by Team AllYourVideogames | Jul 2, 2022 | Shopping |

O Nubank Platinum card it is yet another option that the bank offers its customers to manage their money. It has some advantages and disadvantages compared to the Gold version.

If you are already a Nubank customer, check the card details offered by the brand compared to the Gold version and put it on the scale if it's worth it.

Check out, below, the strengths and weaknesses, the benefits that each version of the cards has and that you need to know. Right at the beginning, it is worth mentioning that: “the advantages of the Gold and Platinum cards are granted by MasterCard, the brand of our card, and not by Nubank”, informed the financial institution.

Benefits of Platinum and Gold Cards

Platinum and Gold are credit card options that Nubank customers can have. In both cases, Mastercard is the card brand.

In addition, they have an annual fee waiver and customers can use the benefits of Mastercard Surpreenda.

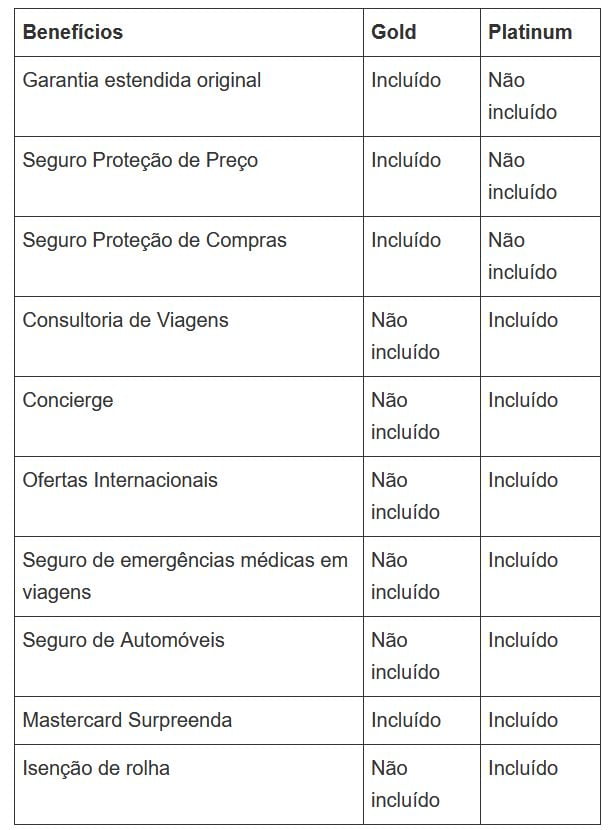

Thus, both the Platinum and Gold versions have common benefits, but receive some exclusive services. Below is a table with what each card version offers:

Disclosure Table/Nubank

Disclosure Table/Nubank

1. Original extended warranty

With this benefit, it is possible to extend the warranty period of items purchased with Nubank Gold by up to one year, without incurring additional costs.

It is worth noting that the coverage must have a guarantee of at least three months, without exceeding a period of three years.

2. Price Protection Insurance

If you buy something for a price x, but find the same product in another store for a lower amount, you can ask Mastercard to refund the price difference. This benefit is valid for 30 days, counting from the date of purchase of the product.

3. Purchase Protection Insurance

In the event of an accident or the person being stolen, the customer can apply for this benefit. This is valid within a period of 30 days since the product was purchased.

4. Travel Consultancy

This benefit offers clients a travel consultancy to assist with destinations, itineraries and other cases. Thus, the person receives options of hotels and resorts with category advantage, early check-in and breakfast, according to the availability of the place.

5. Concierge

It is a 24/XNUMX personal assistance service. With it, you can have General Information, restaurant reservations and concert tickets.

6. International Offers

You can receive exclusive cashback promotions when you travel, buy your products and pay using the card at foreign establishments participating in the bank's program. This advantage applies to both physical and online stores.

7. Travel medical emergency insurance

If you are traveling alone or with your family and need emergency medical care, the card has a service that allows you to request assistance and coordination to help resolve the situation.

8. Auto Insurance

This benefit applies to cars rented with the credit card. The person receives coverage in cases of collision damage, theft and/or accidental fire.

9. Mastercard Surprise Program

Surpreenda is Mastercard's benefits program, which gives one point for every purchase made with a debit, credit or prepaid card, regardless of the amount.

In other words, the more points a person accumulates, the more possibilities they have to exchange for special offers.

10. Cork exemption

This benefit is for wine lovers. With it, you can take the bottle of wine free of the corkage fee for the first bottle.

However, it is worth remembering that the corkage fee is an additional fee charged to customers by the restaurant, for bringing their own wine to be consumed at the establishment.

Disadvantages of Nubank Platinum Card

Nubank offers interesting benefits to its customers, but it is important to note that there are also some disadvantages. For example, charging a fee for use abroad, in the amount of 4% of the total purchase.

In addition, in the case of the Nubank Platinum credit card, the accumulation of miles is different from other banks. At Nubank, this benefit can only be used successfully if customers subscribe to Nubank Rewards, which costs R$19 per month or R$190 per year.

If you are a Gold customer, but want to upgrade to Platinum, you will have to cancel your card. That is, you can only have one of the options.

It is not possible to request the Platinum Nubank card. It is only offered by the bank according to your consumption and income profile. According to the bank, it is recommended that a person have this card with a monthly income of at least R$6.

And if you want, you first need to use the Gold card, and over time, the opportunity for Nubank to offer Platinum may arise.

Learn More: How to apply for a Nubank credit card

Additional information about the Platinum Nubank card

If you are already a Nubank user and receive an email asking if you want to join the Platinum card, it is up to you to obtain this version or keep your little purple one. What we mean is that change is not mandatory.

Now, if you accept to make the change and wish to have the benefits offered on the virtual card as well, you will need to update the virtual version through the Nubank app, available for Android and iOS.

Another important point to note is that the updated limit of the Platinum Nubank card is defined by the bank itself according to its consumption.

In some cases it can stay the same or increase when a person makes the switch from Gold to Platinum. If you wish, you can request an increase in the limit through the application, which will be analyzed by Nubank.

Is it worth applying for the Platinum Nubank card?

After all the explanations in this post, it will depend on the type of products and services you consume. Above all, Nubank Platinum Nubank benefits are aimed at people who travel a lot, whether for work or not.

If this is not your case, the ideal is to keep the Gold version of the card.

If you are still in doubt, a tip is to make a list of your financial life and evaluate your consumption habits, how much you spend throughout the month, and if you intend to travel more often or save money. If your understanding is that it's not worth it, keep the current services you already use.

And if you have any questions that you want to clarify, contact the bank on the number: 0800 608 6236, through which you will find everything you need to know.