by Team AllYourVideogames | Feb 20, 2022 | Technology |

The task of calculating net salary it can end up being a bit confusing if you don't know how to do it in detail. You will likely have to take several discounts into account.

The good news is that there are some online tools that can help you when calculating net salary.

In this post, we try to help in the best way possible, explaining what the net salary is, the main discounts you need to take into account and, especially, some tools you can use to calculate your money.

In all, we have separated 7 online calculators. When searching the internet, you will find some other options, as well as mobile apps that serve this purpose.

Learn More: Percentage Calculator: The 6 Best to Use Online

What is net salary?

Every worker knows the value of his gross salary recorded in the work card when he receives the services rendered. And that value contains all discounts. The net salary is nothing more than the value of the gross salary, but with all legal and necessary discounts deducted.

So, a question remains: why is the employee informed about the gross salary by the companies, but the net salary value is not informed? In a very simple way, we can say that these mandatory discounts are considered, by law, a benefit and an obligation for the citizen.

Learn More: Gestational Calculator: the 21 best ones to download

Main discounts made until reaching the final value

Now, let's check in more detail which discounts are deducted from the gross salary and which you should consider when calculating net salary.

1. Social security contribution (INSS)

The social security contribution (INSS) is a mandatory discount for the employee and is deducted directly from the gross salary that the registered employee receives by the company following the rules of the Consolidation of Labor Laws (CLT).

With the INSS, the employee also guarantees: sick pay; maternity pay; retirement and pension for dependents in different situations.

The social security contribution will have its value adjusted annually, and the discount will depend on the employee's gross salary. Those who earn a lower salary will contribute a smaller percentage and those who earn a higher salary will contribute a larger percentage.

Taking into account the year 2022, the percentage of contribution to the INSS varied between 7,5% and 14%.

2. Gross Salary / INSS Contribution

To help you and give you an idea of what your contribution would be like according to your average salary, we separate a table with the base rate for calculating the contribution to the INSS by salary range with the information for the year 2022.

But remember: the amounts can be adjusted annually, so the contribution percentage may not be the same in 2022 or in the next few years:

| Salary | Aliquot |

| Up to $ 1.100,00 | 7,5% |

| Between R$1.100,01 and R$2.203,48 | 9% |

| Between R$2.203,49 and R$3.305,22 | 12% |

| Between R$3.305,23 and R$6.433,57 | 14% |

Learn More: Online ROI Calculator: Check out the best options

3. Withholding Income Tax (IRRF)

The Income Tax Withheld at Source - IRRF is also a mandatory contribution by the employee hired via CLT by a company. This tax is calculated after the INSS and a legal amount per dependent is subtracted from the employee's gross salary. This amount per dependent is R$189,59.

After deducting these amounts, a tax rate table from the Federal Revenue is used to know the exact amount of the salary that will be withdrawn for the IRRF.

It is important to always keep in mind that the table may end up being updated annually, depending on the country's economic scenario. However, the values have not changed since 2022.

IRRF table

Before we detail the table for you to check the Withholding Income Tax, it is necessary to know that the value will not necessarily represent the total amount of the gross salary that will be paid to the country's public coffers. It is more considered a tax advance as it is paid monthly.

Normally, when declaring the Income Tax every year, the employee will inform all the amounts contributed, along with all the necessary legal information. With this, he will find out if he will need to pay an additional residual amount of the IRRF.

Now that you're in the know, check out the IRRF tax rate table made by the Internal Revenue Service based on salary ranges:

| Calculation basis | Aliquot |

| Up to R $ 1.903,98 | Free |

| Between R$1.903,99 and R$2.826,65 | 7,5% |

| Between R$2.826,66 and R$3.751,05 | 15% |

| Between R$3.751,06 and R$4.664,68 | 22,5% |

| Above R $ 4.664,68 | 27,5% |

Learn More: BMI Calculator: The 14 Best to Always Use

4. Other minimum wage discounts

If the company and the employee reach an agreement, other amounts may be deducted from the employee's gross salary. There are several examples, but the main ones are:

- Transportation vouchers;

- Health care;

- Private pension;

- Union Contribution;

- Food.

It is important to note that, in these cases, discounts are optional. Thus, it is up to the employee to decide whether to use it or not and whether these amounts will be deducted from the salary.

In addition, tardies and unexcused absences can also be deducted, so keep that in mind when calculating take-home pay.

