by Team AllYourVideogames | Sep 21, 2022 | Credit Cards |

Are you out of money to pay your bill?

Check out how does the credit card minimum payment work and understand if it is worth resorting to this option.

The credit card can be a great ally for your finances.

If used consciously, it makes it possible to pay your purchases in installments in the coming months.

But you need to be careful and planning, as this can become a nuisance.

The interest on credit cards is one of the highest on the market.

Therefore, it is necessary to be attentive to your expenses so that you do not suffer from an accumulation of future debts and not lose control of your finances.

Learn More: How to pay bills with a credit card?

To understand how it works, check out the meaning of some terms and how interest rates work in this type of transaction.

How does the credit card minimum payment work: Revolving Credit

When you are unable to pay the full amount on your credit card bill, you can pay only the minimum amount or an amount less than the total due, and leave the rest for the following month's bill.

In this way, the use of revolving credit begins.

Revolving credit is a short-term personal loan (30 days), which can be used to pay your card bill.

Its main purpose is not to let your name be negated by the non-payment of your invoice and avoid blocking your card.

This type of credit can also be used to withdraw cash using a credit card.

It's not very common, but it's possible.

However, you need to be aware of the risks that this may entail in the future, such as high interest rates.

Revolving credit is divided into two categories, which are: regular revolving and non-regular revolving:

regular rotary

When the amount of the invoice paid is between the minimum stipulated amount or an intermediate amount, we have, in practice, the regular revolving.

Interest percentages are high and may vary between creditor companies.

non-regular rotary

When the consumer does not make any type of payment, he automatically enters the non-regular revolving and begins to accrue interest on interest.

It is also a loan.

In this case, it is less advantageous in relation to the regular one and you can still have your name on the list of defaulters.

It is worth mentioning that revolving credit can be used on a constant basis.

But be careful: the interest rate in this type of transaction varies on average from 13% per month and can reach more than 300% per year.

See how it works below.

How the credit card minimum payment works: Revolving credit interest

These are the interest rates that will be levied on the remaining amount of your bill.

Let's assume that you have an invoice totaling R$1.000,00 and you don't have the money to pay it off.

The minimum amount for payment will be stated on the invoice itself.

You can only pay the minimum, which can vary around 15% of the total amount.

It is worth noting that this percentage may vary between credit operators.

As of 2022, the Central Bank made some changes to the rules for cards and started not to limit this percentage.

In this way, each operator calculates according to the consumer's profile.

Therefore, before joining the minimum payment, be aware of all the information contained in your invoice.

It will contain the interest rate that will be applied.

Therefore, you will be able to better assess whether it is worth joining this option.

To help consumers with credit cards, there is a booklet from the Central Bank with all the necessary information for you to make good use of this tool.

Let's go through our simulation to understand how it works in practice:

Total invoice amount: BRL 1.000,00

Minimum amount for payment: 15% i.e. R$150,00

Revolving interest: 15% am

Remaining amount for the next invoice: R$850,00

In this case, interest will be levied on the remainder (R$850,00).

In addition to the revolving interest, this operation will also apply: IOF (Taxes on Financial Operations) monthly of 0,38% and daily IOF of 0,0082% (fictitious values).

Let's calculate on the monthly IOF of 0,38% and the daily IOF of 0,0082%.

In this way, we will have:

Interest on revolving: 850,00 x (1+0,15) = BRL 977,50 (ie BRL 127,50 of interest)

Monthly IOF: 850,00 x 0,0038 = BRL 3,23

Daily IOF for 30 days = 850,00 x 0,000082 x 30 = BRL 2,09

Amount to be paid on the next invoice: R$977,50 + R$127,50 + R$3,23 + R$2,09 = R$1.110,32

That is, by making the minimum payment, in a month you will accumulate a loss of R$260,32.

But, you still have other payment options.

One of them is already obligatorily described in the invoice, which deals with the installment of your total debt.

As a general rule, if you are unable to pay off the debt before making the minimum payment, check if you will be able to pay the amount in full in the next month.

Otherwise, analyze whether the debt installment does not fit better in your pocket.

Interest on installments is fixed and fees are lower.

The problem in this case is that your limit is blocked and as you make payments, it is gradually released.

In addition to this option, you can also pay an intermediate amount, which is above the minimum stipulated amount and below the total amount.

That way, you will be able to reduce the incidence of interest.

It is important to pay attention to your bill.

It will contain all this information, including the interest rates applied for each of the payment alternatives.

Do the math and see the best option to pay off your bill.

