by Team AllYourVideogames | Sep 8, 2022 | Technology |

I bet you've heard the following sentence about financial education: "learn to use Bhaskara's Formula that one day you will need it", it's almost a cliché, but hardly a person who doesn't work with calculations needed to use this formula at some point. of life.

Despite this, there are some accounts that you really need to understand, especially if you deal with financial issues, such as interest.

But don't worry, even if you don't understand a lot of math, there are tools to help you do the math.

So, check out the best options for online compound interest calculator.

In addition to seeing online compound interest calculator alternatives, in this post you will be able to check an explanation of what interest is, the difference between compound interest and simple interest, as well as some extra information.

Therefore, calculators will be indicated that can be used online by the websites and also some applications that you can download on your mobile device.

Juros Compostos Online Calculator

It is worth mentioning that the listed calculators allow users to make different simulations and comparisons of financial investments in a simple and fast way.

In addition, you can use the tools to have a base on the values of your investments and financing.

So, here are the best platforms to calculate compound interest.

1. Citizen Calculator

We opened the list with the Citizen's Calculator, a free tool provided by the Central Bank of our country (Bacen).

With it, it is possible for anyone to calculate in a simple way how much an application earns in interest.

In addition, it is also possible to calculate the cost paid in financing.

Therefore, the platform performs financial accounts following the compound interest method.

Then it is possible to make the calculations of correction of values, financing with fixed monthly fees, applications with constant deposits and future value of capital.

You can access the tool through the Bacen website or download the application from the Google Play Store or the Apple Store.

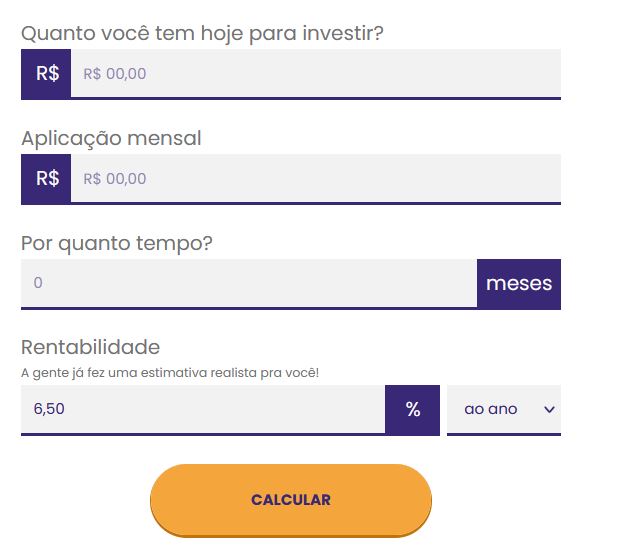

2. Me Doll!

The second calculator indication is on the Me Poupe website, by Nathalia Arcuri, a finance specialist who has more than 6 million subscribers on her YouTube channel.

So, if you are going to use this tool, pay attention to the “How long?” field. which needs to be completed in months.

In addition to the compound interest calculator, you can also do the following simulations: financial independence, investments, rent or finance.

3. FDR Compound Interest Calculator

The Finance, Rights and Income (FDR) website also has its tool to calculate compound interest.

With a simple and straightforward look, users can calculate interest rates by selecting the period on a monthly or annual basis.

After you enter the numbers you want to calculate and get the result, a table and a graph will appear that indicates the total invested, the total interest earned and the total at the end of the period.

With the chart, you can track the accumulated and invested money month by month, as well as the total interest.

4. Compound Interest

Leaving the websites for mobile applications, the indication is the Compound Interest app, available for devices with the Android and iOS system.

With it, you can calculate compound and simple interest very easily.

In addition to being able to perform the accounts, people can save the simulations and access them whenever they want.

And if the user creates an account on the app, he is allowed to log in on another device and access the saved data.

Therefore, the app is ideal for simulating the final cost of an investment that has fixed interest.

You can even track the month-to-month throughput of your simulation.

