by Team AllYourVideogames | Nov 11, 2022 | Credit Cards |

Nubank is one of the main digital banks available today. But one of the biggest difficulties that customers may face is knowing how to increase the limit in Nubank.

In this text, we will give you some tips to know how to increase your credit card limit and improve your financial life.

The first step is to learn more about Nubank and the credit card.

If you want to know how to access digital banking, just install the application directly from the App Store, for iOS devices, or from the Play Store, for Android devices, or directly access the Nubank website and create your account via the web. .

In these access options, you can already access your account. If you already have one, you can request your card, or create your account, if you don't already have one.

Let's check how to increase the limit on Nubank.

Learn More: Digio or Nubank which is better?

How does Nubank define the card limit?

In order to understand in more detail how Nubank sets the credit card limit and how to ask for a limit increase, it is necessary to know how a credit card works.

In practice, we can say that the card works as a kind of short-term loan. That is, the institution, in this case Nubank, lends you money in its possession and you can use this amount for a certain time, normally for a period of one month.

However, when that time is up, you will have to pay the amount you spent that money borrowed to the bank, what you didn't use you won't have to pay.

That is, when we are talking about the card limit, it is actually the available amount of the loan that Nubank made to the customer.

Institutions and banks that offer credit cards often carry out risk analyzes to define how reliable someone is to have a credit card and what limit this person will receive. That is, the bank will assess whether you are someone trustworthy, in the same way that you do before lending something to a person, making sure that he or she will return it.

The limit that a person will receive on their credit card is directly linked to the ability to pay that loan every month.

However, whenever you have a debt in the past or lack information about it, your limit can end up being harmed.

Now that you know how the credit card works, it's time to check out the main tips and learn how to increase the limit at Nubank.

Learn More: New Nubank acquisition promises to automate conversations to aid in financial planning

The best tips to increase the limit at Nubank

1. Always try to pay the invoice before closing

The first tip we can give you on how to increase the limit is to always try to pay your invoice before the closing date, or exactly on the closing day. In addition, it is also extremely important to make this payment with a Nubank account, or NuConta, as it is called, thus releasing your credit limit on the spot.

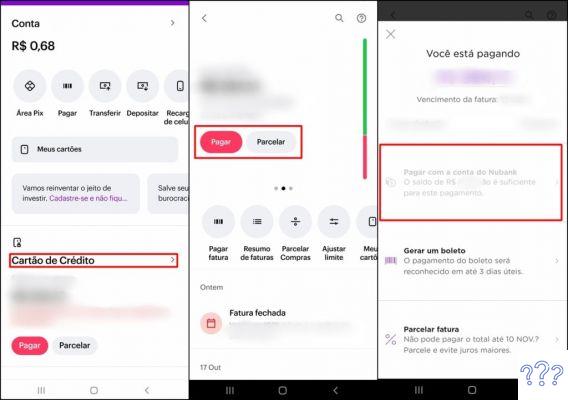

To carry out this procedure, simply open your digital banking application, click on the “Credit Card” option and slide your finger on the screen to the side, until you find the “Current Invoice” option.

By clicking on the “Pay” button, you will be able to pay your invoice using the money deposited in your Nubank account. If you do not want to pay your expenses with your Nubank account, you still have the option to pay the invoice in installments and generate a slip.

After making the payment, your card limit will be available for use in just a few minutes, allowing you to make your purchases again with the Nubank credit function.

However, keep in mind that by paying in advance, the invoice will remain open, as the closing date will not change.

2. Explore the available limit using the Nubank card

It is important to know that patience is needed to get a higher limit at Nubank, as the institution usually increases credit card limits gradually, analyzing the data of purchases made with the card.

Thus, the more purchases you make, the more Nubank will be able to assess your profile in detail and adjust the new available limit according to the purchase information.

This type of assessment can end up being harmful depending on the information collected. Depending on your actions and purchases, Nubank may find it best to lower your credit limit rather than increase it. So you need to pay attention.

To increase the limit at Nubank, most users usually make as many purchases as possible on the card and pay the bill in advance.

Users who delay payment use the installment option and revolving card may have their limit lowered by the bank.

Learn More: Nubank Platinum Card: What are the advantages and how to get it?

3. Always keep your income up to date on the app

The analysis of information from users' purchases made by algorithms are not the only categories analyzed to increase the limit at Nubank.

The customer's personal information, credit and monthly income are also analyzed. Thus, it is always important to have this information updated in your application, as it will be a key point to increase the limit at Nubank.

