N26 our country: What are the advantages and how to open your digital account?

N26 our country: What are the advantages and how to open your digital account?by Team AllYourVideogames | Dec 8, 2022 | Finance |

It's been a few years since fintechs and digital banks are here to stay. More and more people are joining and putting their trust in these digital financial institutions. As a result, several companies and startups are founded or foreign companies come to the Brazilian market looking for their own space, trying to attract as many customers as possible. This second situation mentioned happens with the N26, our country, which promises to enter the country once and for all in 2022.

N26 our country

N26 is a startup created in 2022 and launched in 2022. It originates in Germany, and its headquarters are in Berlin. In this way, all its operations are carried out over the internet, even because this bank does not have physical branches. As a result, the services provided by the financial institution need to be accessed from the computer, and banking transactions are made simply and quickly through the N26 app or even through the website.

It is worth noting that the N26 work model is very similar to Nubank. So much so that, in 2022, the German startup announced its intentions to enter the Brazilian market. However, after two years, the service is still not available in our territory.

But this situation may change soon, since in November 2022, N26 announced that it is coming to our country for good, and the expectation is to offer the services in bulk in the first half of 2022, but without a date in specific. The expectation is that now it will work.

If it actually operates in the country, our country will be the first territory in Latin America to receive N26 services. It is also worth noting that the platform is currently in a test phase. And despite all the financial difficulties that the vast majority of our countryers go through on a daily basis, there are many reasons for fintech to want to offer its services in the country, for example, the large base of potential customers.

To give you an idea, Nubank, until the end of November 2022, had a little more than 48 million customers, while N26 has about seven million users, all distributed in more than twenty countries in which the bank European digital operates.

And the speech preached by N26 our country is to inaugurate what they are calling the second generation of fintechs. For the startup, the first was relevant to democratize access to financial platforms, while the new one to come aims to help people take better care of their own money.

The planning of N26 our country goes beyond providing services and features of a traditional digital account, the startup wants to bring to the country tools that are executed internationally.

And one of the tools that draws attention is “Spaces”, which is based on a shared account in which a group of people manages. In addition, another interesting feature is the salary advance in up to two days, and there is still a plan to make an investment tool available in the future. In any case, you will be able to check out more differences from the N26 to our country at another point in this post.

Learn more: Revolut our country: The digital bank with an international card

It is also important to make it clear that, unlike other fintechs, N26 does not intend to gain a reputation as a free digital bank, even if it provides some free features.

The startup will use a model with some premium features. As a result, all the rates for our country have not yet been released, but it is already possible to see some rates, as will be shown in the next topic. Anyway, to have a base, European customers pay up to twenty euros a month.

And for everything to work out and thinking about its growth, N26 won, in October 2022, a financial contribution of US$ 900 million from the Third Point Ventures and Coatue Management funds, this contribution made the startup valued at US$ 9 billion. As a result, the financial institution is the second largest in Germany, behind only Deutsche Bank.

Even though it is a huge bank, compared to Nubank, the German startup is still far behind. That's because our country's fintech, which is going public, is worth at least US$ 50 billion

Fares charged on the N26 our country

As the bank has not yet been launched in our country, the rates of fees can be changed even before that happens. In addition, additional fees may be added. So, know, below, the prices of the tariffs that have been published so far:

N26 digital account

- Account opening: Free

- Account maintenance: Free

- Add money by PIX: Free

- Payment by bank transfer: Free

- Virtual account card issuance: Free

- 1st copy of the N26 account card (physical): Free

- 2nd copy of the N26 account card (physical): BRL 25,00

- Sack: R $ 6,50

N26 credit card

- Annuity: Free

- Issuing a virtual credit card: Free

- 1st copy of the credit card (physical): Free

- 2nd copy of the credit card (physical): R$ 25,00

- National transfer: R$ 6,50

- Emergency credit assessment: BRL 25,00

It is worth mentioning that the 2nd copy of the credit card can be exempt in case of theft or theft.

