by Team AllYourVideogames | Sep 1, 2022 | Shopping |

To answer if C6 Bank is good, we have developed a complete analysis of this digital bank.

From now on, you'll know the bank's reputation in the market, what services are available to the customer, what customer service is like, among other issues.

After reading this article, you will have enough inputs to make a more complete assessment and define if C6 Bank is good for your financial planning and your routine.

Is C6 Bank good?

Yes. To justify this answer, we are going to present some elements that help to prove the quality of this financial institution and if C6 Bank is really worth it.

Various products available to the customer

When opening a digital account at C6 Bank, the consumer has access to several products:

- Account without fees and with free withdrawals;

- Credit card does not charge an annual fee;

- Free debit card;

- Instant payment and no fees (PIX);

- Account in dollars and euros;

- Free transfer via SMS;

- Free toll and parking tag;

- C6 Bank Tim.

It is important to note that the “C6 bank credit card initial limit” offers good credit for consumers who need more purchasing power.

By analyzing the benefits that are offered by this financial institution, it is possible to conclude that C6 Bank is good.

This is because, the more solutions available in a single place, the more practicality and efficiency the consumer guarantees during the routine.

Various products for legal entities

One of the main problems that most customers face with a financial institution is the absence of other services together for individuals and companies.

Thus, it is necessary to open a checking account in more than one bank.

To bring more organization to your routine, C6 Bank allows consumers to create a personal account and an account for their business.

The account for legal entities brings several benefits to the user:

- Free account for your business;

- Access via computer;

- PJ credit with less bureaucracy;

- Limit for emergency situations;

- Debit and credit card with no annual fee.

C6 MEI

Versatility is one of the most important characteristics of the institution. C6 Bank also offers several benefits for MEI.

- Free digital account and credit card with no annual fee;

- Card machine and payment link;

- Free toll and parking tag;

- Transfer via SMS.

Fidelity program

When evaluating whether C6 Bank is good, many customers look for data on the Loyalty Program.

Without a doubt, it is one of the best on the market. This is because the score does not expire and the consumer can use it in any way.

To give you an idea, the program contains more advantages than the money itself.

You can purchase products, pay bills, among other benefits. The most interesting thing is that the user can accumulate points in several ways:

- Make salary portability to C6 Bank;

- Register your PIX keys at the financial institution;

- Acquire the bank card (credit or debit) to boost the score.

In addition to the non-expiring score, the customer guarantees other benefits, such as: no monthly fees, the possibility to exchange your score for cash and no bureaucracy to exchange points for tickets or products that are available at the C6 Store.

Investment Platform

C6 Bank is much more than a digital account.

It offers several benefits for users who want to invest their money.

It is possible to resolve all the details through the application, without the need to contact an expert on the subject.

The institution also offers products with low fees and for all types of investors.

Another positive point is that the company has free brokerage for several investments:

- CBDs;

- Funds;

- Shares;

- FIIs;

- ETFs;

- BDRs.

Ease of Account Opening

There is no point in having a multitude of products if the bank does not have an easy account opening process. And this is not a C6 Bank problem.

To have an account with this financial institution, you just need to download the C6 Bank app.

It is available not only on Google Play but also on the App Store.

You must click on “Open Your Account” and follow the system's instructions.

It is essential to make it clear that it is not necessary to have in-depth knowledge of technology to open an account at C6 Bank.

The process is practical and can be completed in a few minutes.

Exemption from Fees

In recent months, the rise in food, gasoline and other products hampered financial planning.

Therefore, when evaluating whether C6 Bank is good, it is important to look at the fees that are charged by the financial institution. And at this point the consumer guarantees several benefits.

To have an account with this financial institution, it is not necessary to pay any fees. You can also withdraw money for free at Banco24Horas network tellers.

If you are interested in investing your money in investments, we have good news: investing in fixed and variable income does not require any type of payment.

Unlike other digital banks available on the market, the loyalty program has no monthly fee.

When making a comparison with Nubank, one of the most beloved institutions among customers, C6 Bank offers a more economical solution to its customers.

To participate in Nubank Rewards, the participant must pay a fee of R$190 per year or R$19 per month.

In addition, the institution itself makes it clear that the consumer needs to use more than R$ 1.600 per month to exchange the score for incredible prizes.

If you are looking for savings, Nubank is probably not suitable for your profile.

It is a great point to evaluate which is the best alternative: C6 Bank or Nubank.

So, in addition to guaranteeing many benefits, the consumer also achieves more savings for their pocket by being a C6 Bank customer.

customer service

When evaluating the quality of a financial institution, we cannot ignore the customer service of digital banks.

This is one of the most important points of C6 Bank.

The institution has support available 24 hours a day, seven days a week.

The whole process is done through a chat. There are still other contacts to talk to consumers:

- Capitals and metropolitan regions: 3003 6116;

- Other locations: 0800 660 6116;

- WhatsApp: (11) 2832 6088;

- Email: faleconosco@c6bank.com.br.

The more service channels a company offers to the consumer, the more positive reviews it has from the market.

This is because it shows that the company is available to serve its customers in many ways.

Application

The C6 Bank app is one of the best alternatives on the market.

The interface is practical and can be used even by people who are not skilled with this type of technology.

Is C6 Bank good at Reclame Aqui?

The Reclame Aqui website is a great source to assess the reputation of a financial institution in the market and other establishments that are part of our routine.

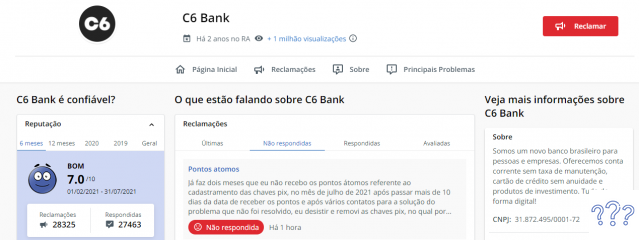

According to Reclame Aqui, in August 2022, C6 Bank's rating on the page was 7.0, out of 10, which is considered good by the platform.

In addition, 60.1% of users would do business with this financial institution again.

To better understand the company's reputation in the market, we recommend evaluating “C6 Bank Complaints”.

Thus, you can understand more clearly the credibility of the institution in the market.

Here, we mention which are the elements that impact when evaluating whether the C6 Bank is good.

However, we know that an item can be verified differently for each person.

Therefore, carefully evaluate all points to make a more assertive decision.

About C6 Bank

When talking about this financial institution, one of the most common questions among customers is: C6 Bank is from which bank?

It was built by former executives of the institution BTG Pactual, in 2022.

However, only in January 2022, the company acquired licensing from the Central Bank to act as a financial institution.

After finding out if C6 Bank is good, learn about the 10 best digital brokers to invest in and improve your billing at the end of the month.