by Team AllYourVideogames | Nov 23, 2022 | Credit Cards |

Have you ever been to a C&A store and been approached by an attendant asking if you want to make the card?

The most standard response in this situation is: “I'm just looking!”. All normal so far. But if you really want to make the card C&A Bradescard it is possible to request it online.

In this post, you will check how to apply for a C&A Bradescard card, understand the way the limit system works, the advantages and disadvantages, the fees charged and much more information to get you up to speed on this subject.

What is the C&A Bradescard card?

C&A Bradescard cards are issued by Banco Bradesco.

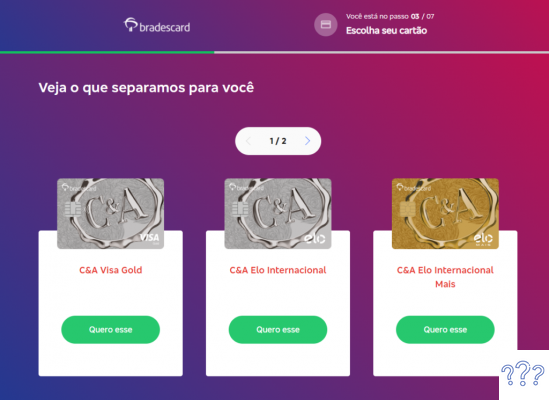

Customers can choose between five options, two with the Visa brand or three with the Elo brand.

Learn More: Riachuelo Visa Card: How to apply and what are the advantages?

Each one has its own benefits and standard advantages, such as discounts on tickets for the cinema, concerts and partner stores.

However, the cards have an annual fee that can be considered salty, as will be shown in the next topic.

C&A Bradescard Card: Limits, annuities and other fees

The C&A Bradescard card receives a limit according to its financial profile after an analysis carried out by Banco Bradesco. With this, the limit increases gradually as you use the card.

After six months of use it is possible to ask for an increase in the limit.

To do this, you can go to a C&A store or call the Customer Service at the following numbers: 4004 0127 for capital cities or 0800 701 0127 for other regions. Upon requesting the increase, a new credit analysis will be carried out.

Regarding fees, the bank charges some fees for certain services. Each withdrawal made in our country costs R$12. Abroad, the value is R$16.

And if you lose your card, it is stolen and you need a duplicate, you will have to pay R$13,99.

It is still possible to request an emergency credit assessment, if you want to buy a product, but your limit is not enough. This service costs R$18,90. In addition, if you wish to pay your water, energy, telephone, gas, tax or other bills using the card's credit function, there is an operating fee of R$18,90.

And as previously mentioned, C&A Bradescard cards have an annual fee, which are as follows:

C&A Bradescard Visa Card

- C&A Visa Nacional and Super: R$173,88 per year or 12 installments of R$14,49;

- C&A Visa Gold: R$221,88 per year or 12 installments of R$18,49.

C&A Bradescard Card Elo

- C&A Elo Internacional: R$221,88 per year or 12 installments of R$18,49;

- C&A Elo Internacional Mais: R$245,88 per year or 12 installments of R$20,49;

- C&A Elo Grafite: R$329,88 per year or 12 installments of R$27,49.

It is also worth mentioning that it is possible to request up to two additional cards. For this, the person must be 16 years of age or older. Remembering that the limit of additional cards is directly linked to the cardholder's limit, generating a single invoice for all cards.

In addition, the annual fee for each additional card, regardless of the brand, costs 50% of the amount charged to the cardholder.

C&A Bradescard Cards: Benefits

Regardless of the brand you choose when applying for your C&A Bradescard card, some benefits are standard for all customers:

- 10% discount on the first purchase made at C&A stores;

- 50% discount on Cinemark network tickets throughout our country;

- 50% discount when buying a small popcorn plus a 500ml soda or juice at the cinema;

- Possibility to pay your purchases in up to 5 installments without interest or 8 installments with interest, with up to 100 days to start paying for the product;

- Despite charging the withdrawals, there is the possibility of making the payment in up to 24 installments with interest charges;

- Access to the Bradesco Cards application, which makes it possible to manage expenses, invoices, limits and payments made by cell phone;

- Possibility to order up to two additional cards;

- Additional services such as insurance and assistance in case of theft, in addition to emergency credit assessment;

- Permission to enter loyalty programs of the brands, in this case, the Vai de Visa Program and Livelo.

It is worth mentioning that the Elo Grafite card offers exclusive advantages, such as:

- Fidelity program,

- Access to the Play Kids platform;

- Access to reading tool 12 Min;

- Travel insurance

benefits of flags

In addition to card discounts, the brands also offer advantages to their customers through the loyalty program.

Below is a summary of some of the benefits:

- Discounts on the bill in restaurants;

- Discounts at clothing and shoe stores;

- Discount at car rental establishments;

- Travel discounts;

- Accumulate points to exchange for discounts on products and receive vouchers and coupons.