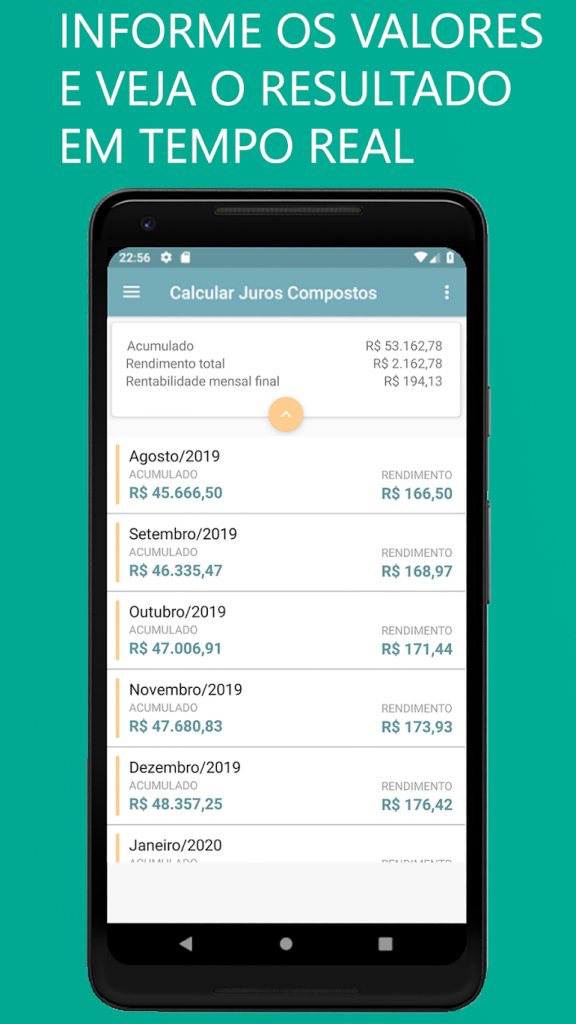

5. Calculate Compound Interest

And to finish the list, you can download the Compound Interest Calculation app for your Android phone.

With it, you can calculate the monthly or annual compound interest rate, configure the interest parameters, check the period you use regularly and also look at the simulation history.

It is also possible to follow a graph and a table indicating the accumulated month by month.

Also, another nice feature is being able to save the simulation in PDF and share it, if you want to do so.

Photo: Disclosure/Devs.mg

Photo: Disclosure/Devs.mg

The following is some important information about interest and compound and simple interest calculations.

What are interest?

Interest can be defined as a consideration when lending money to individuals or companies.

In this way, the loan amount is increased by a percentage of the total amount, which may vary according to the business.

For example, a person borrowed money from a family member and, as a condition, he required that at the end of each period, that person repays the loan by an additional amount.

This extra amount is interest.

When is interest applied?

Interest can be applied to any trade where payment is made over the long term.

It all depends on how the deal was closed.

For example, the person who invests in Treasury Direct or in shares of investment funds, the interest is multiplied according to the size of resources that is piled up in that investor's account.

This also happens with credit card bills that are not paid by the due date.

In this way, for each month that the debt is not paid, interest is levied on the total amount, that is, in addition to the debt of the present value of the item, it will be necessary to pay interest and not only the initial amount.

This situation can become the famous “snowball”.

So, it's important to keep in mind that there are two forms of interest: simple and compound.

See the explanation of each of them below.

Learn More: How to pay off a loan and pay less interest?

Simple interest and compound interest

The percentage of simple interest only applies to the initial value of the purchase, loan of the product or service.

This means that remuneration on money will only be earned on the amount initially injected or lent.

In compound interest, the interest rate is based on the total accumulated capital, which is updated monthly.

So, this is a big difference in relation to simple interest.

For a better understanding, see the example in the simulator below.

In it, the loan is R$10 thousand, with 10% annual interest, with payment in installments over five years.

You may notice that compound interest increases with each passing year.

In this example, the person borrowed R$10 and had to pay R$16,105.

Remembering that the longer your installment, the greater the final interest amount.

Therefore, if the loan conditions were the same as in the example, but only in simple interest, this person would have to pay R$15 thousand.

Compound interest tends to be widely used in financial market matters, whether in the remuneration of investments or to calculate debts with loans and financing.

This is because compound interest can yield a greater profit to the lender compared to simple interest.

Learn More: How to simulate vehicle financing online?

Here are the main features of simple interest and compound interest:

simple interest

- The amounts of the debt installments are the same;

- Interest must be paid periodically (monthly or annually). This will depend on the agreement reached between the creditor and the debtor;

- The summed capital follows a constancy, for example: 1150, 1250, 1350, 1450, 1550, and so on;

- If the debtor does not pay the interest along the agreed amount, therefore, this will result in an inflationary and percentage loss of investments.

Compound interest

- Compound interest amounts are paid only when the application matures;

- Compound interest is increasing and with real and nominal conditions, in case the rate is higher than inflation;

- The summed capital follows an upward curve, for example: 11.000, 12.100, 13.310, 14.641, and so on;

- Compound interest is an application based on interest on interest. This means that the additional fees are conditioned to the amount for each month of the year.

In short, the difference between simple interest and compound interest lies in the form of calculation.

This means that simple interest is charged on the initial amount and compound interest is charged on the total amount for each month.

Thus, one may want to calculate compound interest in three different situations. Discover each case:

- To find out how much you will receive at the end of the investment made, either with interest or in the total accumulated;

- To know the value of the interest rate, whether monthly or annual investment, from the amount invested and the total amount received;

- To find out the period you will need to leave an amount applied to reach a certain amount.

So, now you can see that with the online calculator it is no longer necessary to know the cost formula to calculate simple or compound interest.

But it is essential to understand the entire collection process.

With this understanding, it will be possible to know a rate of the final value of the item you purchased.

And never stop looking for products with the lowest interest possible.

With everything that has been shown throughout this post, it is important to understand all the information that has been presented, whether you are the creditor or debtor.

So, if you are in a debtor position, be careful with possible high interest rates.

Whenever you buy a product or take out a loan, focus your attention on the values of these fees and the format of the extra fees to identify simple or compound interest.

And, finally, it is worth mentioning that often taking a loan is not the best choice, because compound interest can be very high, and you pay almost double the initial capital invested.

The situation can get even more complicated if you don't have a fixed income.

So, it is important to research well to value your money and have a greater profitability.