What are the differentials of the N26 digital bank?

Our countrymen still do not know what services will be made available by the startup in our country, but it is possible to highlight some features that are offered abroad and are not so common to be seen here.

That said, check out some of the differences between the N26 digital account below:

consumption management

The N26 app helps you better manage your monthly consumption. This is because the bank has artificial intelligence, in which it recognizes and separates your expenses, indicating how much you spend monthly at the supermarket, on your health, in cafeterias, entertainment, with studies, among others.

It still allows users to create specific consumption subcategories, which allows them to see exactly where their money is going each month.

Spaces

N26 lets its users create spaces within the digital account, which means that it is possible to create a kind of sub-account to better manage your savings. Thus, with this tool, a path is traced to save money to buy a product with a higher price, raise capital to give a gift, to take a trip, among many other possibilities.

It is still possible to tag all your expenses, further expanding your experience within this tool.

To be clear, spaces is a function similar to Nubank's “Save money”, but in the case of N26, the user can create several spaces and allocate the money to each established objective. At Nubank it is only allowed to have access to one space.

And this feature can be even better if you choose to have a premium N26 account, because you will be allowed to create a collective space in which other users who are linked to this bank can also manage the account.

The collective space can have up to ten administrators, and everyone can collaborate, spend and manage the money in the account. This function is ideal for saving money in a group, in pairs or in the way you decide. It is also worth noting that everything is recorded in the app what each member did, thus avoiding possible problems.

N26 client area

N26 still has its internet banking space. In addition to the app, customers can make transactions through the fintech website.

In this way, the site has all the features and security of the app. With this benefit, it has expanded the possibilities of downloading account data (such as your bank information), downloading statements, among other features.

The N26 has Stealth Mode, which is a tool that offers more privacy to browse the web using the notebook, which can be nice to do in possible public places. Anyway, this function leaves the page with a dark layout, which is good to use overnight so as not to spoil your views and even a format with fewer transitions for those who like more simplistic settings.

Cashback Program

The application of this fintech makes an individual invitation code available to all its customers, with which users can send it to whomever they wish. So, another person just needs to enter the link that was sent to open an account at N26, activate the card they will receive, and make a purchase with the card, so you will receive your cashback. The app sends you a notification at the same time you earn your money back.

travel insurance

Some N26 account types offer customers the advantage of having travel insurance. Among the benefits is coverage for flight delay and baggage of five hundred euros, and loss of baggage of two thousand euros.

FIND OUT MORE: 123 miles is reliable? Check out our honest opinion

Is the N26 reliable?

Directly answering the question of this text topic: yes, N26's accounts are reliable. Customers are giving the platform positive ratings. For example, in the startup's profile on TrustPilot, a tool for evaluating companies abroad, the fintech has a score of 3,7 out of five, which is considered good.

In this way, N26 provides good tools for managing and securing your account. This can be seen when making any changes or transfers to the account, as a notification is sent in the app and in your email showing that some action has taken place.

And as the bank accounts were created with Europeans in mind, it is still worth noting that there are no fees for electronic withdrawals in any country that is part of the European Union.

It is also worth noting that the N26 is regulated by the European Central Bank. With this, transfers between other institutions, only in euros, can be carried out by Wise, formerly TransferWise, which is a very secure platform.

Learn more: Western Union: How to send money abroad

On top of that, blocking the card can be done with just a few taps on the app, which is a great benefit as you don't have to go through a bureaucratic process.

What are the requirements to open an account at N26?

ATTENTION! Reinforcing the information that N26 account opening is not yet available in our country. Despite this, it is possible to have an account in this digital bank. Therefore, all the information from here is only valid for creating an account abroad, including the advantages that will be shown a little later.

