by Team AllYourVideogames | Oct 15, 2022 | Banks | 4

One of the main vehicle financing companies in the market is Aymoré Financiamentos, which belongs to Grupo Santander.

In this post, we will separate the main points and everything you need to know about the Aymoré Credit in order to carry out its financing.

In addition, we also separate the main advantages, your evaluation on Reclame Aqui and more.

Learn More: Alum Financing: is it reliable? How it works? Find out here

Aymoré Santander Financiamentos

When it comes to new and used vehicles, Aymoré Créditos is the leading company in the financing market.

It is especially recognized for its agility in granting credit, in addition to offering very attractive interest rates to the public.

Among the various lines of financing offered by the company, we can mention:

- Dental equipment and medical hospital equipment;

- Financing for motorcycles and vehicles;

- Financing for construction equipment and furniture;

- Financing related to information technology for software and hardware;

- Exchanges, tourism, packages and cruises are also financeable;

- Aymoré Crédito also offers financing for sustainable products with accessibility, cleaner processes and renewable energy.

Learn More: How does Pronampe financing work?

Aymoré Personal Credit with Guarantee

Aymoré Credit Guaranteed Personal Loan is also known as Vehicle Refinancing.

This option is well suited for customers who have the need to purchase a certain amount of money so they can balance their accounts and have a vehicle paid off.

At the company, you have the possibility to finance up to 100% of the value of your vehicle, thus being able to use the amount received in any way you want.

In other words, you, as a customer, do not need to report to Aymoré Crédito about how you are using the financed amount.

Another recent company that is also part of Grupo Santander is A SIM, which specializes in issuing personal loans to customers completely online.

The SIM Personal Loan has offers ranging from R$500 to R$25.000, which can be divided into up to 24 installments, according to the client's wishes.

After applying for the loan, the money will be available in your account within one business day.

Advantages of using Aymoré Financiamentos Santander

One of the main advantages that we can mention from Aymoré Financiamentos is that when we compare the interest rates of vehicles financed by Aymoré Créditos with personal loan rates, we can conclude that they are much more attractive values.

But other benefits that the company has are:

- The money is deposited in your account on the same day you contract the financing;

- Unlike Leasing, the customer continues to own his vehicle even with financing, as one of the company's conditions;

- With special interest rates, the financing can be divided into up to 36 installments.

Learn More: How to simulate vehicle financing online?

Aymoré Credit Leasing

Known as Financial Commercial Leasing or Vehicle Leasing, this option works like a lease or purchase of a certain asset of yours.

The operation is simple, with the customer needing to lease their vehicle and pay monthly for it.

With the end of the contract, the costs and responsibilities for the good become his.

Advantages

The leasing option offered by Aymoré Crédito has its advantages, such as the non-incidence of Tax on Financial Operations (IOF).

In addition, the period for contracting the service is 24 months, with the client still being able to extend this period for five years, if desired.

What fees are charged at Aymoré Crédito?

If you want to know the value of the fees that are charged by Aymoré Crédito, a complete table is available online informing these numbers.

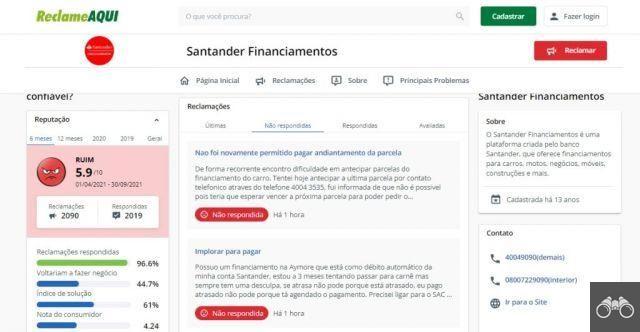

Aymoré Financiamentos Santander reputation in Reclame Aqui

If you want to know if it's really worth using the company's services, one of our tips is to check the opinion of customers on the company reviews website Reclame Aqui.

In this case, as Aymoré Créditos is part of the Santander Financiamentos group, it would be correct to see Santander's assessment, so check it out below.

Santander Financiamentos has a bad reputation, with a rating of only 5,9/10.

The company has a good response rate to issues, responding to 96,6% of complaints filed against them.

However, the rate of solving these same problems is only 61%.

Of the customers who complained about the services, only 44,7% said they would do business with the company again.

We see that several customers had problems with the services of the lender.

So before using Aymoré Credits, our suggestion is for you to talk to other people who worked with the company and get in touch directly with Aymoré to clarify your doubts.

Learn More: How to simulate real estate financing online?

Aimoré Credits: Channels to get in touch

There are several channels for you to use if you want to contact Aymoré Financiamentos, below we list them all for you.

Telephone Aymoré Credits

If you want to get some information about financing, talk about company services, ask questions related to the contract, you can use the Aymoré Credits telephone numbers, which are:

- For metropolitan areas: 4004-9090;

- For other locations: 0800 722 9090

Aymoré Credits Call Center

Now, if you want to speak directly with one of the company's attendants, then you can use the Aymoré Call Center.

Customer Service works through the number: 0800 762 7777.

Ombudsman Aymoré Credits

If customer service has not resolved your problem, another communication channel for you to use is the Aymoré Créditos ombudsman.

In this channel, you will report what happened and then work with the company to solve the problem.

The number you need to call is: 0800 762 0322.

This channel also serves to make complaints about the company.

Another service option is through WhatsApp, being able to resolve situations related to the contract, slips, negotiations, customer area and personal loan.

Just click on the green button labeled “Speak Now”.

With this, you will be forwarded directly to WhatsApp.

Chat

The institution also has an online chat for you to be served on time by the attendants.

As soon as you access the Santander Financiamentos website, the chat appears on the right side.

Just inform the subject you want and continue the chat.

Social Medias

With social networks, you can clarify your doubts and follow the main news about Aymoré Crédito.

The most used networks by the company are:

Apps

Last but not least, we have the Santander Financiamentos app, making it even easier to solve some of your problems.

With it, you can request a duplicate of your boleto, check the installments, balance and data, change your payment method, exchange the financed asset and transfer the financing.

The app is available on the Play Store for Android devices and on the App Store for iOS device users.

Just access the digital stores and perform the installation to start using.

Learn More: How to pay off a loan and pay less interest?