by Team AllYourVideogames | Nov 4, 2022 | Credit Cards |

A new fintech our country is emerging! It is about Will Bank card.

As it is in its initial period of life, it is worth mentioning right away that some common features to be seen in other financial institutions are not yet available in this company.

But the expectation is that this bank will consolidate more and more over time.

In any case, one of the services that you can request is the Will Bank card.

So, in this post you will be able to check a little about the emergence of this financial institution, the services that are available, how the digital account works, the limits, the fees, the positive and negative points, how to apply for a Will Bank card, and a few more information to let you know about this new fintech.

Learn more about the Will Bank card

Will bank was born through the merger with Meu Pag!

Both were part of the same conglomerate of companies, in this case, Grupo Vista, which has been operating in the financial market for over 15 years.

In this way, My Pag! appeared in 2022 and the merger with Will Bank took place in 2022. And according to the company, since its foundation more than 11 million debit and credit card orders have been registered.

Of this amount, more than 1,6 million plastics were issued by April 2022. Fintech has not released an update on this number.

According to the financial institution, this unification aims to reach small businessmen and merchants who are in cities with up to 100 thousand inhabitants.

In addition, its main attention is in the Northeast region, at least initially.

Seeking its space on the national scene, in July 2022, Will Bank won a financial contribution of R$250 million from a group of investors led by the XP fund and also by the manager Atmos Capital.

As it is a new digital company, the bank's application until the closing of this post is still in beta, but it is already available to everyone and has some features, as will be explained later.

And despite being a newly launched financial institution, you may notice that fintechs are increasingly popular among our countrymen.

To give you an idea, according to a survey carried out by Transfeera, payments made through the 5 largest national banks (Banco do Nosso País, Bradesco, Caixa Econômica Federal, Itaú and Santander) fell from 100% to 53,7, 4% in the last XNUMX years.

This means that conventional financial institutions are losing ground to digital banks.

Therefore, the expectation is that Will Bank will be able to grow and offer good services to its customers, even because it already has some interesting features, such as the possibility of making payments for international purchases, the credit card has proximity technology, and comes with the Mastercard brand, which makes it possible to participate in the Mastercard Surpreenda points program.

It is also important to make it clear that the Will Bank card has a credit and debit function and does not have an annual fee, in addition to the possibility of requesting a virtual card as well.

Will Bank Card: international coverage

Will Bank customers can pay for purchases made abroad or on international sites, and the amount will be converted into dollars by Mastercard.

In addition, the Will Bank account holder can also make withdrawals in another country.

A nice feature is that the exchange rate for the day can be viewed in the digital banking app. It is also worth mentioning that purchases made internationally are subject to the mandatory payment of the Tax on Financial Transactions (IOF) of 6,38%.

So, withdrawals made in another country suffer from more tax charges from the operation, such as a fee that is established by the cashier used.

Anyway, don't worry, all fees charged by the bank will be explained later.

Will Bank Card: What is the extra limit?

In addition to the credit limit offered in your Will Bank digital account, there is the possibility of making a payment of up to twice the amount of your last ticket generated in this fintech.

For example: if your invoice amount was R$1.000 and you paid R$2.000, then you will have an extra limit of R$1.000.

The discharge of this extra limit can be carried out by issuing a partial boleto with a cost greater than what was charged. That way, you can use this extra limit to make purchases and withdrawals.

It is important to note that this amount does not enter as a credit on your subsequent invoice.

With this, the amount can be used as many times as you want until the extra credit runs out. Just be aware that the surcharge is always deducted first when making a purchase or directly withdrawing the credit limit.

On the withdrawal, interest of 6,99% is charged on the amount of credit used. This extra credit cannot be used to make transfers.

And to finish this subject of limits, it is important to point out that it is still not possible to request the increase of the standard limit established for the Will Bank account.

According to the financial institution, there is no deadline for this resource to be made available.

Thus, a limit increase is not offered through chat, social networks, call or WhatsApp, beware of possible scams.

Will Bank card digital account

As soon as you apply for the Will Bank card and it is approved, you will automatically gain access to your digital account in the app, that is, there is no need to ask to open the account.

That way, no type of analysis is done for the opening of the account, just to have the credit card. So, if you are approved, your digital account will be available at no additional cost.

With your Will Bank digital account, you can send and receive money without having to pay fees. And if you have a balance available on your account, you can make payments, transfers and use your debit card.

In addition, this digital bank account yields 110% of the CDI (Interbank Deposit Certificate).

Just be aware that you can't use all account features whenever you want. This means that it will depend on which resource you are going to use, because each service has its own hours of operation.

Thus, for example, TED transfers can only be made from 8 am to 17 pm. The discharge of securities and tickets is open from 8:20 to 24:1.030. It is possible to withdraw money at any time through BancoXNUMXHoras ATMs, and the daily withdrawal limit is R$XNUMX.

PIX is not yet available on Will Bank. But, according to the digital financial institution, customers will soon receive this transfer option.

