by Team AllYourVideogames | Dec 6, 2022 | Banks |

One of the many card options available on the market is the Banco Original credit card. More and more banks and their activities are becoming digital, even with the emergence of several banks that work 100% online.

Banco Original stands out for being a more traditional option, which has been on the market longer than most competing digital banks. In addition to your Banco Original credit card, with the institution you will have several other functions and benefits available. To know more about the bank and to know if the institution's credit card is worth it, we have separated some points about the company that you need to know and also details about the Banco Original credit card.

Learn more: Banco Pan contract discharge: check out these tips

Original Bank - Main information

Currently linked to JBS and Banco Matone, Banco Original, founded in 2022, is controlled by the holding company J&F Investimentos. As soon as it hit the market, the bank had agribusiness and corporate accounts as its target audience, however, in 2022, the institution also started to focus on accounts for individuals.

Accounts for Individual Microentrepreneurs also gained prominence at Banco Original as of 2022. It is worth noting that the institution differs in some aspects compared to other digital banks.

It doesn't have a maintenance fee, but it charges you if you go over the free amount of usage for the services it offers, so it ends up not being a 100% free service. But compared to more traditional banks, Original still ends up in front, as bureaucratic procedures and fees are few and cheaper.

If you are interested, creating your Original account is quite simple, and you can do this through the mobile application and also on the institution's website. Just choose whether it will be an account for individuals or companies, fill in the personal information that will be requested on the screen, such as e-mail, CPF, telephone number and name, send a photo, video and the documents requested for security reasons.

The Banco Original current account offers the user the possibility to make up to four withdrawals, request two free statements and make two transfers per month. If you exceed these limits, a charge of up to BRL 2,00 will be made. However, if they are transferred to other banks, the fee can reach up to R$ 8,90.

Learn more: Banco Inter telephone, SAC and service channels

PJ Account of the Original Bank

If you want to open an account for your company, Banco Original has the option for a Legal Entity (PJ) account. Customers will be able to choose between four types of accounts for companies: single person account, corporate account, company account and agribusiness account.

If you are MEI, EIRELI or EI, then the one that can meet your needs is the single personal account. With it, you'll be able to manage your business account and your personal account in one place, while still ensuring that they don't get mixed up.

For both the corporate and individual accounts, there will be only one fee. If you want the PJ account, it will have two different plans to be purchased: Original Empresas Unlimited and Original Empresas Basic. In the Basic Companies option, you will have to pay a monthly fee of R$ 19,90, being able to make six withdrawals, five TED transfers and 20 payments each month. In the Unlimited Companies option, the monthly fee will be R$ 49,90, but all transactions mentioned above will be unlimited.

Learn more: Banco Neon telephone, SAC and service channels

Original bank credit card

The Banco Original credit card is considered by many to be one of the best available on the market. The user can count on debit and credit cashback programs, in addition to other benefits. Check below everything you need to know about the Banco Original credit card, issued by the institution itself.

Banco Original credit card flag

The Banco Original credit card brand is Mastercard, and it will also work normally both within our country and internationally. In addition to the cashback benefits at Banco Original itself, you will also have points accumulated on “Mastercard Surpreenda”.

card annuity

Users of the credit card only, or Banco Original customers, can rest assured, as they did not have to pay fees, administration or membership fees, and Banco Original credit card does not have any type of annuity.

Score required for approval

To get your credit card, you will not need to have a very high score, as Banco Original does not stipulate a minimum score to approve customer cards. But even if your credit application is denied, you can still use your Original account and the card with the debit function.

Learn more: Bank codes: Itaú, Santander, Inter, Bradesco and more

Minimum income required to apply

As with the score, the institution does not define a minimum amount for the salary or for your income in the approval of the Banco Original credit card, or even in the opening of your account.

Original Bank Credit Card Coverage

As mentioned before, the card is also international, but in addition to fixed use, you can also make online purchases from companies abroad without further bureaucracy using your card.

In-app credit card

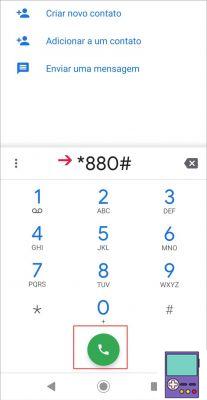

All control of your credit card, in addition to invoice management and your Original digital account, will be done through the institution's mobile application. You can download it from the Play Store for Android devices and the App Store for iOS devices, just search for “Original Bank”.

additional cards

If you are the holder, you can request the inclusion of up to three additional credit cards. They also will not have annuity or other fees and fees, and can have the name that you want for the user, being able to leave with the name of family members, for example.

Learn more: Best digital bank 2022: Check out our favorites

Time needed for approval

When we talk about the Banco Original credit card, the analysis can take up to five business days. However, the approval of the digital card account can happen almost instantly, in some cases.

How to apply for your Original Bank credit card?

To get your Banco Original credit card, you will need to have a digital bank account at the institution. To do this, just follow the process that we described at the beginning of this text to open your account through the website or the application, the process is very easy and fast.

After all, is the Original Bank credit card any good?

If you are looking for a complete service for your credit card, then the Banco Original alternative can be perfect, in addition to having a free digital account for those who apply for the card. The benefits of cashbacks and participation in other programs are another plus point for the card.

In addition, maintaining your account and Banco Original credit card is very well done by the institution's application. Other advantages may be available to PicPay users, such as free transfers on the spot and fast top-ups, as both are managed by the same company.

Learn more: Check it out here: Banco PAN telephone and other contact channels