by Team AllYourVideogames | Aug 16, 2022 | Technology |

Grupo Safra is one of the most important and traditional conglomerates in our country.

The company began operating in the mid-1800s as a banking house, carrying out exchanges between currencies from different countries in Asia, Europe and Africa.

Today, Banco Safra is among the 10 largest private sector financial institutions in the country. The services of this bank take place mainly in our city, but there are customers all over our country.

Thus, one of the tools that all people who use this bank can have access to is the Safra Internet Banking.

In this post, you will see some services that Banco Safra offers to its customers, such as opening a digital account for an individual, the fees charged, the advantages and disadvantages, requirements and requirements necessary for opening your account.

The Safra Bank

Before starting to address the issue of opening an account, it is important to make it clear that Banco Safra has a selected and small audience compared to other financial institutions.

This is because it is intended for people with high income.

According to the bank, the target audience is individuals, with a monthly income of at least R$8.

As it is a financial institution with a smaller number of customers that meet this requirement, people who wish to receive exclusive treatment can choose to start using Safra.

Learn more: How to increase Serasa Score: 5 foolproof tips

See below for the most relevant information about Banco Safra's current account.

Safra Digital Account

The financial institution has several services for customers and an example of this is the Digital Account.

The opening can be done by individuals or legal entities, having the possibility of credit card options, financing, loans, social security, among many other resources.

So, the consumer who opens a Digital Account at Safra can make bill payments, transfers and get certain facilities to apply for a personal loan.

In addition, the client will have an investment portfolio available and can consult specialists to help throughout the allocation period.

It is important to point out that Safra's digital accounts are like regular current accounts that are opened at branches.

That is, with the digital account it is possible to receive exactly the same services as the traditional current account.

However, in the digital environment, the person solves almost any situation directly from the application, without having to leave the house. Therefore, opening an account is done through the bank's app, as will be shown in a step-by-step guide below.

Despite seeking consumers with a very specific profile, the documents required to open a digital account at Safra do not differ from other banks. Therefore, to open the account, the person needs to show an identification document with photo, CPF, proof of residence and income.

It is worth mentioning that you need to be aware of the issue of validity of the vouchers, since in both they must have a maximum of 90 days from the date they were issued.

In this way, anyone who is over 18 years of age and who meets all the requirements shown can open an account with Safra.

In cases where the account is held by minors or through representation, they will be dependent on the bank's internal criteria, and will not be able to open the accounts electronically. That is, for these cases, it is necessary to go to a physical branch.

People have the option of opening an individual or joint account, with the second option being able to choose between two modalities:

- Solidary: in which any of the holders can move the account individually;

- Non-Solidarity: where the movement must be made by all holders jointly.

To open a joint account, you need to go to a Safra branch.

Safra Account: Advantages and Disadvantages

Regarding the bank's positive and negative points, it is worth clarifying that Safra has few branches across the country.

If you need to resolve a situation in a physical branch, the customer may experience some inconvenience.

Be sure to check out the branches of Banco Safra in your municipality. However, the institution offers online service in the application and through Safra Internet Banking.

The bank's customers, according to Safra, have a portfolio with more profitability than savings. In addition, it is still possible to finance vehicles, exchange reais for other types of currencies, take out insurance, see your investments and ask for salary portability.

“For those who prefer to have support when allocating resources, the Safra digital account provides investment specialists ready to assist in the process,” added the bank.

Another very nice benefit is that customers who manage to have a credit card from the financial institution will also be able to participate in Safra Rewards, the bank's Rewards Program. With it, users can redeem selected trips, experiences and products.

Safra's credit card brand is Visa, and with it customers can take advantage of the Visa Concierge service, a personal assistant that is available 24 hours a day.

With it, people can request reservations for flights, hotels, tourist presentations, ask for emergency messages and buy and send gifts.

How do service packages work on the Safra digital account?

Safra makes five service packages available in its accounts.

What differs from each other is basically the transaction amounts and the limits placed on operations without discounting fees.

So, here are the prices charged:

- Basic account: free;

- Digital Light account: R$9,90;

- Digital Account 1: R$19,90;

- Digital Account 2: R$39,90;

- Unlimited Digital Account: R$69,90.

Check below the details of each of the packages offered by Safra.

Basic Account

In the basic package, users only pay for the services they use.

Safrapay Light Account

- Transfers between vintage accounts: unlimited. Fee: R$2;

- Transfers to other banks (DOC or TED): 4 monthly payments. Fee: R$5,90;

- Boletos, Taxes and Dealers via Safra Internet Banking or Application: Not included;

- Withdrawals in boxes or external network terminals: Not included.

SafraPay Account 1

- Transfers between vintage accounts: unlimited. Fee: R$2;

- Transfers to other banks (DOC or TED): 22 monthly payments. Fee: R$5,90;

- Bills, Taxes and Dealers via Safra Internet Banking or Application: once a month;

- Withdrawals from cashiers or external network terminals: once a month.

