by Team AllYourVideogames | Dec 2, 2022 | Banks |

Next is a fully digital bank, aimed at a younger audience. But will the Next Bank is good? Discover the advantages and disadvantages of the digital account that has been gaining more and more users.

Having a digital account brings numerous benefits that a traditional bank is often unable to offer, such as the possibility of carrying out various types of transactions over the internet without having to go to a branch, for example.

In addition, digital banks are usually exempt from fees or annuities. The new digital age brings us countless types of comfort and the world of banking could not be different.

That said, the digital bank Next, created by the traditional bank Bradesco, has been on the market since mid-2022 and is living proof that technology is, without a doubt, a great ally in our lives.

There are several other digital banks. But today our focus is Next. Check below how this bank works, what are its main advantages and disadvantages and if it is worth opening your account.

Know More: Best digital bank 2022: check out our favorites

Is Next Bank good? Discover Bradesco's Digital Bank

In the beginning, when Banco Next was created, it did not offer many good investment options and charged a fee to have access to basic and unlimited services, such as TED, for example.

But, over time, Next has had changes and updates and today it no longer charges a basket of services or fees. Next has become one of the best digital banks in our country and has a large number of customers.

In addition to the digital account with current account, savings account and debit card, Next also offers international Visa credit card, PIX, unlimited and free TEDs, payment of boletos, automatic debit, bank loan, mobile recharge and much more.

Another interesting point, especially for people who use a lot of cash, is the fact that withdrawals are unlimited and free. Withdrawals can be made at any ATM in the Banco24horas network and by Banco Santander, as it is affiliated with Banco24horas.

It is also possible to make unlimited withdrawals and deposits at Bradesco branches, as Next is owned by Bradesco. So, it allows operations at its ATMs.

The Next app has its own tools, such as the Mimos tool, which offers exclusive discounts at partner stores, and the Flow tool, which helps you organize and control your money and expenses.

Learn More: What is Finclass financial education and how does it work?

Next Investment Platform

In addition, Next has an investment platform with opportunities in Fixed Income, Investment Funds and Savings.

In Fixed Income, there is the CDB that yields 100% of the CDI and is guaranteed by the FGC (Credit Guarantee Fund) and its minimum investment is R$100. The CDB has daily liquidity, where you can withdraw money on any business day.

In Investment Funds, there are more possibilities for risk and term investments, such as investment funds linked to Fixed Income, to our country's stock exchange, to the IPCA and even to the American stock exchange.

Within the app there is also a shortcut to Ágora Investimentos, which is Bradesco's official broker. By clicking on the shortcut, you are taken to the Ágora website and you can register.

Learn More: The 10 best digital brokers to invest

How to open a Next digital account?

To open a Next account, you must download the application (Android | iOS) and provide the personal data requested. Documents and proof of address are required to send photos of them.

You will also need to record a video explaining that you want to be a Next customer. After that, an analysis will be carried out, which takes 3 to 7 business days for the registration to be approved.

You also have the option of requesting a credit card along with a debit card, which will also undergo an analysis. The card is sent to your address after approval, free of charge.

Next app features

The Next app has several functions, but despite that it is very intuitive and simple to use. Check out the tools available and what each one offers.

Anyone who has a mobile device with a fingerprint reader can access the app by placing one of the fingers on the sensor, without the need to enter the password.

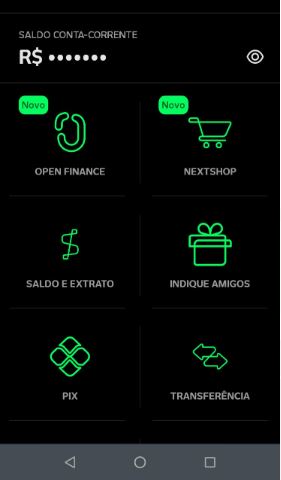

Upon entering, we come across the following tabs:

- Open Finance: Aims to connect and share banking information from other financial, insurance, investment, foreign exchange institutions, among others;

- NextShop: It's Next's new marketplace. With it, it is possible to find thousands of offers in different categories and with the possibility of cashback of up to 10%, which is deposited in the account right after the payment is approved;

- Balance and Statement: To check your balance and statement with your debits and credits.

