by Team AllYourVideogames | Nov 8, 2022 | Credit Cards |

There are several credit cards on the market.

Each offers services to attract customers, some even have unique features. And with so many product options, people can end up getting confused, missing certain details that make all the difference in everyday life and in your pocket.

And in this scenario, another new alternative emerges, it is the Will Bank.

Will Bank is a fintech from our country that emerged in 2022 and has been looking for its space in the financial market.

Right off the bat it is important to point out that this is a new company and that it does not yet have certain features, but it is slowly releasing some common features that you can find in other banks.

Anyway, in this post you will be able to check the main information about the Will Bank card, such as its brand, limit, fees, consequences of invoice delays, how to request it, and some additional information.

Discover the Will Bank card

First, it is important to make it clear that the Will bank card has no annual fee and has no maintenance fees.

It comes with the Mastercard brand and, consequently, the customer is entitled to participate in Mastercard Surpreenda. However, this digital bank does not yet have its own loyalty program.

Another outstanding feature is that the Will Bank card can be used to make international purchases, either in physical locations or on websites. To be able to use this feature, you need to unlock it, following these steps: enter the app, tap “Manage cards”, then “View all settings”, and finally enable the option “Use when traveling abroad” ready.

It is also worth mentioning that it is necessary to pay attention to international purchases when it comes to tariffs, which are as follows:

- Dollar value at the time of making the purchase of the product;

- Tax on Financial Transactions (IOF): 6,38% of the purchase price;

- Spread Fee: 4%, transaction cost fee.

Learn More: Western Union: How to Send Money Abroad

And as soon as you apply for the credit card from this financial institution, a digital account will also be created, without having to pay any additional amount for it.

Will Bank card limit

In the card application process, the bank does a credit analysis and determines what your limit will be.

The institution does not specify the analysis criteria. But it is known, in general, that the Serasa score is a relevant aspect.

Then, the value of your limit will be established. A negative point is, for now, it is not allowed to request the limit increase and there is no deadline for this alternative to be made available.

Even so, the financial institution advises its customers to pay the bill on time and use the card frequently. That way, the bank will understand that you like the company's service and in the future you will be able to increase your credit limit.

If you consider your limit low, the bank provides a feature called Extra Limit. In this way, the customer can make a payment of up to twice the cost of their last closed boleto.

That is, for example, if your bill was R$600 and you pay R$1.200, then you will have an extra limit of R$600.

Payment can be made by issuing a partial slip at a higher cost, as explained in the case above.

With the extra limit, it is possible to make purchases in national and international territory and also make withdrawals. However, transfers with the extra limit are not yet allowed.

It is also worth noting that the amount does not enter as a credit on your next invoice. In addition, the value can be used as many times as you want until it runs out.

Another point worth mentioning is that each withdrawal has an interest rate of 6,99% on the amount of credit used.

Consequences of delaying the payment of the invoice

Will Bank blocks your card after five calendar days of invoice delay, if you have not made the minimum payment of 15% of the total amount of the ticket.

In addition, there is a fine of 2% on the amount to be paid, charged regardless of the number of days of delay. The IOF tax of 0,38% is also levied, plus 0,01118% per day of delay, and monthly interest is up to 15,7% on the amount due.

The payment of at least 15% can be made by bank slip, within three working days after the payment is identified and the customer will be able to make purchases again. But if you are unable to make the payment, the amount and late fees will be included in the following month's invoice.

There is the possibility of making the installment of the invoice via chat using the application. But interest of up to 13,7% will also be charged monthly, plus IOF (0,38%,) and 0,01118% per day of delay.

So, to avoid possible problems, it is important to choose the best due date for your invoice.

Thus, the alternatives for the billing due date are the 5th, 10th, 15th, 20th and 25th of each month. According to Will Bank, the best day to buy is six days before the invoice due date.

What is the Will Bank virtual card?

In addition to the physical credit card, you can request a virtual card and it is not even necessary to have the plastic in hand to have the virtual card. It is allowed to have up to five cards per day and a maximum of 15 per month.

It is important to make it clear that the virtual card can only be used on the internet, for example, in e-commerce, delivery apps, in transport, streaming services or any other transaction that is carried out online.

