by Team AllYourVideogames | Nov 16, 2022 | Credit Cards |

Do you know CeA cards and do you know what benefits are available with this card?

These are the cards that are linked to the well-known C&A department stores, quite common among the store's customers. If you are thinking of having a CeA cards of your own, then you need to know as much as possible about it.

Therefore, we have separated the main information and how you can request yours. CeA cards are offered by CeA in agreement with Banco Bradesco.

With them, you can have a series of advantages with the store and with other partners.

Here's how CeA cards work and the benefits you'll get.

Learn More: Which credit cards give the most miles?

What are CeA cards and how do they work?

Among the CeA cards, there are a wide variety of options. There are currently five different types of cards for customers, and you can choose according to your preferred brand and usage preferences.

The CeA card options are: Visa Gold, Visa Internacional, Elo Mais, Elo Grafite and Elo Internacional.

It's not enough to just ask for what you want. To get it, you need to have a minimum income of a minimum wage, otherwise you won't be able to.

All these cards have an annual fee charged in 12 installments. This annuity, if added to the 12 times, can have a total value ranging from R$221,88 to R$329,88.

Learn More: Is the Will Bank card reliable? Check our opinion

What are the main advantages of CeA cards?

Regardless of the brand and CeA cards you choose, most of the advantages available are common to all customers:

- You will have 50% discounts on combos and cinema tickets from the Cinemark network;

- On your first purchase made at C&A, you will have a 10% discount on the final price;

- Your card will be accepted worldwide, not just in our country;

- With your CeA cards you can also make withdrawals at Banco24Horas and directly at C&A stores. However, you will have to pay a fee of R$16 for withdrawals outside our country and R$12 for withdrawals within the national territory;

- You will have two limits available, one for your purchases and one for withdrawals;

- You can pay your withdrawal with a possibility of payment divided into up to 24 installments, but with interest;

- CeA cards allow you to pay your purchases in up to 5 installments without interest, in addition to having a differentiated installment for purchases made in the chain's stores, which are up to 10x for purchases made online and 15x for purchases made in physical stores;

- Having one CeA cards also gives you the opportunity to have two additional cards;

- Access to the Bradescard and Bradesco Cards applications to monitor your expenses, limits, invoices and the possibility of making payments through the app;

- Pay up to 3 interest-free installments for your electricity, telephone and water bills;

- You may have access to insurance and assistance, such as life insurance, for example;

- For users of CeA cards with the Elo brand, there will be more than 60 million free Wi-Fi points around the world;

- You will be able to participate in your brand's points programs, such as the Vai de Visa Program and Livelo;

In addition to the various advantages mentioned above, with CeA cards you will also not have an annual fee for purchases made at C&A stores. That is, if you choose to use your card only at the store, the annual fee will not be charged on your invoice.

However, if you make a purchase at any other establishment, regardless of the amount, the annual fee will be charged normally.

For Elo Grafite card users, even more advantages will be available, such as greater accumulation of points, access to VIP lounges at airports and much more for customers.

And what are the main disadvantages?

Even with this gigantic list of advantages, CeA cards is not only praise and also has some limitations.

These negative points are very important and you need to take them into account when deciding whether or not to request yours.

The first negative point that is worth mentioning is the annuity charge, a very late option compared to the competition. Other institutions, fintechs and digital banks choose not to charge an annual fee on the cards offered to their customers.

And in this, CeA cards lags far behind and is a less attractive option.

Another point you need to be aware of is that you will not be able to apply for your credit card online.

To get yours, you'll need to go to a store, a point where CeA cards lag behind the competition.

Last but not least, the card also does not have any rewards program of its own, which for many can be a disadvantage, for example for those who often travel.

The only programs available are those related to your flag.

Learn More: Renner Card: how to request and consult the invoice

CeA Bradescard card how to request yours?

As stated above, you need to go to a physical store to apply for your CeA cards.

You need to fulfill some requirements for this:

- You cannot have credit restrictions on Serasa and SPC;

- The client cannot be a minor and be over 18 years of age;

- You must present proof of residency;

- The applicant must work at least three months and have a proven income;

- You must bring and present your original CPF and RG documents, and the CPF must be up to date with the Federal Revenue.

You can find all the necessary information on the Bradescard website and check the contract and fees, for example.

Even with all this information, you will not be able to request your card on the website.

After requesting your card at one of the physical stores, the company and Banco Bradesco, the card issuer, will carry out a credit analysis and define whether or not your card request will be approved.

