Master Bank: How it works and how to open your digital account

Master Bank: How it works and how to open your digital accountby Team AllYourVideogames | Sep 1, 2022 | Banks |

O Banco Master it is yet another alternative that promises to simplify the consumer's relationship with money.

Through the internet, you have access to several products that are important for your routine, such as: credit card, digital account, loans, among others.

From now on, we are going to present a complete guide about this financial institution.

Our proposal is that, at the end of the content, you are more prepared to assess whether the bank meets your financial needs.

To that end, we will cover the following topics:

- What is Master Bank?

- What are the benefits of the Master Bank digital account?

- How to open a Master Bank account?

- What is the rating of Banco Master on Reclame Aqui?

- Is it worth opening a digital account at Banco Master?

Learn More: Which is the best digital bank for loan?

What is Master Bank?

Before showing more details about Banco Master, it is important to explain its concept.

After all, most people still mix up the terms “Banco Master Máxima”. The confusion is justifiable, and we will explain this new change from now on.

Three years ago, since the change in shareholding control, Banco Máxima changed its name. Currently, it is known as Master Bank.

There are three characteristics that help to understand the difference between the current version and the old model: digital banking, agility and innovation, offering the consumer several modern products.

Banco Master's proposal is not to be just another financial institution in the digital market.

He wants to go further, with productions and services that can help not only individuals, but also legal entities.

To achieve these goals, the account invests in a perfect triplet that helps maintain the development of the institution and consumers: people, infrastructure and technology.

Banco Master's objective is to simplify the lives of consumers and help people achieve new goals on a daily basis.

For this, the financial institution expanded its area of operation, with state-of-the-art infrastructure and innovative products.

If you want to know more details about the history of Banco Master and how it got to this moment of “revolution”, which the company calls it, find out about the bank's history on the company's official website.

What are the benefits of the Master Bank digital account?

The Master Bank digital account offers several advantages for individuals:

- Digital account with speed and practicality for your routine;

- Possibility of making payments for consumption bills through a mobile device, computer or tablet;

- PIX;

- Credits to help the consumer in emergency periods, regardless of their net worth;

- Personalized service to safely invest your money in recommended wallets;

- Access to the Remessa Online platform to transfer and receive resources at any time of the day.

The “Master Bank Loan” is another benefit that we cannot ignore in this article.

It is considered one of the most attractive alternatives compared to other options on the market.

This is because the discount is applied to the consumer's payroll.

In this service, the customer gains more speed and practicality at the time of release of personal credit.

The most interesting thing is that the payment terms are designed according to the consumer's reality.

That way, you don't compromise your budget.

You can ask questions with the company about the service in the following service channels:

- 4003-4952 (capital);

- 0800 881 0001 (other locations).

The Banco Master team is available from Monday to Saturday, from 08 am to 20 pm.

If you are looking for information, such as “Master Bank Vacancies” and “Master Bank Work with Us”, we recommend giving preference to the company's official website.

There, you can ask questions about these and other subjects.

Master Bank: Payroll Credit Card

The Bank also offers consumers a credit card that is deducted directly from the payroll.

The benefit is granted to public servants: municipal, state and federal, retirees and INSS pensioners who have an agreement with the financial institution.

You have access to several benefits with this credit card.

In addition to not having consultation with the SPC and Serasa, it guarantees exemption from the annual fee, the possibility of taking advantage of the advantages offered by the Visa brand and also contains the Saque Fácil service.

Find below the complete list of bodies affiliated to the bank:

- Guarujá City Hall;

- Uberaba City Hall;

- City Hall of Uberlândia;

- IPSERV MG;

- Sao Vicente City Hall.

Remessa Online is a feature that allows the user to make financial transfers between countries.

The process is carried out with safety, agility and practicality.

The system releases purchase, sale, service provision, investment, among other services.

Individuals

At Banco Master, individuals have access to the following benefits: checking account, investments, foreign exchange, structured operations, prepayment of receivables, foreign trade and services, which are suitable for companies that want to grow, but do not want to waste time with banking products. that require a lot of bureaucracy.

Learn More: C6 Bank PJ: how to open an account for your company

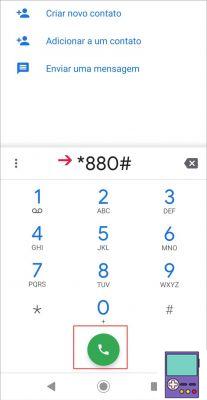

How to open a Master Bank account?

There are no mysteries to open a digital account with this financial institution.

Just download the application, fill in your details and follow the platform's guidelines.

The process is usually completed within a few minutes.

What is the rating of Banco Master on Reclame Aqui?

Reclame Aqui is a great site to assess a company's reputation in the financial market.

In September 2022, the institution's rating on the portal was 6.1 out of 10, which is considered regular by the platform.

Despite not being a company with a high score, the institution has already responded to 99.4% of complaints and the problem-solving rate is at 71.9%.

This shows that, unlike other alternatives available on the market, it seeks to help consumers.

In addition, Banco Master always seeks to modernize its products, with the aim of improving the customer experience.

The company's Call Center also helps to understand how reliable the financial institution is.

It contains affordable options that operate from Monday to Friday, from 08 am to 18 pm.

Customers who live in the capital can contact the bank by calling: 4003 1117.

Residents of other locations can talk to the company through the number: 0800 727 0779.

The ombudsman takes calls at the following contact: 0800 729 1710.

The service is not available on public holidays.

Is it worth opening a digital account at Banco Master?

Yes. This type of service brings several benefits to the consumer, such as: practicality, less bureaucracy, better investment alternatives, personalized service, account for individuals and legal entities, among others.

When you open a digital account at Banco Master, you don't have to leave your home to solve financial problems.

All you need is a computer or mobile device with internet access.

On the other hand, it is never too much to make it clear how important it is to have more than one digital account.

That way, when any system crash or other kind of problem occurs, you can run financial services smoothly.

Daily, we are in the habit of evaluating the most important financial institutions on the market so that the reader can make more assertive decisions for their pocket.

Below are some options that will help you expand your portfolio in relation to digital accounts.

- Is C6 Bank good? Check out our opinion about digital banking

- Digio or Nubank which is better?

- Internet Banking Caixa: how to access and use it?

Here, we have developed a complete assessment of Banco Master. It is essential to make it clear that the content was not sponsored by the company.

Therefore, the review was made based on our experience and the opinion of other consumers.

It is worth checking the information carefully before making a decision.

After knowing the main information about Banco Master, find out which is the best digital bank to store your money.

In this article, we separate several tips that help the reader to make a more assertive decision for their pocket.