by Team AllYourVideogames | Aug 5, 2022 | Shopping |

You already know the iti credit card no annuity? This is the novelty of Banco Itaú, which until recently only made available the iti digital account.

According to the bank, the new card guarantees some benefits such as zero annual fees and a limit of up to R$10.

Technology has been changing our lives as a whole and banking has not been left behind.

We live in the Age of Digital Banking. Basically, they are banks that do not have a physical structure and offer their services through the virtual universe.

There are numerous options and offers on the market with several advantages, such as Banco Inter and Nubank, for example.

A fintech has exemption from fees, less bureaucracy in accessing credit and agility in transactions. These are examples of the benefits you can enjoy by opening a digital account now.

This new movement made traditional banks adapt to this new reality.

With this, Banco Itaú launched its iti itaú digital wallet, which now also has the credit card in its physical model with the Visa Platinum brand.

It has no membership fees or annual membership fees and can be requested through the app.

Learn More: How to pay bills with a credit card?

How to apply for a no-fee credit card

Image: Publicity/Itaú

First of all, to apply for an iti credit card, there is a condition: you must have or open a conta in the.

It is a strategy of the institution, because, in this way, the bank has the possibility of attracting more customers and boosting its growth.

Itaú Digital Account: how to open

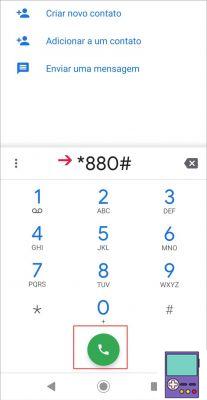

You can create your account for free on the Itaú website or download the app on your cell phone.

Just download the iti Itaú app: digital bank that is available on the Play Store and App Store.

With the digital account, you have several services. Among them: transfer and receive without fees with PIX, receive cashbacks, pay slips, recharge your cell phone, withdraw money at Banco24horas teller machines.

You can also shop online, put money in your balance by transfer or bank slip, pay with QR Codes at machines and share payments with other people through the app.

