by Team AllYourVideogames | Apr 16, 2022 | Entrepreneurship |

If you have a business and are registered as MEI – Individual Micro Entrepreneur, you need to file your billing statement annually. The submission process is easy and at no cost to entrepreneurs. See how to make the annual MEI declaration

DASN-Simei is the name given to the document that must be delivered by May 31 of each year. This annual declaration of the simple national, aims to present the gross income that your company obtained in the previous year.

Learn more: How to open a MEI: 5 steps to be a microentrepreneur

Basically it works like our income tax, the difference is that it is aimed at legal entities and not individuals. Be careful not to miss the deadline.

How to make the annual MEI declaration: step by step

Step 1. Access the home page of the entrepreneur portal website by clicking here

Step 2. On the top tab, in the left corner, click on annual declaration;

Step 3. Enter your business's CNPJ and special characters for security confirmation and click on continue to enter your data and start your declaration;

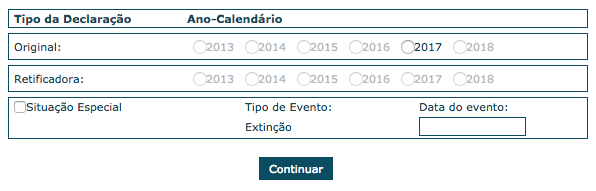

Step 4. Choose the year you want to declare. It will always be the former. For example, if you are filing in 2022, the reporting year will be base year 2022;

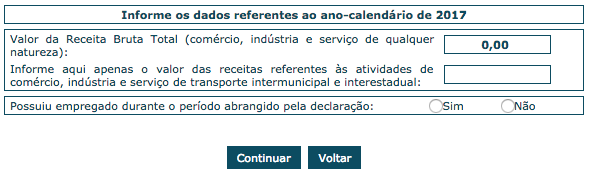

Step 5. In the field for each activity, enter the amount of total gross revenue collected in the previous year. This applies to commerce, industry, or services of any nature;

Step 6. After filling in the requested information, click make declaration to send your data. Ready, now you will receive, by email, the receipt of sending your document.

If you are an individual microentrepreneur and did not have annual revenue in the previous year, you will still need to submit your statement. In this case, you can fill with zero the fields destined to the values referring to the invoicing.

Tip!

The revenue limit to qualify as MEI was 81 thousand reais for the year 2022. However, this amount must be divided proportionally to the months in which your company was operating.

For example, for companies listed in May 2022, the total revenue limit for the year cannot exceed BRL 54. That is, proportionally to the 8 months of operation.

How to file the MEI annual return in arrears?

If for some reason you failed to deliver your statement, know that you need to regularize this situation. In this case you will transmit an overdue statement.

The submission process does not change, you will have to follow the steps presented above. The only difference is that you will have a fine to be paid after submitting your statement.

This fine has a minimum value of R$ 50,00 reais. As soon as you transmit your statement, it will be possible to download the DARF for the payment of the pending with the Federal Revenue. This guide must be paid at a bank accredited by the Federal Revenue Service.

It is important to highlight here that if the fine is paid within 30 days after sending the declaration, small businesses receive a 50% discount on its value. That is, it is worth taking advantage and paying off within this period to guarantee the discount.

How to make the annual MEI declaration: I entered the wrong amount, now what?

Immediately after sending the declaration, the entrepreneur's portal allows individual micro-entrepreneurs the option of rectifying the information declared. However, this can only be done if your declaration is up to date, that is, it is the one for the base year that is within the submission deadline and that it is made before that deadline expires.

If you want to correct the information of a declaration transmitted in previous years, in this case it will be necessary to send a new declaration. What changes here for the process taught in the previous walkthrough is that your statement will be rectifying and not original.

How to make the annual MEI declaration: Calculation of gross sales

As we said earlier, the amount to be informed in your statement is the gross revenue. This means that you must add up the gross amount received during the year, without considering expenses.

To raise this amount, a good way is to add the value of each invoice issued in the previous year. In addition, you can obtain the value by adding up the receipts from customers in your bank transactions, or by adding the values of receipts issued to customers.

Therefore, it is very important that throughout the year of activity of your company, you control the values of your sales.

How to make the annual MEI declaration: 4 important tips

1) Some bodies request the MEI declaration to issue licenses. Bodies such as: sanitary surveillance, city halls, fire department, SEFAZ.

2) For micro-entrepreneurs who wish to open a bank account for their CNPJs, the MEI declaration serves as proof of income in the documentation required for registration with the bank.

3) You cannot confuse values referring to your individual (CPF) and your legal entity (CNPJ). The gross revenue (invoicing) of the MEI activity is exclusive to the CNPJ.

4) The amounts withdrawn from the company to remunerate the owner (profit) constitute income for individuals and are exempt and non-taxable income up to the limit of 16% (services) or 8% (for commerce and industry) of gross revenue.

If this text helped to clear up your doubts, tag someone here in the comments, who, like you, is a MEI and needs these tips so you don't forget to send the annual MEI statement.

For more information read more on our blog, visit the links:

- How to open a MEI: 5 steps to be a microentrepreneur

- Income tax 2022: how to declare for the first time

- Applications for companies: 10 options for business management