So, to create an account at N26, you must meet the following requirements:

- Be at least eighteen years old

- Possess proof of residency in one of the countries in which N26 operates, which are the following: Germany, Austria, Belgium, Denmark, Slovakia, Slovenia, Spain, Estonia, Finland, France, Greece, Netherlands, Ireland, Iceland, Italy, Liechtenstein, Luxembourg, Norway, Poland, our country, Sweden, Switzerland.

- Have a cell phone with internet access that supports the N26 app

- Valid European passport or European residence card that has one year of validity. According to fintech, in the case of some countries it may be necessary to send other documents. To see the list of countries click here.

- It is not necessary to show proof of income to open your N26 account.

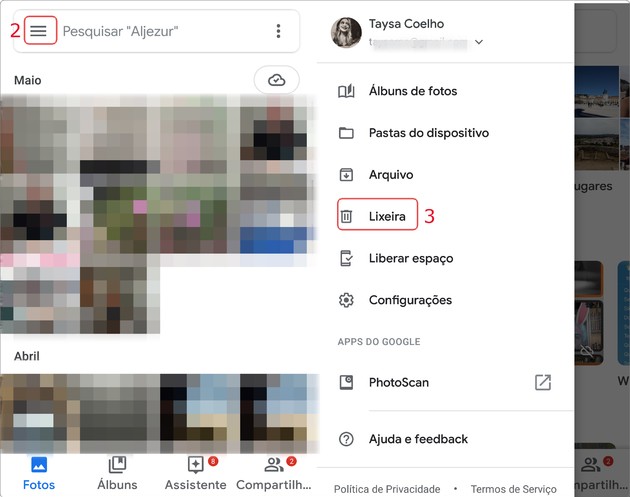

How to open an account on N26?

The N26 account opening procedure is not complicated. In addition to being free, it will only take you a few minutes to complete the entire process, as you can see in the following tutorial:

Step 1: Download the Banco N26 app, available for mobile phones with Android and IOS systems. Once downloaded, open the app and tap on: Open Bank Account.

Step 2: choose the country where you live (or place in Europe where you want to send the card. So, as already warned, at least for now the residents of our country still need to wait a little longer to be able to create an account in our country of the N26.

Step 3: now, enter your personal data: full name, address, passport, proof of European residence with the year of validity, e-mail, cell phone, date of birth, nationality and country of birth

Step 4: select the type of account you want to open.

Step 5: it will be necessary to validate your identity through a video call or photo and document verification. As a tip, checking the document using the European residence card is faster than using the passport. If you use your passport, you will need to take a photo of your passport, a selfie and send the location of the device, all to prove that you are in a place where the fintech operates.

Step 6: An activation code will arrive via SMS, which needs to be placed in the app to perform the pairing. If your code is not sent, you will need to contact the institution's support channel. For this, you can use the app's own chat.

Step 7: ready! your N26 account will be made once your request is approved. Remembering that the card will be generated and you will be able to receive it at the registration address.

Photo: publicity/N26

Our countrymen who have European citizenship, regardless of what it is, as long as the country has Bank N26 operation, they do not need to prove their address in Europe, it is only necessary to show the European passport as proof of identity. Just be aware that some countries may need to present other documents, which will be shown in the app.

Main features of the N26 account

Now that you are aware of the main aspects of Banco N26, check out the summary of the most important characteristics of this financial institution

- Opportunity to open a digital account to use in several European countries, as long as you meet all the requirements and rules that have been explained

- Account opening has no fees

- It is not necessary to send proof of monthly income

- There are free account modalities without having to pay maintenance

- Integration with Wise platform to send international remittance money

- Real-time messages of all the movements you make in the app

- Determined amount of free withdrawals per month, according to the type of account created, being able to make withdrawals even outside their country of origin

- App has expense control and security functions, being able to block the card, limit for international use, delimit expenses, among others

- Map of the ATMs that are closest to the customer

- Expense control alternative

- Space and tag functionality

- Possibility to earn cashback

- Travel insurance

- The internet account, without the need to solve possible problems in physical establishments.

- Guaranteed security, as good as traditional banks