by Team AllYourVideogames | Sep 9, 2022 | Technology |

MagaluPay is like a good alternative for those people who are tired of the bureaucracy of banks and financial institutions that offer limited benefits to customers.

Developed by Lojas Magazine Luiza, the digital account promises to make your relationship with money more practical and easier.

The absence of fees and the possibility of resolving all pending issues through the cell phone are some of the reasons why the account is becoming a darling among customers.

From now on, we are going to present how it works, what are its benefits, how to download the application, among other interesting questions.

After reading this content, you will be more confident to promote the union between the digital world and the finance market.

Learn More: Which is the best digital bank to open your account?

What are the benefits of MagaluPay?

There are several benefits to being a MagaluPay customer.

To get an idea, it is possible to purchase products in physical stores or through the app using the account balance.

The user also receives part of the money back (cashback) on all purchases made with the Magalu card.

Another positive point is that the consumer can transfer money to other users through PIX.

With just a few clicks, you can make payments on traditional bills, such as electricity, water, telephone and internet.

Learn More: Banco Bari: How to open your free digital account

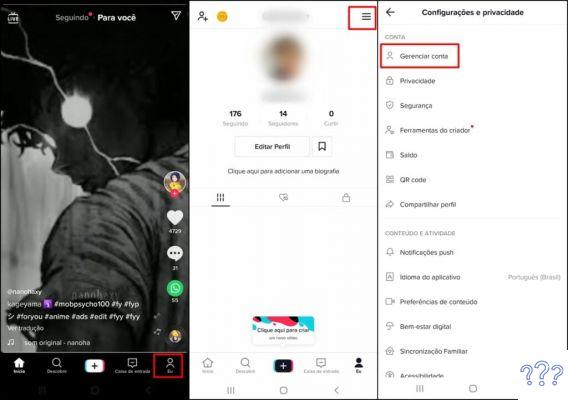

How to download the Magalu App?

The process to download the Magalu app is simpler than it sounds.

It is not necessary to be a technology expert as the system is practical and can be completed in a few minutes.

The first step is to download the Magalu app on your mobile device to enjoy all the benefits of MagaluPay.

For users who have the SuperApp installed on their cell phone, they must follow the guidelines below to activate their account.

- Touch no item MagaluPay – Activate your account;

- Select the button “Enter your e-mail or CPF”;

- Enter your CPF number, add the password and tap Continue;

- Choose the item “Activate my free account”;

- Add your current phone number and tap “Send SMS”;

- Enter the code that was sent by SMS.

Ready. Now, the user can make purchases on Magalu and guarantee cashback.

It is never too much to remember that, to enjoy the benefits of the digital account, the user must complete the registration.

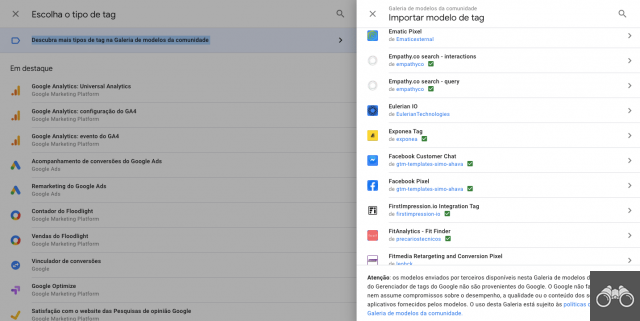

How to transfer any amount to Magalupay account?

From now on, we are going to show you the main guidelines for making a transfer through PIX or the Bank of our country:

1. Pix

Initially, the user needs to complete the registration on MagaluPay.

Then you need to register a key in your account.

This step takes place without bureaucracy and can be completed in a few minutes.

Then, just use the registered key to make the transfer.

2. Transfer

A lot of people don't know, but it's possible to make transfers between digital accounts.

In this way, it is possible to forward any amount to a co-worker, friends or relatives who are MagaluPay users.

It works like this: the first step is to choose this alternative from the menu.

Afterwards, a barcode will be issued that needs to be authorized by the user who will be responsible for transferring the amount.

Now choose the value to be forwarded.

Finally, confirm the data and values.

3. Bank of our country

To make a transfer in this financial institution is quite simple.

Set this alternative, access your institution account through MagaluPay.

Choose the amount you want to forward the money.

In a few seconds, the new balance will be displayed on your digital wallet screen.

To finish this process, you need to separate a document (RG, CPF or RNE) and choose a place with good lighting to take a selfie.

This step is important to ensure account security and authorize all MagaluPay features.

How to buy and how to pay with or MagaluPay?

In MagaluPay, the user can pay water, electricity, telephone bills, among others.

Choose this alternative from the menu, type the barcode or use the camera to read the number of an account.

Finally, authorize digital payment.

To purchase products in Magalu establishments and SuperApp through MagaluPay, there are no mysteries.

In establishments, after defining the product, tap on the “Purchases in Magalu Stores” button, which is located in the application itself.

Then, scan the seller's QR Code and make the payment with the amount available on the account.

Now, to make in-app purchases, purchase products as normal.

When paying for the items, choose the “MagaluPay” button and use the amount available in the account.

Here, it is worth mentioning that the user can split the account with the support of his credit card and MagaluPay.

How does Cashback Magalu work?

The consumer can receive cashback in the app itself.

To do this, activate your MagaluPay account.

Then, buy only the products that are marked “Money Back”.

The amount is debited from the account balance within 20 days after the payment has been authorized.

This amount is calculated according to the percentage that is displayed on the Cash Back badge.

It is essential to make it clear that freight, interest and other fees are not added to this program.

Cashback can be used in the Magalu app and in physical establishments.

How does PIX work in Magalu?

Developed by the Central Bank, PIX is considered one of the best means of payment by Brazilians.

That's because, it works 24 hours a day, free of charge and is quite safe.

To ensure more practicality for your routine, we recommend registering a PIX key in your MagaluPay account.

In this way, the consumer guarantees all services in one place.

The system is secure, as is the case with other accounts that are references in the market.

Final review about MagaluPay

The MagaluPay digital account is one of the best on the market.

After all, it offers several interesting benefits to the consumer.

The network also belongs to one of the main companies in the area, which is as important as other brands, such as Americanas, Mercado Livre and PicPay.

The exemption from fees and the possibility of solving all financial problems through the cell phone are great positive points that cannot be ignored in this article.

It is worth testing and enjoying all the benefits.

After discovering the main details about MagaluPay, find out which is the best digital bank to apply for a loan.