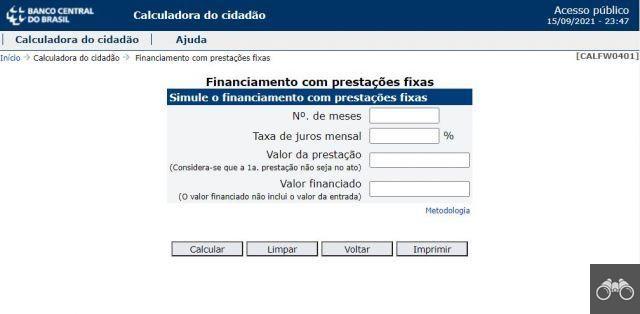

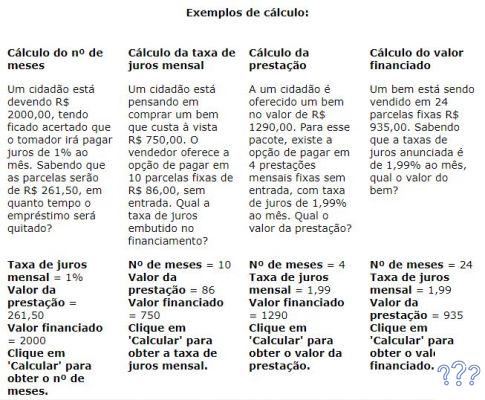

A good tool to assist you in this process is the Citizen Calculator, available on the Central Bank website.

Learn More: Online compound interest calculator: the 5 best on the market

How does the credit card minimum payment work? through apps

If you do not receive your invoice, you can access it through your credit provider's application or through the website.

There is no need to go to agencies or speak on the phone.

In the app or on the website, you will find all possible options for making the payment, information about the interest rates applied to each transaction and an overview of how interest will be applied to the following invoices.

Pay attention to the values informed for each option, because it will be through the amount paid that your operator will identify which of the proposals you adhered to.

Example: Your invoice closed with a total of R$1.000,00 and you were offered, as an alternative, the minimum payment of R$150,00 or in installments, of 1 down payment + 12 installments of R$125,00.

Once you have this information and access to the invoice barcode, you can pay through your bank's app.

Remembering that some operators also already provide QR Code on the invoice and accept payment via PIX.

In the “Value to Pay” field, enter the exact amount corresponding to your chosen option, remember that it will be through this that your operator will identify the alternative that best fits your budget and will apply it to your next invoice.

Now that you know the methods applied to this type of operation, you understand that it is always a risk to adhere to any of these options, as they have exorbitant interest rates that in a short time can become a snowball.

The ideal is to try to keep track of your credit card expenses, using it only when it is really necessary, in order to calculate well the impact it will cause each month.

How not to lose control and keep your card?

The answer is quite simple.

The ideal is to pay your bill on time, without depending on installments or minimum payment.

To ensure that this happens, we have separated some tips so that you do not fall into this trap:

Plan your spending

Keep in mind that you cannot spend more than you earn.

Make a note of everything that goes in and everything that goes out.

That way, you'll see where you're putting your money and you'll be able to manage it better throughout the month.

Do not forget to highlight fixed monthly expenses, such as water, electricity, gas, internet, telephone, financing, among others.

Subtract that slice from your earnings, check what's left in cash and set a ceiling for your credit card.

Expense Cut

Now that you know how much you can spend on the card without compromising your income, cut back on unnecessary expenses.

It is often the small amounts spent here and there that are the biggest responsible for your bill going above what you have set aside to pay it.

Do not hoard credit cards

Having multiple credit cards seems to be advantageous, but in fact, it just seems like it.

If this is your case, we suggest you study which one best meets your expectations and cancel the others.

Learn More: Personal Financial Planning: The 5 Best Apps

Extra tip on how credit card minimum payment works

If you cannot make any of the payment methods proposed by your operator, it is good not to let the debt run wild, because in a matter of a few months, the amount can become extremely difficult to pay off.

In this case, it would be better to take out a payroll loan, if you fit this profile.

If not, make a simulation of a personal loan and see if it is feasible to do so.

In this type of operation, the interest rates applied are lower than those of revolving credit.

It is important to note that several financial companies and banks provide the loan application tool on their websites and/or applications.

In many of them, in addition to the simulation, it is possible to contract your loan without leaving home.

More comfort and convenience that can provide you with a more viable solution to pay off your card bill.

But beware, to avoid unnecessary debt, take just enough to pay off your debt.

Knowing how the credit card minimum payment works and the other options offered, evaluate carefully and hire them only if there is really a need.

Learn More: How to pay off a loan and pay less interest?