It is also worth noting that it can be used for purchases on websites in our country or abroad.

Learn More: Does Free Annuity Credit Card Forever Exist? Check everything here

Another important point is that the identification numbering and the Card Verification Value (CVV) security code are provisional. Despite this, the invoice for the physical card and the digital card is just one.

Therefore, the cards share the same account limit.

How do I track the delivery of my card?

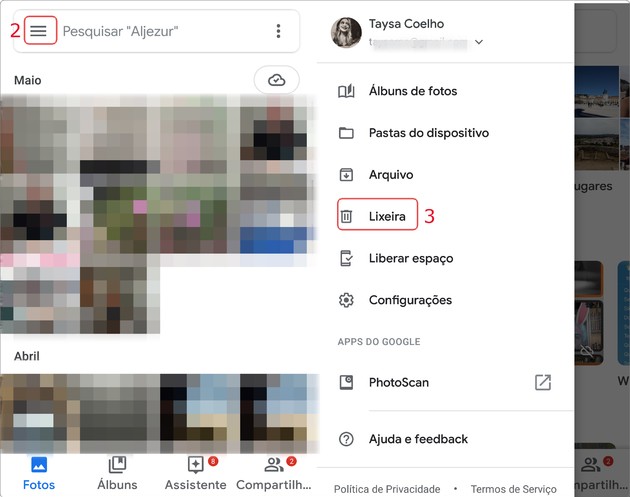

If you requested the card and it was approved, you will be able to track the delivery through a tracking code that will be sent to the registered email. It is worth noting that the tracking code can take up to five business days after approval.

In addition, if you want to consult the delivery more directly within the application, you can check each step. You only need to access the “Cards” tab and you will see all the details of where your card is.

And according to Will Bank, the delivery time is related to the city where the customer lives. So, in general, if there is no obstacle, after the card is made, within 15 working days the card will arrive at your home. Remembering that it is allowed to use the virtual card even before the physical one arrives.

Once you have it in your hands and you want to use it, the first step is to unlock the card. To do this, simply log in to the app, tap on the “Manage Cards” option and then on “Activate my Card”.

Now, if you have lost your Will Bank card, been robbed or any other such situation, you can request a duplicate.

In this way, it is necessary to go to the app's chat and explain the reason for requesting the new card.

How to apply for the Will Bank card

With everything you saw throughout the text, it made you interested in the Will Bank card, so be part of the bank and learn how to apply, as will be explained in detail in the following step-by-step.

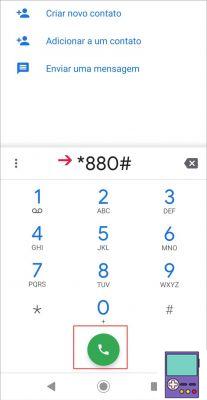

The first step is to download the app available for mobile phones with Android and iOS systems. After that, proceed to the tutorial:

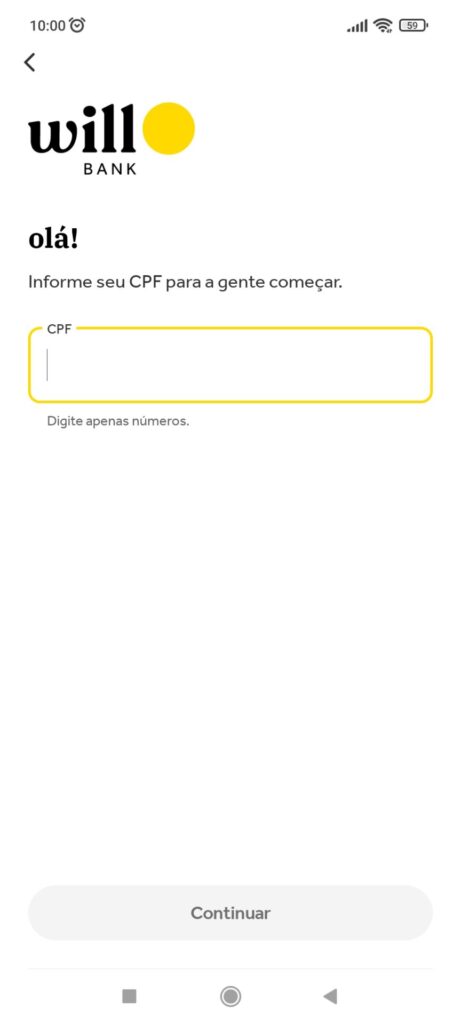

Step 1: With the app already downloaded, open it. You will be on the home screen, tap on “Register”;