Remembering that both programs offer very similar services, but each with its partner stores.

If you want to know more about the Vai de Visa Program and Livelo, you need to access the platform's websites.

C&A Bradescard Cards: Disadvantages

As much as some advantages of the cards are interesting, there are some negative points that you need to keep in mind if you are thinking of applying for a C&A Bradescard card.

First of all is the annuity issue. Nowadays it is possible to find credit cards, mainly from digital banks that do not have an annual fee.

In addition, this fee charged has a very high value, which can end up being an important point in the customer's decision, since he will always think what is best for his own pocket.

Learn More: No annual fee credit card: the best on the market

The salty charge on withdrawals is also a factor to take into account, as paying R$12 per operation is not well regarded.

There is still a fee of R$18,90 if you pay a credit card bill.

And even though C&A offers the C&A&VC relationship program, it lacks a tool that gives cashback to customers, in which users make purchases with a part of the money back.

Bradesco Cards App

Customers who have a C&A Bradescard card can download the Bradesco Cartão application for mobile devices with the Android and iOS system.

In addition to the features already mentioned throughout the text, it is worth highlighting the simplicity of the app. Everything promised can be found easily.

However, the application has some problems and has a score of 3,8 in the Google Play Store.

When looking at the comments, it is noted that some users complain about not being able to access the platform because they have an invalid login. Still reports of slowness and bug problems when confirming the password with the fingerprint.

In any case, if you have an internet banking card, it is worth trying the app.

Bradescard in Reclame aqui

Reclame Aqui is very useful for finding out about the quality of service provided by companies.

In the case of Bradescard, issuer of the C&A card, the customer relationship service can be considered good, following what is seen on the platform.

The overall score is 7,3 and the proportion of complaints answered is 98,1%.

And most of the complaints on the site are about mismatched information, inadequate billing of services, non-receipt of tracking data from a card, problems with the payment of your invoice in installments and delays in payment of the boleto.

Therefore, it is possible to notice that the problems are small details that could be avoided.

However, the bank's service is able to resolve the vast majority of cases reported in Reclame Aqui. As a result, the solution rate on the platform is 77,9%

How to apply for a C&A Bradescard card

With everything you've seen so far, your desire to have a C&A Bradescard card has been aroused, so see, below, how to request one online:

Step 1: Access the Bradescard website;

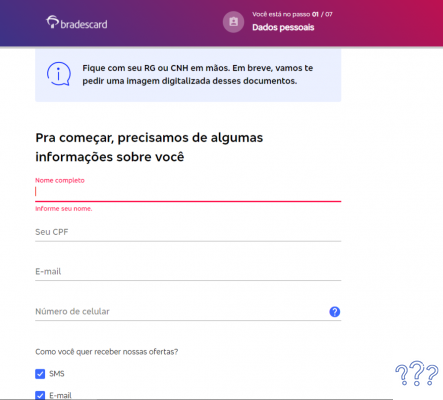

Step 2: On the page that opened, you need to click on “Make yours now” or “Order Here and Receive at Home”. The important thing is to get to the tab to fill in your data;

Step 3: In the new tab, fill in the requested information: full name, CPF, e-mail and mobile number;

Step 4: You will receive an SMS message in which you will have a code that needs to be entered in your registration. Once this is done, proceed to the next step;

Step 5: Now you need to choose which card you want to apply for. After making your decision, go to the next page;

Step 6: Again, you will need to fill in personal information: date of birth, marital status, gender, nationality and your mother's name;

Step 7: Fill in the information of your address where the bank must send the card;

Step 8: Now you need to enter the area you work or occupy, your profession and your monthly income. As much as you don't need to send the income document, it is important that you put the information in line with reality;

Step 9: It is necessary to forward a document with a photo and that has your RG. Your CNH can be used at this stage;

Step 10: Ready! Now it's time to wait for the bank's analysis to find out if you meet the requirements to have the C&A Bradescard card.

It is worth mentioning that you can request the card with the C&A store. In this case, you must bring proof of income, a receipt proving that you have been working for at least three months, proof of residency (preferably as current as possible) and documents.

Learn More: Renner Card: how to request and consult the invoice

It is also important to note that only people aged 18 or over can apply for the card. Also, for the card to be approved, you cannot have outstanding issues with SPC or Serasa.

And the minimum income required by the bank is at least one minimum wage.

Main C&A card service channels

If you need to clarify any doubts or have a problem, the fastest way to resolve it is to contact Bradesco's service channels by phone.

With this, it is worth noting that the vast majority of matters can only be resolved with the cardholder or dependents.

That is, if you borrowed someone's card and need to speak to an attendant, you will also need the holder to be nearby.

That said, you can call one of these numbers for assistance: SAC: 0800 730 5030. Ombudsman: 0800 727 9933 and Call Center 4004 0127.