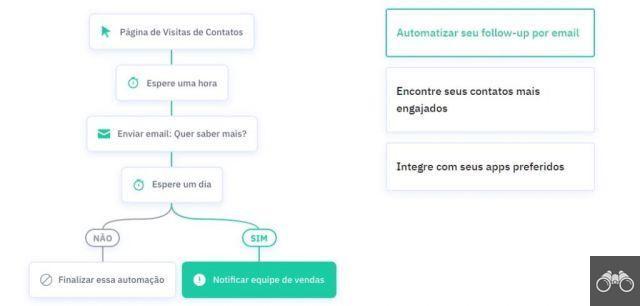

Order your credit card online: check out the step by step

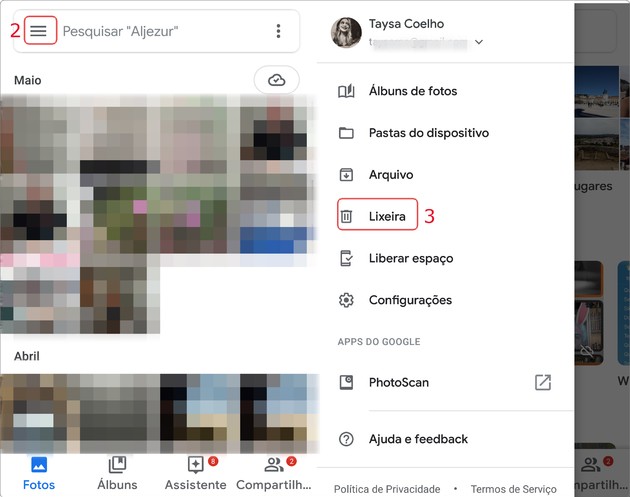

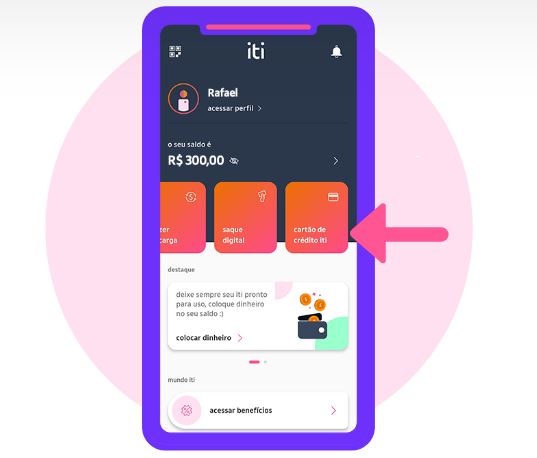

1. On the home screen, tap “iti credit card”;

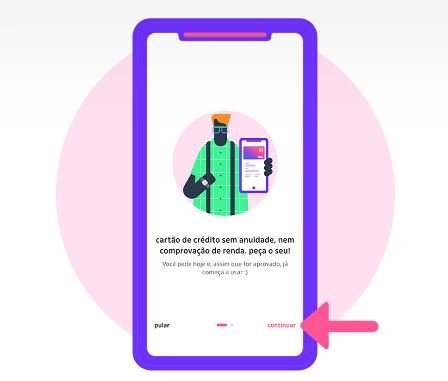

2. Check the card advantages and tap “Continue”;

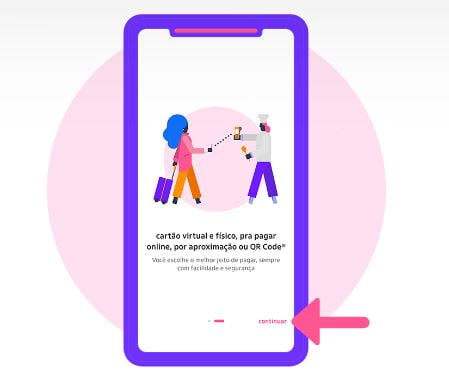

3. Tap “Continue” again;

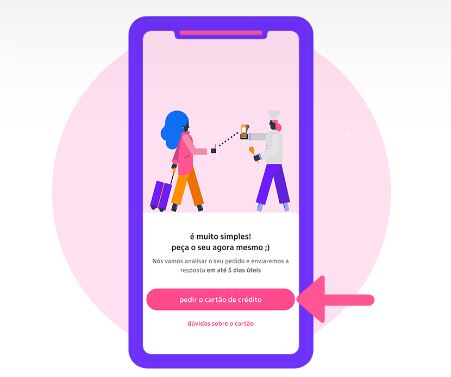

4. Ask questions about the card and tap on “Request a credit card”;

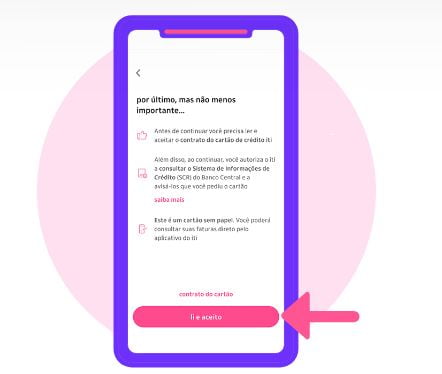

5. You must accept the Terms. Then, tap “I have read and accepted” to proceed;

6. Enter your iti password, which you access the application;

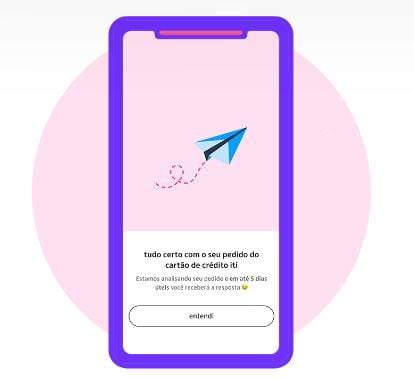

7. Finish and tap on “I understand” and wait for the order to be analyzed.

The card request is free and the analysis is done within 5 business days. If you are approved, you can immediately start using the virtual card and order the physical card, at no additional cost.

With iti cards, you can make purchases online, without having to wait for the ticket to clear.

You can also subscribe to movies, series and music apps, you can easily register the card for payments in a transport, delivery app, among others.

This card is accepted in all machines, it has NFC (Near Field Communication) technology that allows payment by approximation.

For added security, the physical card does not come with numbers printed, only the name of the holder.

Other information such as account number, branch and expiration date are accessed by the app.

Possible fees for Itaú cards

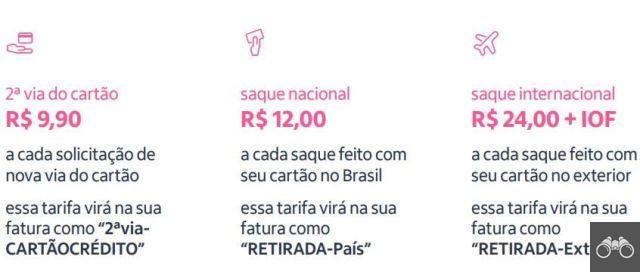

Despite being a card with no annual fee, in some specific cases fees may be charged for the provision of services. Are they:

Advantages of the iti credit card

In addition to all the benefits of the digital account, which are also the same as the credit card, you have control of your financial life in the palm of your hand.

You can choose the due date for your invoice and manage your expenses from the app itself.

Having a digital account comes with a combo of benefits and the freedom to be able to make an operation at any time is one of them, as there is no time limit, such as self-service at conventional bank branches, which is usually from 08 am to 22 pm .

Services can be accessed 24 hours a day through digital channels.

iti Phone: Contact the iti credit card

If you have any questions or need to talk to the iti team, you can also get in touch through these channels:

For capitals and metropolitan regions: 3003 6484

Opening hours: Monday to Saturday: from 2:08 to 22:XNUMX

Call: 0800 720 3670

Opening hours: Monday to Saturday: from 2:00 to 00:XNUMX

Sac for the hearing impaired: 0800 722 1722

Opening hours: Monday to Saturday: from 2:08 to 22:XNUMX

Iti Ombudsman: 0800 720 3690

Opening hours: Monday to Friday: 2 am to 6 pm

Other locations: 0800 2000 484

Opening hours: Monday to Saturday: from 2:08 to 22:XNUMX

History of Banco Itaú

Itaú was founded by Alfredo Egydio de Souza Aranha in 1943, twenty years after Unibanco, which was founded by João Moreira Salles. At the time, Itaú was called Banco Central de Crédito SA.

The second generation of founders was Walther Moreira Salles and Olavo Setúbal. Olavo was Alfredo Egydio's nephew and has his name on the headquarters building, located in Alfredo Egydio de Souza Aranha square, in our city, called Torre Olavo Setúbal.

In 2008, Itaú merged with Unibanco and created the most successful private bank in Latin America that we know today, Banco Itaú, which today also has its iti digital account.

Learn More: Simple PJ Account: How to open an account for your company