by Team AllYourVideogames | Mar 20, 2022 | Technology |

Pix Cobrança was announced and promises to make the use of boletos a thing of the past. Find out how it works and how this new technology promises to leverage the world of payments in our country. Pix is our country's instant payment. It is part of the SPI (Instant Payment System) and was created in February 2022 by the Central Bank. It began operating in November of the same year in the country.

The main purpose of the system is the possibility of making transactions and payments instantly and free of charge (for individuals), 24 hours a day, 7 days a week, as long as you have, of course, money in your account.

Learn more: What is Pix, how it works and 5 benefits of using it today

How does Pix work?

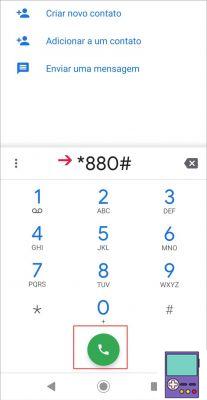

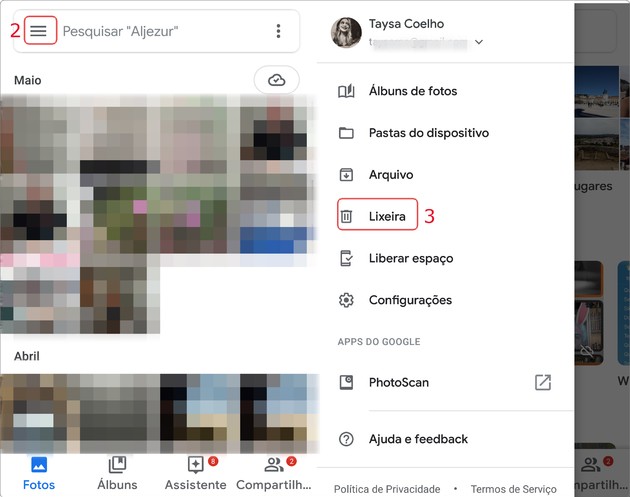

To use the Pix system, simply enter your bank's application, look for the Pix option and register the electronic keys. Four different types of keys are available for registration:

- CPF;

- E-mail;

- Cell phone number;

- Random key generated by the Central Bank.

The Random Key or Virtual Payment Address (EVP), is a random sequence of numbers, letters and symbols, which identify the account holder's account. This option is an alternative for people who do not want to share their personal data with other people when carrying out banking transactions.

In case you need to change your email address or mobile number, you must register the new data and delete the old ones. It is possible to castrate 5 electronic keys, in the case of individual bank accounts. Legal entities can register up to 20 keys.

Despite being free for individuals, there are Pix charges for legal entities. Corporate clients of Itaú, Banco do Nosso País, Santander and Bradesco can pay up to R$10,00 in fees per transaction via Pix. Caixa Econômica and some fintechs are the only ones that still have tax exemptions. Fees vary by bank.

Even with fees, for freelancers, using Pix has great advantages. The fees charged by banks are still lower than those charged by credit card companies.

The advantages of implementing Pix in banks are numerous, but not everything is perfect. And its main disadvantage is the impossibility of carrying out scheduled transactions or with the addition of interest or discounts.

Check out in the video below, a little more about how Pix works

Learn more: What is Pix, how it works and 5 benefits of using it today.

To this end, in October 2022, the Central Bank announced the launch of yet another functionality of the system:

Pix Collection: what is it and how does it work?

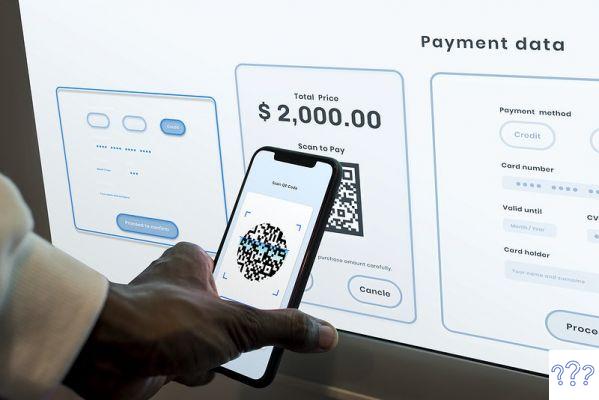

In short, the new functionality comes with the objective of streamlining the payment of bills. In a note, the Central Bank announced that through Pix Cobrança: shopkeepers, merchants, service providers and other entrepreneurs will be able to issue a customizable QR Code for instant or scheduled payment, through due dates.

In a nutshell, Pix billing allows you to schedule or set a billing due date. Something that was not yet possible on the “normal” Pix. With this function, Pix Cobrança is a strong candidate to replace the famous boletos.

It will also be possible for the self-employed to add information in addition to the sale or service value such as fines, interest and discount. To make the payment, the customer must scan the QR Code and make the transaction.

Pix Collection brings several advantages to both the customer and the person offering a service or product.

As benefits we can mention:

- Agility for the customer who will no longer need to carry tickets that require going to banks and lottery shops with long lines.

- Fast payment, which will be made at the same time as the transaction, without the need to wait days for the ticket to be debited. This is a big plus for both the customer and the business owner.

- There are no bank fees for issuing the QR Code, which makes it possible for the self-employed not to pass on fees for their services.

It is worth remembering that not charging fees for legal entities is at the discretion of your bank and the rules for the maximum number of free transactions are available on the website of the Central Bank of our country.

The Pix Collection tool was scheduled to start on March 15, 2022. However, the Central Bank postponed it again and now it will be available from the day May 14, 2022.

Pix came to replace transfers via TED or DOC, allowing us to make instant and fee-free transactions. And now comes Pix Cobrança, to replace slips and streamline this type of bill payment quickly, easily and free of bank fees for its issuance.

Continue no Blog

- What is Pix, how it works and 5 benefits of using it today

- Account on PagSeguro: How to do it?

- PicPay how does it work? 6 steps to pay and transfer

- How to generate a boleto at Nubank: 2 ways to charge