Step 2: On the page that opened, enter your CPF;

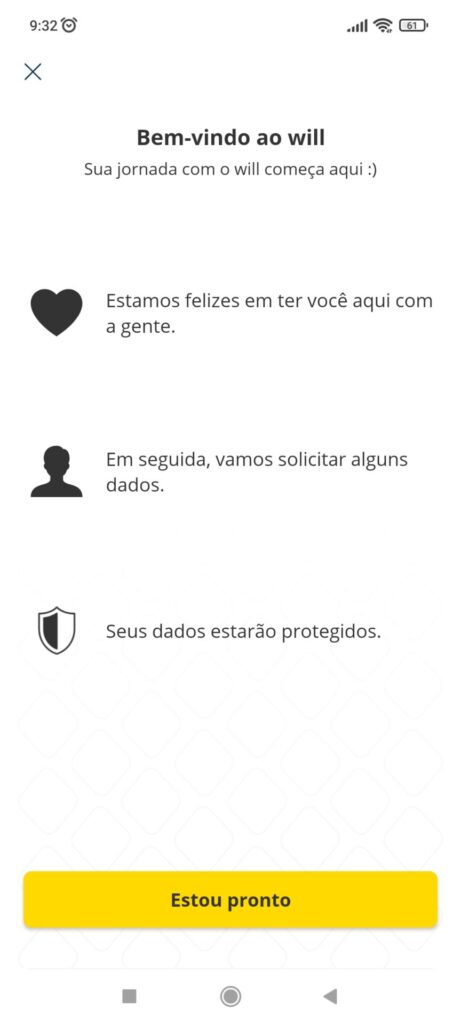

Step 3: You will see a welcome message, read and tap “I'm Ready”;

Step 4: Enter your full name;

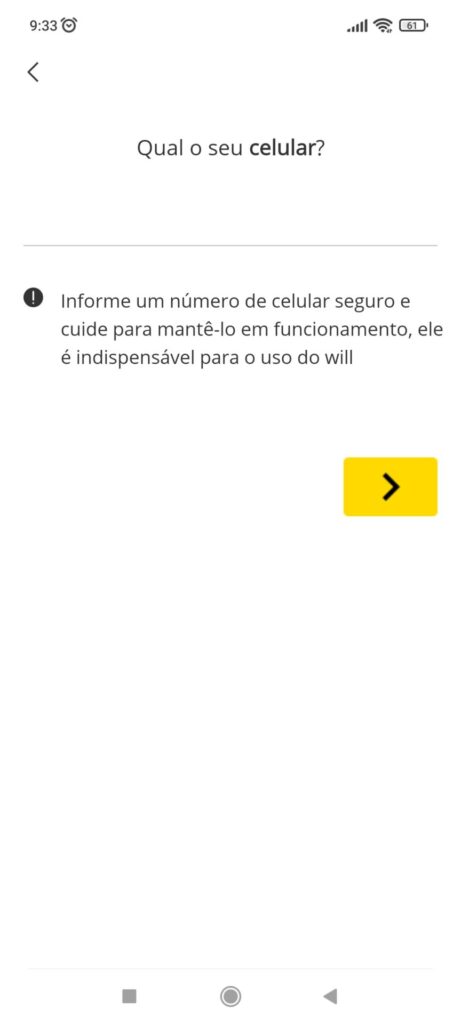

Step 5: Now you need to fill in your mobile number. After doing this, tap the yellow arrow. In the window that opened, you need to put the code that was sent via SMS;

