital wallet apps

The second alternative to paying your credit card bills is with digital wallet applications, which is a slightly more interesting option. These apps allow you to pay boletos without having to deal with extra fees or fees lower than those charged by bank agencies.

There are several applications for you to know how to pay boletos with a credit card. We have separated the main alternatives for you:

Learn More: How to apply for a PicPay credit card?

Mercado Pago

Probably the best known on the list, Mercado Pago is available for download on both Android devices from the Play Store and iOS devices from the App Store.

It is a program that is part of Mercado Livre but can also be used individually as a digital wallet for the user.

In addition to allowing purchases within the Mercado Livre marketplace, Mercado Pago also offers services such as gift card sales, mobile recharges and even payment of bills and slips with credit card.

Previously, payment could be made free of charge and without fees.

But over time, the platform started to charge a 4,99% fee for those who use a credit card to pay bills and bills in the app. But even with this fee, Mercado Pago is a great option for paying bills with a credit card.

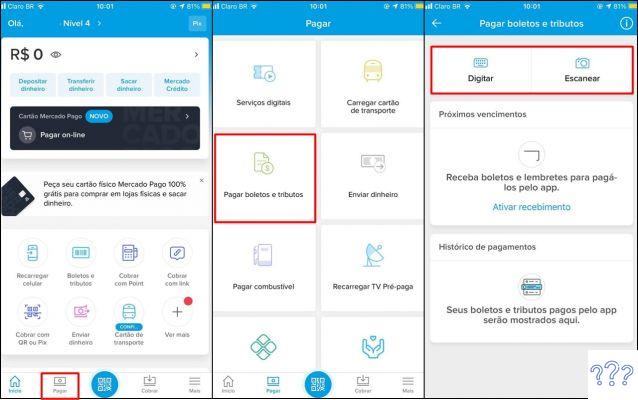

To use, just go to "Pay" in the bottom menu of the app, then go to the option of "Pay boletos and tributes". After that, you can choose between making the payment by typing or scanning the barcode.

But of course, first you need to have an account registered with your personal data.

Learn More: Mercado Pago credit card: how does it work?

RechargePay

Also accessible in the Play Store and App Store virtual stores for Android and iOS devices, respectively, RecargaPay is an excellent option for how to pay slips with a credit card. In addition, as its name suggests, this application also allows you to recharge credits on your cell phone.

If you want to pay without any fee or fee, the limit amount is R$500 per month. This limit is exclusive to bill payments and consumption of electricity, water, internet and telephone.

For amounts greater than this and other types of consumption, you will need to pay a fee of 2,99%.

A plan called Prime+ is also offered to users, that is, by paying R$19,90 per month, you will have a limit of R$2.000 for paying bills and boletos, in addition to the right to a greater cashback to recharge your phone and cards. of transport.

It is worth mentioning that payments using the Itaucard and Credicard cards do not accumulate more points since November 2022.

So, although you can still make your payments, if you use any of these cards, we recommend not using RecargaPay, as you will not have the benefits.

IQ

In addition to being able to be used on Android and iOS smartphones, IQ also stands out for the possibility of being used on the platform's website, on the computer. However, the program only accepts payment for consumption, such as: water, electricity, gas, internet, telephone, pay TV and taxes.

Despite this limitation, it is worth mentioning that IQ does not charge any service fees.

However, there are maximum payment amounts per month and per account. Respectively, these amounts are R$1.000 and R$700.

The user has the option of programming the IQ to automatically pay monthly or pay only when desired. Credit cards accepted are Mastercard and Visa only.

PicPay

PicPay, when launched, reached mainly the young audience, allowing payment between people.

For those who want to know how to pay slips with a credit card on PicPay, you must pay a fee of 2,99%. It is worth noting that the app is available on both the Play Store and the App Store.

The app allows the user to send up to BRL 700 per month to another PicPay account to make payments free of charge. That way, you can use your available money in the other account to pay your bills and slips using your credit card.

However, the Itaucard and Credicard cards also no longer score in the app since November 2022.