- Refer Friends: At Banco Next refer and win. By referring friends to also open an account, you and your friend can earn up to R$15;

- PIX: To pay and receive payments via PIX. It is allowed to register the following keys PIX, CPF, mobile number, e-mail and/or random key;

- Transfer: To carry out bank transfers, where the night limit is from 20h to 6h by the time of our city;

- Payments: It has 3 options: pay with barcode, SP vehicle debit and automatic debit;

- Cellular recharge: To buy credit for your device, simply inform your number, operator and value. The recharge drops off at the same time;

- Card: With several options related to cards, such as requesting a credit card, making digital payments, canceling the card, viewing the services and card and making settings;

- Credit: To check your credit;

- Investments: For you to make your investments;

- Agora Investimentos: To access the broker's website;

- Objectives: Investment area where you receive tips for the best investment option to raise money;

- Flow: Spending Planner, where you can enter a spending limit by category. There is automatic and manual planning and when you reach the limit, you are notified;

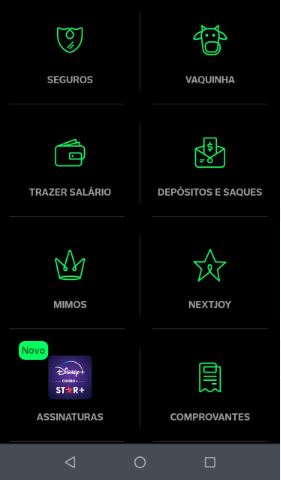

- Insurance: Next offers several insurances with several plans. There is life, dental, debit card and home insurance;

- Vaquinha: You can organize a virtual crowdfunding through the app itself. The maximum number of cows is up to 5, the maximum value of each cow is R$10.000,00 and per person R$5.000,00;

- Bring Salary: Next offers the option to bring your salary to your account, free of charge;

- Deposits and Withdrawals: In deposits and withdrawals, you can transfer from Bradesco or other banks, at the ATM, schedule withdrawals and consult scheduled and performed withdrawals;

- Mimos: Partner companies offer discounts and cashback when paying with the Next card. You can have discounts of up to 50% on cinemas, subscriptions and other services;

- NextJoy: Digital account for minors, with parental participation. The account offers financial education and resources to manage expenses and know how to enjoy pampering. It's also free;

- Subscriptions: Discounts and benefits on Disney and Star+ subscriptions;

- Evidence: All financial information gathered;

- Donations: If you wish, you can contribute to institutions or social causes through payments made with the Next card.

Advantages and Disadvantages of Banco Next

Now that you are familiar with Bradesco's digital account, it is important to make a general assessment of the pros and cons of opening your digital account.

Therefore, here are the advantages and disadvantages that we consider about this bank:

Advantages

- 100% digital account, everything is solved by the app itself;

- No annuity;

- Visa-branded debit and credit card;

- Unlimited and free DOC and PIX transfers;

- Unlimited and free withdrawals and deposits on the Banco24h network or Bradesco branches;

- Bank loan;

- Exclusive discount and benefit tools such as Mimos and NextShop;

- salary portability;

- Ticket payments;

- Recharge cell;

- Insurance

Disadvantages

- It does not offer automatic income like some digital wallets;

- The credit card is more difficult to get approved;

- The Visa Platinum card charges an annual fee;

- Poor after-service, according to its users;

- Only 1 TED available for free accounts;

- Unlocking the card needs to be done at a cashier.

Banco Next no Reclame Aqui

On the Reclame Aqui website, Banco Next has a rating of 7.4/10, with 100% of complaints answered and an 80.3% solution rate, where 60% of people would do business again.

Is Next Bank good? It is worth it?

If you are still afraid of opening a digital account, know that Banco Next conveys total security as it is a digital account created by Bradesco, a traditional bank with solidity in the market.

Furthermore, the advantages that Next offers are quite attractive despite having some points that may be lacking, depending on your needs.

We can therefore conclude that Banco Next is good and has advantages that many traditional banks do not offer, but it is necessary to assess whether everything it provides is enough to meet your profile.

Learn More: Bank of our country PJ Digital: how to open your account?