Learn More: How to calculate 13th free salary? the best calculators

Online calculators to calculate net salary

To help you when calculating net salary, we have separated some online calculators that you can use for this.

Calculation of Net Salary - iDinheiro

Our first option is the iDinheiro calculator, and how it works is very simple.

To know how to calculate net salary, you need to fill in the requested fields, enter the amount of your gross salary, the discount amount you have, whether it is amounts agreed with the company, pensions or other obligations, and enter the number of dependents you have .

After that, just click on “Calculate” to get the net salary amount. For a new query, just click on “Clear” and fill in the data again.

2. Net Salary Calculator – Mobills

To calculate net salary, you can also use the Mobills calculator, which works very similarly to iDinheiro.

To obtain the result, simply inform the gross salary, discounts and the number of dependents you have. Then just click on “Calculate” to get the result of your net salary and on “Clear” to be able to make a new query.

Learn More: Online calculator: the 15 best tools to calculate

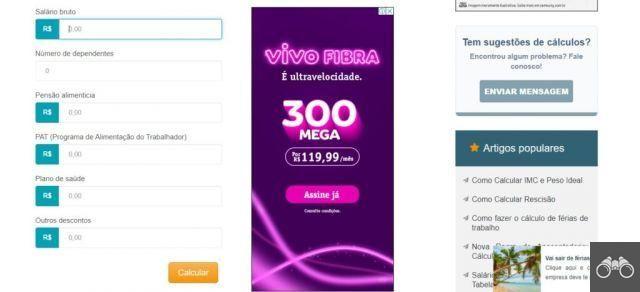

3. Calculation of Net Salary - Easy Calculator

The Easy Calculator Portal offers an option to calculate more detailed net salary and is the best option for those who have many discounts on their gross salary.

To use it, you start by informing the gross salary received at the company, then enter the number of dependents you have. After that, you will have the discounts part, which is very well divided between alimony, Worker's Food Program (PAT), Health Plan and Other Discounts.

Just fill in the correct values for each one and click on “Calculate” to get the net salary.

4. Net Salary Calculator – Invest Value

Our fourth calculator option for you to calculate net salary is the version made available by Valor Investe, which works very similarly to previous versions.

You will need to inform the amount of the gross salary and how many dependents you have. Then just enter discounts such as alimony and Private Pension. If you have more, you can use the “Other discounts” section.

Then, just click on “Calculate” to get the result of the net salary.

Learn More: Online compound interest calculator: the 5 best on the market

5. Net Salary Calculator - FDR

Portal FDR also provides a net salary calculator for its users, where you only need to enter the gross salary, the number of dependents and the discounts you pay.

To get the net salary amount, just click on “Calculate”. To carry out another query, you just need to click on “Clear” to calculate net salary again.

6. Calculation of Net Salary - Calcule.Net

At Calcule.Net, you can also calculate net salary in a simple way, following steps practically identical to the calculators mentioned above.

You will enter information such as the total amount of gross salary, the number of dependents you have, discounts such as alimony, dental plan, health plan, food ticket. If you have more, you can enter it in the “other discounts” tab.

By clicking on “Calculate salary” you will obtain the net amount, while in “Clear”, you will be able to perform a new query with the minimum salary amount, for example.

Learn More: How to calculate the fertile period? Top 10 apps and websites

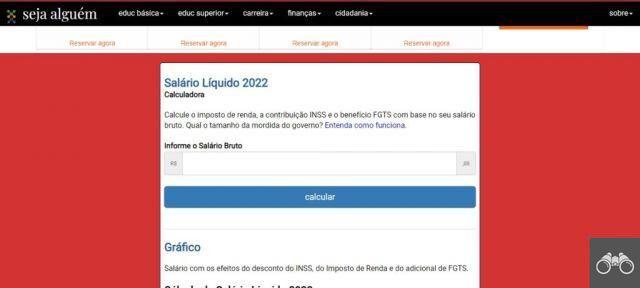

7. 2022 Net Salary Calculator - Anyone

Last but not least to organize your personal finances, we have the calculator from the Sejalguém portal, where you will only need the gross salary amount and no other information, unlike the calculators mentioned above.

After entering the gross amount, just click on “Calculate”, you will know the net salary amount with income tax, INSS and FGTS contributions already deducted.

Learn More: Investment Simulator: Top 10 to save to favorites