I

Image: Best Destinations

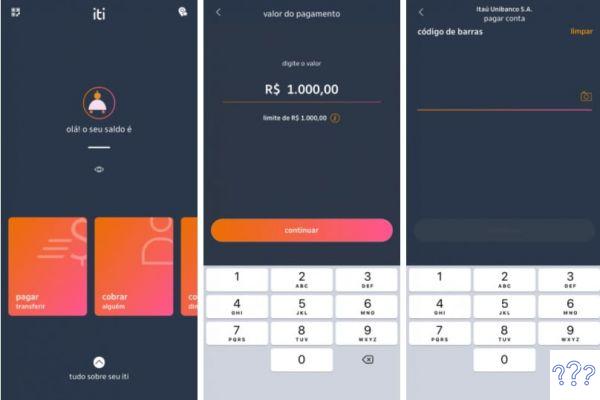

Created by Banco Itaú, Iti allows users to make transfers, charges and bank payments free of charge. However, Iti does not allow the use of a credit card to pay bills and bills.

So, you can pay the bills only with the balance available in your account.

There are ways to get around this limitation and have a way to pay slips with a credit card and the best, for free. The app allows you to send up to R$10 per month to another Iti account through your credit card without any charges.

After that, you can use the amount that went to another Iti account to pay your bills and credit card bills.

Per month, if you use the Itaú credit card, you can make up to 10 transfers of a maximum of R$1.000 or up to R$500 if you use other cards.

According to your engagement on the platform, your limit can be expanded even further. The app is available for Android and iOS devices in digital stores.

Learn More: Dafiti Card: how to make a Dafiti credit card

AME

With the objective of being an application to make payments for purchases made with companies belonging to the B2W group, such as Americanas, Shoptime and Submarino, the AME app has expanded and started to make payments of slips and bills with credit card.

Payments for water, electricity, gas, internet, mobile, landline and cable TV bills are accepted. You can also pay your taxes such as IPTU, IPVA, DARF, GRU and fines.

Although the AME does not disclose the maximum amount allowed for payment of each bill during the month, it does report the maximum amount of authorized monthly transactions. Depending on the user, the amount can vary from R$1.000 to R$5.000.

In the beginning, the service was completely free, but now they charge a fee of 1,99%, it is also available on the Play Store and App store for Android and iOS smartphones.

Although it is a more restricted program, it can be an affordable way to pay bills with a credit card.

To open your Ame account and earn R$10 more cashback on your first purchase, use our discount code: YF9ZX.

99Pay

Being part of the 99 transport app, 99Pay can already be considered a digital account program due to the financial services presented.

In addition to paying bills, bills and bank transfers, the app also allows the user to recharge their phone.

The monthly limit for how to pay slips with a credit card is R$5.000, without fees. You can use up to R$3.000 per week. There are no details if, with payment of an extra fee, it is possible to make payments that exceed these limits.

The range of 99Pay is limited, and is only available in some cities, they are: Vitória, São José dos Campos, Uberlândia, Bauru, Ponta Grossa, Joinville, Florianópolis, Limeira, Londrina, Maringá, Piracicaba, Campo Grande, Sorocaba, Campinas , Cuiabá, Curitiba, Porto Alegre, Fortaleza, Recife, our city, Aracajú and São Luís.

But if you live in another city, just ask someone who lives in one of these cities to transfer you over R$1.

This will automatically activate your account. But it is worth mentioning that the app is constantly expanding to reach other cities.

You can download the app from both the App Store and the Play Store, and it is available for Android and iOS devices.

Let's Install

Image: Best Destinations

Vamos Parcelar is the newest credit card payment program on the list. It allows you to make payments up to 18 times for a convenience fee.

If you want to use the lowest possible rate, which is 1,95% and still be entitled to 1% cashback, you will need to make cash payments. This ends up causing the final cost of the entire operation to drop by 0,95%.

But if you prefer to pay in installments, the cashback can reach up to 5% of the value.

However, you will also be charged a higher rate than paying cash. So, if you want to accumulate points and miles, this alternative may not be the most attractive.

We need to point out that, as this is a new app, it is undergoing changes and adaptations to the market.

For example, the cashback as well as the convenience fee are constantly changing. So, to avoid further problems and misinformation, we recommend using Vamos Parcelar sparingly and always consult the information before knowing how to pay boletos with a credit card.

Learn More: No annual fee credit card: the best on the market