What are the fees charged by the Will Bank card?

Although the Will Bank card does not have an annual fee, the financial institution has some fees.

So, check out the bank's fees below:

Late payment invoice

- Fine: 2% of the amount due on the invoice, charged regardless of the number of days late;

- IOF: 0,38%, charged regardless of the number of days of delay, plus 0,01118% for each day of delay;

- Interest: up to 15,7% per month on the amount owed, charged in proportion to the days of delay.

It is important to make it clear that late fees for an invoice will be charged on the subsequent invoice.

Minimum invoice payment

- Interest: communicated in the “Credit card” and “Fees and charges” tab;

- IOF: the same standard as in the previous topic.

Invoice installment

- Interest: up to 13,7% monthly;

- IOF: follows the same pattern.

Withdrawals using the credit limit

- Interest: 6,99% on the credit amount used.

The fees charged when using the credit card for all international purchases are as follows:

- The dollar value at the time you make the purchase;

- The IOF, which is currently 6,38%;

- And the transaction cost fee, called Spread, which is 4%.

Learn More: How to send money abroad?

It should also be noted that the Will Bank card is blocked after five calendar days if there is a delay in your bill, if you have not paid at least 15% of the total debt.

Will Bank Card Pros

Throughout the text we comment on the benefits of the Will Bank card.

Check out a summary of the positives:

- Card without annual fees;

- International coverage;

- Proximity payment technology;

- Free digital account;

- Extra limit.

Will Bank Card Negative Points

On the other hand, fintech still needs to improve in some aspects:

- It is not allowed to have an additional card;

- There is no loyalty program available;

- It is not possible to make PIX transfers;

- Service fee;

- Inability to ask for a standard limit increase.

Here it is worth mentioning that the bank is still new, and that these resources will probably be implemented in the future.

How to apply for a Will Bank card?

With everything you've seen so far piqued your interest in the Will Bank card, in this topic you'll learn how to apply for one.

The first step is to register using the Will Bank app or website. You need to fill in some data, such as your full name, CPF, mobile number, email and send photos of some documents.

As soon as you finish filling in all your data, the Will Bank team will do a credit analysis, the result will come out within a period of 15 days.

Thus, you should receive an email with the announcement if your request was approved or not. If so, fintech will create your digital account and send your credit card.

It is worth noting that after the account is approved, the credit card process will begin and this step may take up to five business days to complete.

You will be able to follow the entire operation by email, which will also contain the tracking code to track the delivery.

Now, if you haven't been approved, you can try to re-order your Will Bank card after 90 days.

It is not disclosed what is taken into consideration for approval. But, in general, the Serasa Score is always an important point, although the Will Bank card also does not specify the average score to be approved.

Learn more: How to increase Serasa Score: 5 foolproof tips

In any case, fintech performs a risk analysis when offering credit to its customers.

For this, the financial institution consults the information in the credit data companies.

A useful feature is that there is no need to wait for your Will Bank card to arrive to start using it, as it is possible to make purchases using the virtual card.

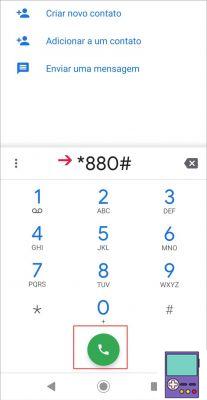

However, when the physical card arrives at your home, you will need to unlock it, as shown in the GIF below:

Photo: Disclosure / Will Bank

Photo: Disclosure / Will Bank

Remembering that the digital bank application is available for mobile phones with Android and iOS systems.

Is it worth applying for the Will Bank card?

When talking about the Will Bank card, the first point that needs to be taken into account is the question of being a new fintech in the financial market.

Because of this, some people may be wary of investing in an institution that is still seeking to consolidate itself, which makes a lot of sense.

However, even if it is a new bank, the initial services offered show the company's potential and the strategy of capturing new customers is interesting and the fintech is reliable.

Learn More: What is Finclass financial education and how does it work?

And if you are afraid of investing your money in this bank, a good option is to take a look at the main reasons for customer complaints. The vast majority will question the delay in the credit analysis, although the company informs that this process can take up to 15 days.

Despite these complaints, Will Bank has 99.9% of questions answered on Reclame Aqui. However, its overall rating on the site is 7,6, which is considered just good.

It is also worth mentioning that the Will Bank app has a beautiful and modern design. And most importantly, it is simple to use, as it has an easy-to-understand layout and is far from bureaucracy.

So, with all the features available so far, the Will Bank card has interesting features, but they are still limited compared to the competition.

Anyway, the positive points are useful for your day to day. If you don't have the Will Bank card yet, it will be useful to save your money and pay for products in international purchases without bureaucracy.

Even so, it is possible to find other credit cards in the fintech market and even traditional banks with more resources and advantages, such as financial services, loans and opening an account with better yield for their financial products.

And if you have any questions, you can access the Will Bank Service Center.