by Team AllYourVideogames | Apr 22, 2022 | Shopping |

O Nubank credit card has become one of the most popular and preferred by users in recent years to organize their financial life. For starters, this is a card with no annual fee and no fees, which is a differentiator in itself and one less thing for you to pay. In addition, all support and control of your card can be done entirely digitally through the Nubank application. With that, you won't have to waste time going to the agency and wasting hours of your day to solve small bureaucracies.

Are you interested in purchasing a Nubank credit card but don't know where to start? Know that the process is not as complicated or time consuming as in other face-to-face banks and you will not have to pay anything. See below how to apply for your Nubank credit card:

Learn More: How to generate a boleto at Nubank: 2 ways to charge

Apply for your Nubank credit card

There are four ways you can apply for your Nubank card:

- From the official website of Nubank;

- From the Nubank blog;

- Through the Nubank app;

- By a referral link from a friend.

The last two options are linked. I see how to do it:

Nubank credit card: ask for the website

Step 1. Access Nubank's official website or click here to be forwarded to the portal.

Step 2. In the right corner of the screen, enter your CPF and click on “Continue” to proceed with the Nubank credit card request. See the image below that shows the location on the site:

Step 3. You will be forwarded to another window, where you will need to enter, again, your CPF and add your full name and e-mail.

Step 4. Read and Check the Privacy Policy Terms option.

Step 5. Finally, you will only need to wait for approval from Nubank, which will contact you via the registered email to continue the process.

Know more: What is Pix, how it works and 5 benefits of using it today

Nubank credit card: ask for the blog

Step 1. Access the Nubank blog or click here to be directed.

Step 2. In the upper right corner, click on the purple “I want to be Nubank” button.

Step 3. As explained in the tutorial above about the site, a window where you will need to enter your CPF, full name and email address will open. Enter the requested data, check the option confirming that you have read the Privacy Policy, and click on “I want to be Nubank”.

Step 4. Wait for Nubank to contact you with the email you registered. If you've been approved, just follow the instructions and you're done! You will have your Nubank credit card.

Learn More: Pix Collection: how does it work and how to use it?

Nubank credit card: ask for the application through the invitation

Step 1. Install the Nubank application on your cell phone. The app is available for both Android and iOS.

Step 2. Click on “I already have an Invitation” and enter its code. If you don't have the invitation, just click here and fill in the form with your CPF, full name and email and the code will arrive in your email along with the invitation. Or you can ask a friend who uses Nubank credit card to send it to you.

Step 3. To start the registration, you will need the following data:

- Document number: CNH, RG (with issuing body and state) or RNE for foreigners;

- Complete address of residence with neighborhood, complement and number;

- Photo front and back of the document;

- A selfie of you holding the document;

- In addition to your monthly income.

Step 4. The “Try Nubank Rewards” category will be available to you. However, just click on “Continue with card only”.

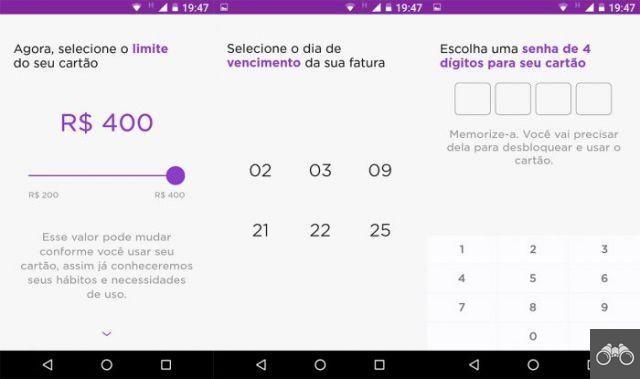

Step 5. A limit will be pre-established by Nubank, select the amount you want to add limit based on the pre-established amount.

Step 6. For your invoice, select the due date you want.

Step 7. In the penultimate step, you will need to set a 4-digit password for your Nubank credit card.

Technoblog Image

Step 8. A signature screen will open, sign with your finger.

Nubank's response should arrive within 5 business days.

Know more: How to transfer via Pix Santander?

Is Nubank credit card worth it? Advantages and disadvantages

As stated earlier, the Nubank credit card is completely free of annual fees and fees, no tricks. In addition, the application also allows you to set a limit on how much you want to spend, being able to make a financial control. If you change your mind, changing the threshold value can be done quickly in the settings. Another tool at your disposal is NuConta, Nubank Conta. Through it, you can leave a saved value yielding profits.

Unlike other banks where this is paid with a certain fee, at Nubank transfers and payments to other banks are also free. Also linked to NuConta, you will be able to make a cash payment through the saved balance, in the debit card option.

In addition to all this, Nubank Rewards is another differentiator. This points program costs R$19 per month or R$190 per year. Even though this option is not mandatory for you to have a credit card, it might be worth considering purchasing it. With Nubank Rewards, for every R$1 spent on the card you will receive 1 Rewards point.

By collecting a certain amount of points, you will be able to offset your expense in credit on the invoice. If you want to redeem the points on airline tickets, for example, the proportion of the discount will be 80 points for R$1. In services such as Uber, iFood and Netflix, among others, the redemption ratio is 100 points for R$1.

However, it is not so easy to get a high limit on Nubank credit card. Compared to other cards, the available limit may be much lower than expected. Even though the value may vary between customers, it is normal to find people who had only R$50 as their initial value.

But it is worth mentioning that this is the minimum value. Your updated limit may be higher and if you are not satisfied, you can ask Nubank directly to increase the limit. There is no limit to the number of times you can apply for a raise. But the more raises you ask for, the more it will affect your score.

Have you already applied for your Nubank credit card? Tell us about your experience of successfully receiving the purple one at home.

Continue on the blog and subscribe to our newsletter

- How to transfer via Pix Caixa?

- How to transfer by Pix Itaú?

- How to transfer via Pix Inter?