by Team AllYourVideogames | Jul 5, 2022 | Shopping |

adThe union between Flamengo and the Bank of our city (BRB) has proved to be beneficial for both sides. In one year, there are already more than 1 million and one hundred thousand accounts in Nação BRB Fla. In this way, customers who use the services of the financial institution can request a Flamengo credit card.

These numbers exceeded initial expectations, as will be explained throughout the post and the biggest fans in our country made the difference.

In this post, you will learn about the benefits that the bank offers to customers, how to open an account and apply for a Flameng credit card, how the Loyalty Program works, as well as extra information.

BRB Fla Nation: How does the partnership work?

It is worth noting that the agreement between BRB and Flamengo is not a common sponsorship that we find in football. This partnership between the bank and the club works as follows: all bank transactions with the team, opening accounts, credit, debit and prepaid cards, insurance, investments and relationship programs with benefits for fans will be divided equally. between both.

In addition, it is important to point out that Flamengo receives about R$32 million annually in a fixed form.

Of course, the bank's target audience is the club's fans, with more than 40 million fans. However, any interested person can open an account.

Next, check out how to open an account at Nação BRB Fla.

How to open an account at Nação BRB Fla?

It is very simple and fast to open a digital account at Nação BRB Fla and you can do everything just with your cell phone. See the step by step below:

Step 1: Download the Nação BRB Fla app, available for Android and iOS;

Step 2: Once you open the app, select the option “I want to open an account”;

Step 3: Put your full name and CPF;

Step 4: Read the Single Agreement and the Usage and Privacy Policy. If you agree, accept and proceed with opening your account;

Step 5: Enter your cell phone number;

Step 6: A token will be sent to you. Check the code and put it in the app;

Step 7: Now, enter your main email;

Step 8: Enter the zip code of your residence;

Step 9: Add the complement and number information, after the app displays the first part of the address (address);

Step 10: You will need to upload two-sided photos of a photo ID. According to the bank, if you use the National Driver's License (CNH), the account opening process will be faster. It is worth mentioning that the application shoots itself when framing the photo;

Step 11: Allow the app to access your photos and videos;

Step 12: Tap Take a “Selfie”;

Step 13: The next step is to register the password to access the application;

Step 14: Now, register the financial transaction password, that is, the card password.

Step 15: Allow access to app location;

Step 16: The application will inform you that the registration is being sent for validation. Now just wait for the account opening confirmation via email and push.

According to the bank, the account is opened within 24 hours, after registering the data and uploading the documents. It is also important to note that the Flamengo digital account is only for individuals and proof of income is not required to open the account.

After confirming the opening of the account, in the first access to the Nação BRB Fla app, you will be able to request your Flamengo credit card, if you have an approved credit limit. “If this option does not appear, it means that a debit card was generated automatically.

As soon as we issue the number and it is on its way, the 'cards' tab will update to show all the information,” the bank said.

After you order the card, it will arrive at the registered address in 10 days, according to the bank. And if you want to track the delivery of your Flamengo credit card, a code for tracking the card will be generated and sent by SMS after issuance.

Flamengo credit card

At the moment, Nação BRB Fla has seven different types of cards, but all of them with the Mastercard brand. And if you are interested in creating your account, see the benefits that each card can offer you.

Flamengo credit card: +Querido

The +Querido card is for customers with a minimum income of R$100, it does not have an annual fee and uses contactless technology, in which it is possible to make purchases by approach. You can make withdrawals at any Banco24Horas or Cirrus Network.

Flamengo credit card: Torcedora Flamengo and Internacional Flamengo

The Torcedora Flamengo and Internacional Flamengo cards receive the same benefits as the previous card for account holders who have a minimum income of R$1.050.

There is no annual fee for the first year and, after that time, purchases using the card will have discounts of up to 100% on monthly/annuity fees, which cost R$198 annually, which is equivalent to R$16,50 monthly. These cards also have contactless technology and withdrawals can be made at Banco24Horas and the Cirrus network.

Flamengo credit card: Gold Flamengo

Gold Flamengo is the card intended more for people with a minimum income of R$2.500. In addition to the advantages of the Torcedora Flamengo and Internacional Flamengo cards, this version gives access to the BRB Vip Club lounge with private x-rays at airports and purchase and price protection insurance.

The annuity starts at R$312 in the annual billing or R$26 monthly, but it is also free of annuity in the first year of use. After that period, you can get discounts of up to 100% of the total fee amount.

Flamengo credit card: Platinum

The Platinum version of the Flamengo credit card is suitable for people with a minimum income of R$4.900 and offers customers the same benefits as the Gold version, including the same annuity fees, which, in this case, are R$444 per year or 12x R$37 after the one year free period.

The advantage of Platinum is that it offers a car insurance and travel assistance service.

Flamengo credit card: Black

The Black Flamengo card is the most complete version that the bank offers.

This option aims to call customers who have a monthly income of R$10 or more. Black gives account holders all the benefits of the Platinum version and free annual membership fees for the first year, just like the previous version models.

The annual fee for the Black card is R$894 or R$74,50 monthly. The “plus” of this model is insurance and Mastercard Programs.

If you want, the bank also offers the option of a prepaid card, which needs to be recharged for use. In this case, it is not necessary to have a current account at Nação BRB Fla.

The issuance costs R$15 and the customer does not pay annuity fees. The recharge can be carried out from R$10, however, a fee of R$2,50 will be charged for the operation. Thus, the balance of the operation is R$ 7,50.

Withdrawals can also be made at Banco24Horas and Cirrus. It is worth remembering that this card can be requested by customers over 16 years of age.