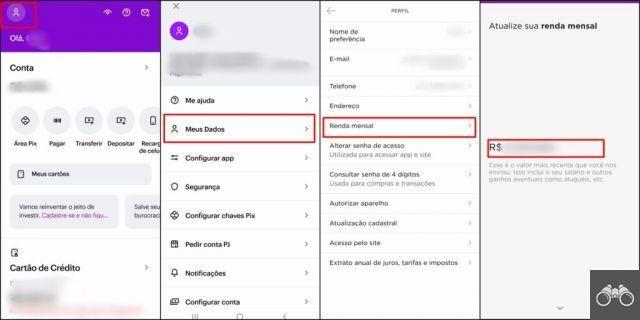

The process to update your monthly income on the Nubank app is very simple and you can do it in a few steps.

Simply log into your account and click on your avatar in the upper left corner to open your profile. After that, enter the menu options, click on “My Data” and then on the “Monthly Income” alternative.

After that, just inform the amount you receive per month.

4. Have your CPF without restrictions

If for some reason you fail to pay a company for a service provided or product purchased, you run the risk of the company pointing your Individual Taxpayer ID (CPF) to the appropriate credit protection agencies, such as the well-known SPC and Serasa .

This ends up making you negative, with the famous “dirty name”. Thus, the consequences can be as varied as possible. The most common and main one is the impediment of getting credits.

All banking institutions check the customer's CPF to analyze the risks before providing credit. If you have pending in other places and your name is dirty, your credit application will almost certainly be refused.

This will continue even if you pay the bank on time and follow all the rules, the only way to fix this is to clear your name.

If you already have a credit card but got your name dirty in another place later, this will probably make you unable to increase the limit at Nubank.

Learn More: How to apply for a Nubank credit card

5. Build your relationship with Nubank

As much as you follow all the tips, always pay on time, avoid having a dirty name, always make purchases on your credit card, etc., the company may not see it as enough to increase the limit at Nubank.

Usually, this happens because the company doesn't know you well and therefore doesn't see it as viable or safe to release you a higher limit.

In most cases, not being able to increase the limit at Nubank may not be a problem with you, but with the institution's ability to grant credit.

The main tip we can give you to achieve your goal is to be patient.

You need to take it easy to build a relationship of mutual trust between you and the digital bank.

6. Have a Positive Record

One of the main points you should follow to increase the limit at Nubank and at other banking institutions is to perform your Cadastro Positivo, Serasa's online platform.

Having this record will make Nubank's life easier when it comes to checking its financial behavior. If it is good, you will be one step closer to being able to increase the limit at Nubank.

The access and operation of the Positive Registry is automatic, so you will not have the Registry if you request to leave it.

So, if your interest is really to increase the limit at Nubank, try not to leave and keep your registration.

Learn More: How does Nubank Rewards work?

7. Use the services offered by Nubank

You also don't need to have only a good external score to get good credit cards and limits. But it is also extremely important to have a great internal score at the institution to be able to increase the limit at Nubank.

But if you're wondering how to do this, don't worry, there are a few ways. In short, you need to use your Nubank account as much as possible, leaving your money in it, and hire the services offered by fintech, such as loan and life insurance, for example.

This will make you improve your relationship with the digital bank and make it even easier to know your profile and financial behavior and the chances of increasing the limit at Nubank are greater.

8. Avoid paying the invoice in installments

Although Nubank offers the options to pay your bill in installments and pay less than the total amount, following these alternatives will go against your goal of increasing your limit at Nubank.

So, what you should keep in mind with your credit card is: “on no occasion spend more than you can afford”.

If you choose to pay less or pay the bill in installments, your internal score at the institution may drop dramatically. Consequently, this means goodbye to the chances of increasing the limit at Nubank.

Learn More: How to generate a boleto at Nubank: 2 ways to charge

9. Request the limit increase directly in the app (as a last resort)

One of the functions offered by the digital bank to increase the limit at Nubank is to request the increase directly in the application.

For this, you need to know that it is very rare for Nubank to meet these requests with a higher limit.

If you make the request for an increase, you will probably receive the message that it was not possible to have this increase, since in most cases the increase in the limit comes from the fintech itself. So try to wait.

One last attempt after trying everything to increase the limit on Nubank and failing, you can take a risk and apply directly, however, you need to take it easy.

Try not to ask for a raise too high and avoid asking too often. If you asked once, wait a long time to be able to ask again, not hours, but months.

Another tip that can be excellent is to place the order right after paying your invoice.

To find out how to order to increase the limit at Nubank, you need to enter your application and go to the “Credit card” option. Look for the option to “Adjust Limit” and then click on “Request Increase”, right below the option to adjust limit.

You will be taken to a screen where you can indicate how much of a raise you want to receive in reais, in addition to justifying the reason for your request.

You should have your answer about increasing the limit at Nubank within minutes after requesting a card increase with the Nubank app.

Learn More: What is Account DV? Find out what it is and what it's for