by Team AllYourVideogames | Aug 6, 2022 | Shopping |

O SX credit card is a great option from Banco Santander for customers looking for an alternative with no annual fee and many benefits.

If you are part of this group, keep reading this post. Here, we'll show you how the card works, what its benefits are, whether it's reliable, how to hire, among other issues.

After reading the content, it will be easier to request your order, especially since the process can be done online. It is not necessary to leave the house and face several hours in line at a financial institution to place your order.

Did you like it? So, read on and clear all your doubts today.

Learn more: no annual fee credit card: the best on the market

What are the benefits of the SX credit card?

Many people have doubts whether the Santander SX card is a credit or debit card. It is important to make it clear that it is credit and brings more purchasing power to the consumer.

The SX card brings several benefits to customers. The first of these is the online card. If you need a more urgent option, there is no need to wait for the physical version to arrive at your home. When you purchase the SX card, you immediately receive an online version for making purchases over the internet. It's more convenience for your routine.

One of the main advantages of the SX card is that it offers the technology approached, paid. That is: the consumer does not need to enter the password to complete a purchase in physical stores. The most interesting thing is that the Santander Pass is offered to the consumer in several ways, such as: card in the form of a bracelet, watch tag and sticker.

To facilitate the control of your finances, the SX card contains the Santander Way application, which is available on Google Play and the App Store. In it, you can monitor your spending in real time and manage your limit anywhere in our country. All you need is a mobile device with internet access.

When hiring a credit card, the first point that is analyzed by most customers is the annual fee. The positive side is that the SX card guarantees exemption from this fee when spending R$100 on purchases. Another possibility is to register your CPF or telephone number as PIX keys at Santander.

We can't always spend R$100 on a credit card. If this is your case, the card charges 12 installments of R$33,25 in annual fees for cardholders and 12 installments of R$16,67 for additional cards.

If you like a Loyalty Program, Esfera is a great option. It offers up to 50% off to buy, travel and enjoy life in a very special way.

Another positive point is that this card also allows you to participate in the Vai de Visa program. It is an alternative that contains exclusive offers in stores and restaurants.

The customer can also make withdrawals in the credit function and pay the amount only when the invoice arrives at their residence.

In addition, it is possible to pay the debt in up to 24 installments. This is very important, as it ensures more practicality, especially when the bill is above family planning.

Visa or Mastercard brand

One of the main benefits of the Santander Free credit card is that the customer has the possibility to choose which brand he prefers: Visa Gold or Mastercard Gold benefits. The first offers the consumer several advantages, such as price protection, purchase protection and original extended warranty.

Mastercard Gold also has extended warranty insurance, purchase protection, price protection and the Surprise Program.

It works like this: every time the customer uses their card, whether in the credit or debit function, they earn a point, regardless of the value of the product they purchased. When the consumer accumulates more than five points, he can purchase a product and take another to his home.

Automatic update of recurring payments

To bring more practicality to your routine, when requesting a new card or renewing it, the new card number can be automatically updated in the register of services that are used every month.

This list includes: subscriptions to magazines, newspapers, cable TV or gym memberships, tolls, among others.

In this way, when re-issuing the card, the user does not need to change the data that were registered for billing, and the amounts will be posted on the invoice normally, preventing the contracted services from being blocked.

The most interesting thing is that this service has no costs and is released to several stores that are part of this benefit, such as: Uber, Spotify and Netflix.

If the consumer is not interested in purchasing this functionality, he can contact the company. Those who live in capitals and metropolitan regions can call 4004 3535.

Customers residing in other locations can speak with the company on the number 0800 702 3535.

There is an option for people with hearing or speech impairments. The contact is: 0800 723 5007.

Who can apply for the SX credit card?

To apply for the SX card, the company requires the customer to have a certain monthly income in their checking account.

If you have a bank account, the requested monthly income is R$500. As for people who do not have a bank account, it is necessary to have a minimum monthly income of R$1.045,00.

How to apply for the SX credit card?

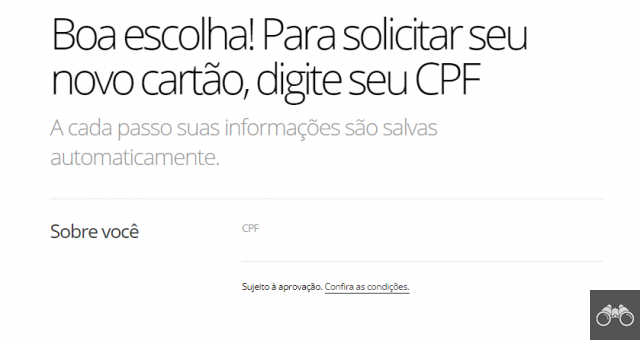

There are three ways to apply for the SX credit card: Through the internet, at a Santander branch that is closer to your home or through the Call Center by telephone.

If you live in capitals and metropolitan regions, the contact number is 4004 3535. For customers who live in other locations, contact 0800 702 3535.

It is essential to make it clear that the attendants are available to customers from Monday to Friday, from 9 am to 21 pm. The team of specialists also works on Saturdays, from 10 am to 16 pm.

In times of a pandemic, we recommend making contact online or by phone. That way, you guarantee your safety and that of others.

If you receive a contact offering the SX credit card, either by cell phone or by email, be aware that it could be a scam. Give preference to the alternatives presented above. That way, you will avoid problems in the future.

Is the SX credit card reliable?

Yes. To answer this question, we will turn to the Reclame Aqui website. It is a great thermometer for assessing a business's reputation.

To give you an idea, in August 2022, Santander Cards, the company responsible for the SX card, had a score of 7,3 out of 10.

According to the platform, it is a good assessment, which shows that the company has a positive credibility in the market.

How to get SX credit card registration approved?

In addition to following the company's requirements, the consumer needs to have a high score, keep the positive registration updated, keep the CPF regularized, among other issues. That way, you have a better chance of getting an approval on the first try.

We know that the market contains several credit card options for customers. However, when comparing the SX credit card with the other options available, it is possible to conclude that it is a great alternative for your pocket.

That's because it contains a free annual fee, several benefits and even allows you to request it online, bringing convenience to the consumer.

After discovering how the SX credit card works and what its main features are, get to know the Platinum Nubank card. Another interesting alternative for customers who seek practicality for their routine.