Photo Disclosure / BRB Fla Nation

Insurance

The customer of Nação BRB Fla can also subscribe to an insurance service, which is aimed at people's health.

“It is an insurance that aims to guarantee the payment of compensation to the insured or his beneficiaries, in the event of a personal accident”, explained the bank.

The financial institution has two insurance plans: Plano Manto and Plano Nação. The only difference between them is that in the second one, the person competes for a monthly drawing of R$10 thousand. Thus, the services offered are: coverage for accidental death and/or total or partial permanent disability by accident.

In this case, the plans will have an insured capital of R$12, 24-hour service and online medical advice service.

To subscribe to any plan, you must be at least 18 years old and no more than 70 years old. Remembering that only Nação BRB Fla account holders residing in our country can join these services.

The online medical care service is available 24 hours a day. With this service, it is possible to obtain a medical prescription, exclusive to medicines with a red stripe and issuance of a medical certificate valid in the national territory.

The service offered by the online medical guidance service is indicated only in cases of low urgency, such as:

- Allergies and skin lesions;

- Breathing difficulty;

- Low back pain;

- Nausea and vomiting;

- Abdominal discomfort;

- Pain or infection in the eyes;

- bites;

- Tingling;

- Swelling;

- Insomnia;

- Headache;

- Fever;

- Flu and cold symptoms;

- Sore throat;

- Vacations and burns;

- Urinary symptoms.

If you want to subscribe to any of these services, you will have to pay R$8 for Plano Manto or R$14,70 for Plano Nação. You can take out the insurance on the first business day after opening the Nação BRB Fla digital account. Within the application, just access the route Insurance > Personal Accidents and select your plan.

It is worth noting that only Nação BRB Fla customers who subscribe to the product will be able to use the online medical advice service. That is, it is not possible to refer someone else, even if they are family members.

+Mengão

Nação BRB Fla also has a loyalty program. With +Mengão, all your transactions made using the credit function ensure the accumulation of points, which can be exchanged for official club products, tickets (when the public is allowed in the stadiums again), sporting items and travel.

This bank's loyalty program is not very different from other institutions. The more you use the card, the more points you will accumulate. At +Mengão, for every dollar spent, you earn up to two points depending on the credit card variant.

If you want to redeem a product from the program's catalog, but you still don't have enough points, you can complete it with your Flamengo credit card. It is also possible to make purchases on the marketplace, collect points on the platform and then redeem them using the “Use Points” function in the app.

+Mengão also allows customers to redeem points to visit Ninho do Urubu (the club's training center). In addition, it is possible to participate in soccer or basketball match days and even take a child on the field with the team before the match, in the “Pequeno Rubro-Negro Carioca” promotion (valid when fans return to the stadium).

The program also allows points to be exchanged for jerseys of the soccer or basketball team autographed by the athletes and tickets for matches at Maracanã.

Successful partnership

Flamengo managed to give greater visibility to the Bank of our city. According to Correio Braziliense, from July 2022 to March 2022, the BRB appreciated by 1400%. It is worth remembering that at this time, Nação BRB Fla had not yet reached more than one million open accounts.

Since the beginning of the partnership, the bank has only grown. According to Paulo Henrique, president of BRB, in an interview given to Paparazzo Rubro-Negro, he states that the value of Nação BRB Fla is R$5 billion.

“We are based on other deals made, by other banks, mainly abroad. Today, the banks that have placed their shares on the stock exchange have received a thousand dollars for each account opened. As we have a million accounts, then 1 billion dollars, which corresponds to R$ 5 billion”, explained the president.

As the partnership says that the amounts collected are divided equally between Flamengo and BRB, if the bank were sold for the amount informed by Paulo Henrique, each party would have R$ 2,5 billion. However, the president reiterated that, at the moment, there is still no physical profit.

“What we need is for Nação BRB to make a profit. Right now, we are opening a lot of accounts and building our customer base. It is these customers, operating the account, making deposits, investing, using the card, buying insurance that begin to generate revenue and from this revenue result that the division (for the club) comes. So the bigger the bank, the bigger this pie of revenue to be split between the two. The secret is for the customer to use everything that is being offered”, said Paulo Henrique.

Still in the interview, the president said that there is a plan that, within a period of five years, the bank will have about 200 million results. “It would be 100 million for Flamengo, apart from the amount that is being generated, in case Flamengo wants to sell part of the shares. It’s in the hands of the fans.”

Extra Info

The Nação BRB Fla application already has the following services: deposits, transfers, payments, investments, credit and debit cards, release of new devices, unlocking and password recovery, pre-approved credit lines, registration of PIX keys and insurance against personal accidents. The bank said more services will be made available over time.

Learn More: What is Pix, how it works and 5 advantages of using it today

If you want to unlock the debit function, just make the first purchase via chip (insert the card and enter the password). It is also worth remembering that if the person is already a BRB customer, they can open a new account at Banco Digital Nação BRB Fla. In this case, you should have two active accounts.

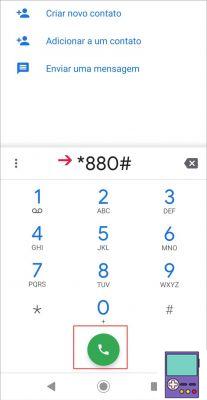

It is also possible to change the payment due date through the Call Center, on the telephones: 4000 1915 or 0800 001 4090, Option 3. The daily limit for withdrawal is R$2 thousand. The limit is reset the next business day.

Although the partnership is still new, it shows promise. That way, if the services offered by the bank pleased you, be sure to open your account and request your Flamengo credit card.

ad