by Team AllYourVideogames | Aug 31, 2022 | Technology |

Banco Bari is a digital account and is considered one of the main references in smart credit. The institution's proposal is to offer financial solutions to simplify the relationship of our countrymen with money, without fees and bureaucracy. In it, you can take out credit, take care of savings more safely, manage finances and apply investments when you need it most.

In this bank model, there is no manager pushing services all the time just to hit the target for the month. You are responsible for your money and can act in accordance with your goals.

One of the main differences between Banco Bari and other alternatives available on the market is that it has a team of specialists to answer the main questions about a particular product. We know that technology can overcome major obstacles of routine. However, the bank believes that people can better understand a scenario, interpret an objective and present the most appropriate solution.

From now on, we will present the main features of the bank, highlighting security, benefits, how to register, among other issues. Follow up!

See more at: What is the best digital bank to store money?

After all, is Banco Bari reliable?

Yes. For over 20 years, the institution has operated with the full credit cycle. It has already offered more than a billion real estate credit to clients, with quality and conditions that are linked to its financial planning.

Despite being digital, the bank offers several service options for customers to answer their main questions. Those who live in capitals and metropolitan regions can contact the number: 4007-2628.

If you live in other locations, the contact number: 0800-602-7007. By Whatsapp, the customer can talk to the company at the number: (41) 98775-7044, while the email address is: help@bancobari.com.br.

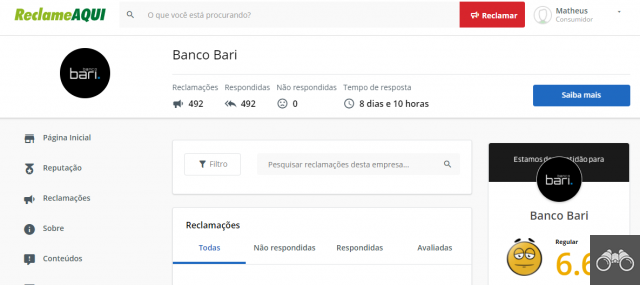

Bank Bari-Claim Here

The Reclame Aqui website is a great channel to check how a company's reputation is on the internet. According to the platform, in August 2022, Banco Bari’s rating was 6.6 out of 10, which is considered “regular” by the system. It is best to analyze the comments carefully to better understand the opinion of customers in relation to the services.

What are the benefits of Banco Bari?

If you like a digital account with several advantages, Banco Bari is a great alternative. Here, the customer can pay, receive, transfer and invest with a few clicks.

In the control account, the user can manage their expenses with the help of a personalized card, while the objective account helps the customer to save a certain amount to reach a goal.

Investments

It doesn't matter if you are an experienced investor or if you are just starting out in the market. Banco Bari contains alternatives for various types of strategies.

The CDB with daily liquidity, for example, is suitable for those who want to build an emergency reserve. It has regressive income tax, and the amount can be redeemed at any time. The most interesting thing is that the minimum investment is only R$ 50.

In the inflation-protected CD, the maturity is two years. It is suitable for those who wish to guarantee the protection of their assets from the dreaded inflation.

Unlike the first alternative, the redemption is released at maturity. On the other hand, it will be available at one of the lowest Income Tax rates. An investment of at least R$50 is required. In the application, the customer has access to other options that are available to the consumer.

Learn more: The 10 best digital brokers to invest

Home equity

Anyone who thinks that there is no flexible loan line is wrong. In the market, it is possible to find alternatives with a property guarantee, with the lowest rates on the market. The Banco Bari offer offers up to 60% of the cost of the property in cash on the account. The benefit is also granted as a credit card limit. Just choose the alternative that best suits your needs.

Payroll loan

The next loan option is aimed at municipal, state and federal civil servants, retirees, INSS pensioners and workers from companies that have an agreement with Banco Bari. The payroll loan contains interest with lower amounts and installments that do not harm your financial planning, since they are deducted directly from the consumer's salary.

Real estate financing

It is an incredible opportunity to acquire the property of your dreams. The client can finance up to 70% of the cost of the property in up to 20 years. It is possible to use the FGTS and complete income with up to four people. Card costs and transfer fees can be added to the total cost of funding. Discover some interesting benefits below.

- Up to three months to start payment;

- Deadline of up to 20 years to pay;

- Rates from 0,79 monthly.

Learn more: How to pay off a loan and pay less interest?

Credit card

For the customer who likes a full credit card, the option offered by Banco Bari is one of the best alternatives on the market. Through it, you can control your finances in the institution's own application. You can set the invoice due date and manage the limit flexibly.

In the Elo brand, the credit card is accepted in more than 11 million stores in our country and also offers exclusive advantages for consumers. Participation in the Livelo program is another interesting feature. You earn one point for every dollar spent. By accumulating a certain balance, the participant can exchange the score for various products and unforgettable experiences.

The Baricard Elo Grafite contains 3 of the 19 Flex advantages for the customer to enjoy without fees. This list includes: travel insurance, 24-hour assistance and Pet convenience. Another positive point is that the credit card does not charge an annual fee from the customer.

Learn more: No annual fee credit card: the best on the market

How to open a digital account in Banco Bari?

Opening an account through the bank's application is quite practical. It is not necessary to have advanced knowledge in technology to do this procedure.

The first step is to access the application store that is available on your mobile device. Then search for Banco Bari and install the application. Then open the system and select the option “I want to be a customer”. Now, enter your CPF and perform the registration steps without skipping any phase.

When entering your email, confirm that the address is correct. This data is very important because it guarantees the completion of the registration. After all, the system will send validation codes via SMS and email. Therefore, we recommend keeping an eye on your spam box.

After completing the registration, the user will receive an email confirming the order to open an account with this financial institution. At this point, the bank will verify your details and, after approving them, will send you an activation code by email.

The next step is to open the application, select the option “Activate the account” and enter the activation code. Now, log into your account. Ready, it is open and the user can enjoy all the benefits that the financial institution offers to the consumer.

Generally, the process we mentioned above can be completed in seven minutes. The approval of the registration takes up to five working days. This period may vary according to several factors, such as document analysis and the submission of the consumer's personal data.

It is essential to make it clear that the “Banco Bari login” can only be done through the application. Any other means of access can be a scam, so stay tuned so you don't have problems in the future.

What documents are required to open a digital account?

Simply enter your CPF number and forward a photo of your identity document or national driver's license (CNH).

Is the bank a current account or a payment account?

As with most digital financial institutions, this digital account is a payment version. This means that it does not contain bureaucracy and is more easily opened when compared to the processes of other account models, including: current or savings.

How to cancel a Banco Bari digital account?

Despite all the benefits offered by Banco Bari, it is not always approved by some customers. It is essential to make it clear that failure does not indicate that this financial institution lacks quality. On the contrary, because each consumer needs different benefits.

The positive side is that requesting the cancellation of the Banco Bari digital account is as simple as opening an account. To do this, you must enter the application, select the “Menu” option, tap on “Profile” and, finally, tap on “Cancel Account”. Then, just run the commands until you finish all the steps.

How do financial services for PJ work?

The institution also has a great portfolio of products for legal entities: Settlement Bank, Digitizer and Custody. The characteristics of each one and their main benefits are available on the bank's official website.

The financial institution's page is also the best alternative to search, such as “Banco Bari work with us”, “Lci Banco Bari” or “Banco Bari second via boleto”. Always opt for the company's official channels.

After discovering the information about Banco Bari, learn how to create an account at PagSeguro. Another interesting possibility for the consumer.