SafraPay Account 2

- Transfers between vintage accounts: unlimited. Fee: R$2;

- Transfers to other banks (DOC or TED): 44 monthly payments. Fee: R$5,90;

- Bills, Taxes and Dealers via Safra Internet Banking or Application: three times a month;

- Withdrawals from cashiers or external network terminals: three times a month.

Unlimited SafraPay Account

Users who choose to open an unlimited SafraPay Account will need to pay R$69,90 per month and all the services listed above can be used unlimitedly.

It is worth noting that the prices of fees also continue to apply to those who use this type of account.

Take the opportunity and check the complete table of the values of Banco Safra accounts.

Single service values

In addition to the fees already informed, check out how much some individual services cost that Safra customers have to pay.

It is worth noting that knowing these prices is interesting especially for those who use the basic bank account.

- Harvest Token: Exempt;

- Balance/Extract in 24h Terminal: R$4;

- Automatic Debit / Scheduling: R$5,90;

- Boleto, Tributo and Concessionaire: R$5;

- Withdrawal Cash/Terminal 24 hours: R$10;

- 2nd Copy of Debit Card: R$10.

Now that you know about Safra's digital accounts, it's time to know how to open your account.

How to open a digital account in Safra

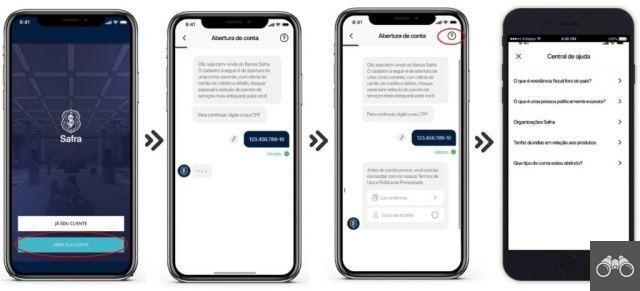

Step 1: First of all, you need to download the application “Safra: account with investment” on your mobile. The app is available for Android and iOS;

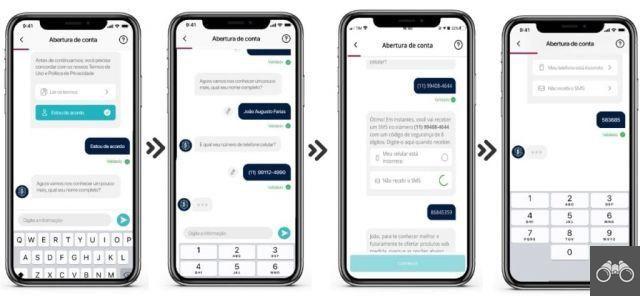

Step 2: You will need to fill in some personal data, such as your full name, email, cell phone number and CPF;

Step 3: After entering your data, you will receive a numeric security code via SMS on the number you registered. Just inform them in the app and go to the next step;

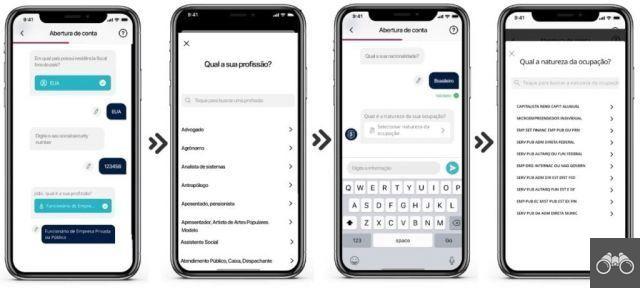

Step 4: If everything went well so far, in the new window that has opened you will need to enter other personal information, such as your profession, gender and city where you were born;

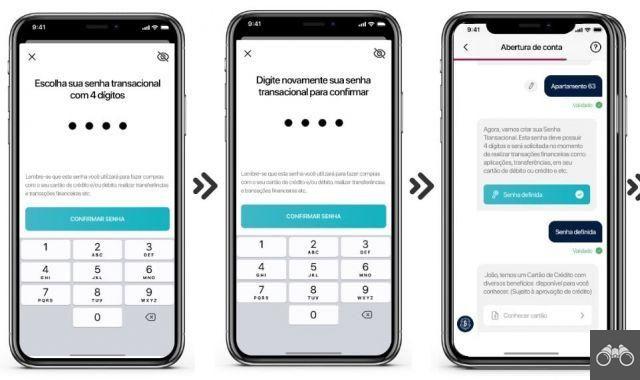

Step 5: Now it's time to choose your account preferences, such as your password and invoice due date;