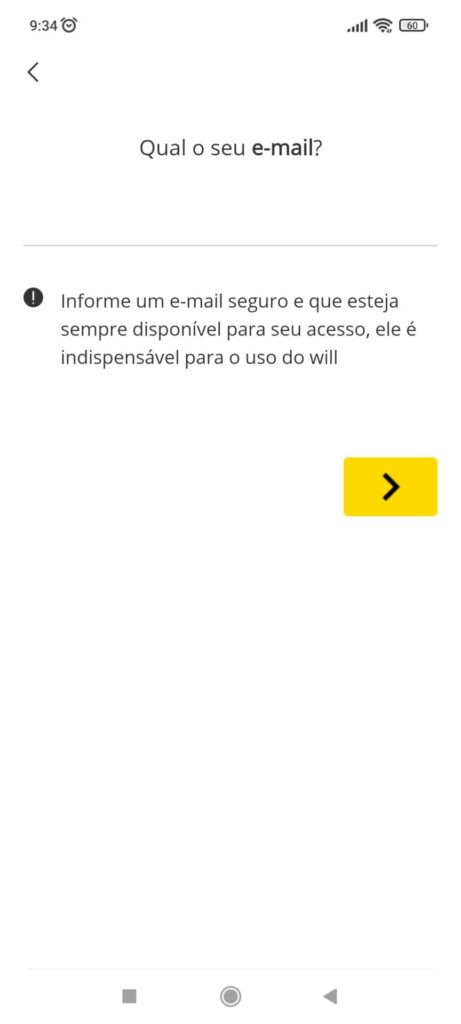

Step 6: This step is very similar to the previous step. The only difference is that the information to be filled in is your main email. After entering your email address, visit your inbox and enter the code in the app;

Step 7: If everything went well, a message will appear warning you that you need to have some documents on hand. Tap “I'm Ready” to proceed with the Will Bank card request;

Step 8: On the page that opened, you need to put your date of birth and city where you were born;

Step 9: You also need to provide your mother's full name;

Step 10: Now, enter your gender (male or female);

Step 11: In this window, you need to fill in some information about education, profession, marital status and your monthly income. Remembering that it is not necessary to send proof of income, but it is necessary to put the true information;

Step 12: Following the tutorial, you will see a message saying that you need to enter your address;

Step 13: This page that opened is just to put your zip code;

Step 14: Now you need to complement your address with information about your neighborhood, street and house number;

Step 15: Select the due date of your invoice and proceed to the next page;

Step 16: On this new page, carefully read the tips for taking a good selfie. When you tap on “I'm Ready”, the application will open your cell phone camera for you to take your photo;

Step 17: Now it's time to image your documents. Read the tips carefully and proceed to the next step;

Step 18: You need to choose what type of document you want to send: RG or CNH. Remembering that it is also necessary to fill in the requested information before sending the photo;

Step 19: After filling in the information, take a photo of your document and send it to the application;

Step 20: In this new step, you will see a subscription message. Tap “I'm Ready” to progress the tutorial;

Step 21: In the window that opened, you need to make your signature as similar as possible to what appears on your sent document. Once the signature is done, go to the next phase;

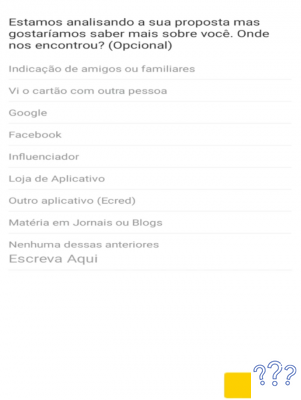

Step 22: An optional page will open asking where you met Will Bank;

Step 23: Done! your Will Bank card order has been placed. You just need to wait.

Can the card be blocked at any time?

Will Bank offers two types of card blocking, the first is temporary blocking.

To access this feature, just open the application, go to the option “Manage Cards” and then “Block Temporarily”. If you want to go back, just follow the same path and unlock it.

Now, if you don't like the Will Bank card or don't want to use it anymore, regardless of your reason, you can cancel your card and, consequently, your digital account. Just keep in mind that to do this you cannot have any outstanding invoices.

To cancel the card, you must enter the chat within the app and request the cancellation. According to the financial institution, if you cancel the card, it is not possible to make a new registration.