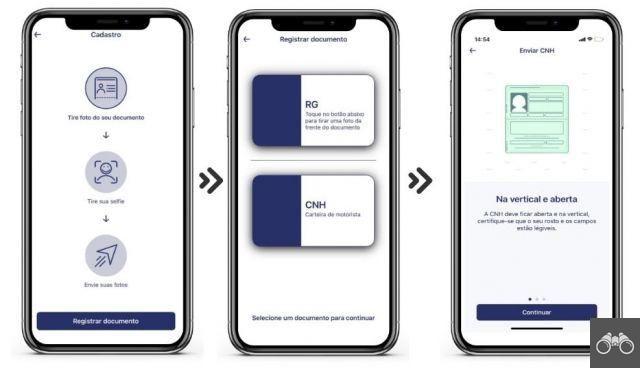

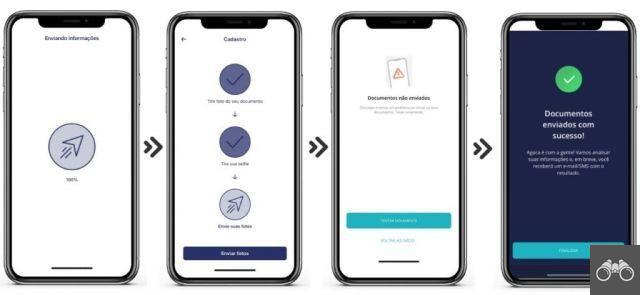

Step 6: The next step is to take pictures of your ID or CNH. Care must be taken: follow the recommendations to make sure that both the front and back of the document are visible;

Step 7: Finally, take a selfie. Once the whole process is done, now you have to wait for the bank. They will let you know if your account was opened via SMS or email.

Image/Disclosure: Banco Safra

It is worth noting that it is only possible to open a digital account at Safra using mobile devices.

The option to Open your Account through the Banco Safra website directs Internet users to the bank's digital channels, that is, the Android and iOS app stores.

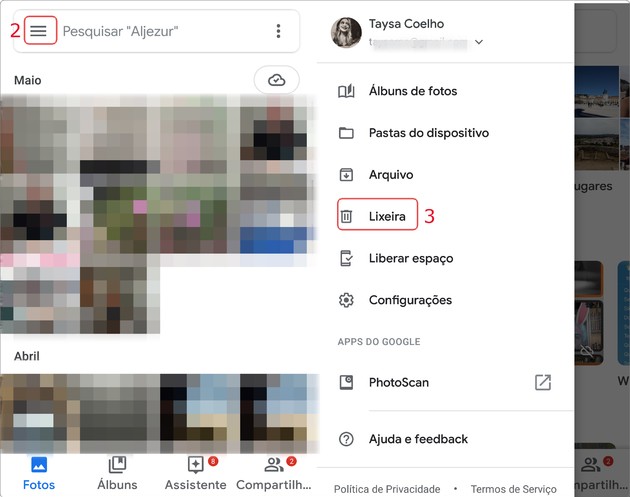

How to access Safra Internet Banking

If your account opening request is approved, see how you can access Safra Internet Banking:

Safra Internet Banking on the computer

Step 1: The first step is to create your electronic password. Install Safra Defender on your computer. After that, configure your electronic password. If you use the Safra App, you can login to Internet Banking with the same password;

Step 2: With your password already set, access the Banco Safra website. In the upper right corner of the homepage, enter your Agency and Account.

Step 3: As it is your first access, you will need to register a device. Thus, on the page that opened, register a name for your device, for example, “My computer”;

Step 4: You will need to allow access. For this, wait for an SMS on your cell phone. It will contain a release code. Once you receive it, enter the numbers on the screen that appears on your computer;

Step 5: Ready! In the next logins, you will only need to inform your Agency, account and electronic password.

Safra Internet Banking in the app

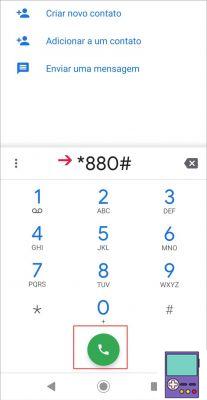

Step 1: Download the Safra app from the Apple Store or Google Play Store;

Step 2: Once you open the app, tap on “I'm already a customer. On the screen that opened, enter your Agency and Account. You will receive a temporary password by SMS;

Step 3: The next step is to activate the Token on your mobile. To do this, in the lower right corner, tap on the “Token” option. To activate it, you will receive another code via SMS. Enter the numbers on the login page;

Step 4: Now register your device informing the name of your cell phone, for example, “My phone”;

Step 5: Finally, enter the release code you received via SMS. Process finished! Now you can use Safra Internet Banking.

Safra Internet Banking Companies

There is still the option to use the Safra Empresas app for legal entities.

To do this, just follow the steps described in the previous topic. However, instead of downloading the Safra App, download Safra Empresas.

The application is available for mobile phones with Android and iOS system.

If you liked the services offered by the bank, it may be a good choice to open your digital account. Just do not forget to check the availability of physical branches of Banco Safra in your municipality.

And finally, if you want to know more about the services, you can visit the Banco Safra website.

If you have any questions, you can also call Customer Service/Data Protection on 0800 772 4136.