If so, the next requirement to be defined is its limit. If all goes well, your card will be an Elo or Bradescard from Banco Bradesco.

How can you unlock CeA Cards?

After receiving your CeA cards, you need to unlock it to start using the credit function.

For this, you will need to contact the Service Center.

Learn More: Pão de Açúcar Card: what are the benefits and how to apply?

How will you go about seeing your CeA Cards statement?

One of the many advantages of having your card managed by Bradesco is that you will also have several ways to monitor your account.

Thus, you can be informed about the payment, limit and statement using the Bradescard application for mobile devices or through the website.

Among the applications, you can use the one on the card itself called C&A Store: Buy clothes and more, available on the App Store and Play Store for Android and iOS.

In addition, you also have the Bradescard application, or Bradesco Cards, as it is known.

It is available on the Play Store for Android devices and on the App Store for iOS devices.

Do CeA cards have an annual fee?

As stated earlier, CeA cards have an annuity that is divided into 12 installments, one for each month of the year.

If you want to know the amount paid on each of the five types of cards offered, you can check the following:

- Visa Gold Card has an annual fee of R$245,88;

- International Visa Card has an annual fee of R$221,88;

- Elo Internacional Card has an annual fee of R$245,88;

- Elo Grafite Card has an annual fee of R$329,88;

- The Elo Internacional Mais Card has an annual fee of R$329,88.

Learn More: Americanas Card: is there an annual fee? Benefits? Know everything here

How to request the duplicate of your CeA cards?

If you are the cardholder and need a duplicate of your CeA cards, you can do this in two different ways.

The first is to go directly to a physical store to request your duplicate in person. The second is by calling the CeA Cards Call Center.

In the next topics, we will make all the numbers available for you to contact.

Is there a way to increase your card limit?

Your first limit on CeA cards will be defined after the credit analysis that takes place at every institution.

Over time and after using your card gradually, your limit may end up increasing on a regular basis, as the bank will continuously analyze your profile.

If you think your limit is too low, you can also request a raise directly from those responsible or go to a physical C&A store or call the Customer Service.

You will need to present a recent proof of income which will go a long way in convincing the bank to release the credit increase.

Learn More: How to make the Assaí card? Check the rules and limits

How to access the duplicate of your invoice at CeA Cards?

You have several ways to access your duplicate invoice on CeA cards, more specifically, you have four alternatives for this:

- Check the duplicate on the Bradescard website or in the application;

- At the service terminals available at C&A stores;

- Through the Call Center by telephone;

- In the CeA stores application, logging in and clicking on the “CeA Card” option, and then going to “Pagar Invoice” to view your duplicate.

What are the service channels for CeA Cards?

There are a few ways to get in touch with the CeA Cards Service Center:

For transactional services, information and inquiries

You can call from Monday to Saturday, excluding holidays, from 08:22 to XNUMX:XNUMX.

In cases of theft, fraud alerts and losses, the service will be 24 hours a day, every day of the week.

If you are a resident of capital cities, the service number is: 4004 0127. Residents of other regions can call: 0800 701 0127.

Customer Service (SAC)

The Customer Service (SAC) serves for complaints, general information and cancellation and operates 24 hours a day.

The contact numbers are: 0800 730 5030 or for the hearing and/or speech impaired: 0800 722 0099.

Ombudsman

If you cannot find answers or solutions to your demands in the channels mentioned above, you can contact the CeA Cartão ombudsman on the telephone: 0800 727 9933.

Learn More: Senff credit card: limit, fees and how to apply

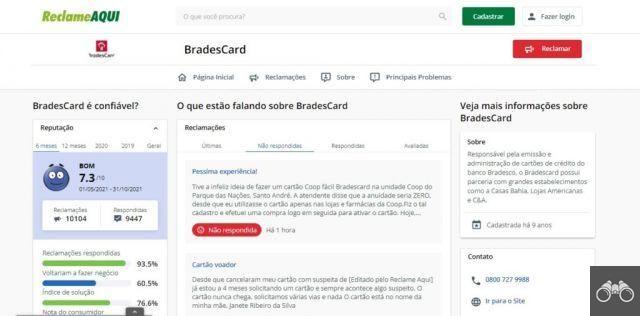

CeA Cards in Reclame Aqui

If you still have doubts about whether or not to request your CeA Cards, an alternative is to check the opinion of other users and Bradescard's assessment, as the card will be issued by Banco Bradesco.

You can do both by accessing Reclame Aqui, as the site is suitable for customers and users to register their complaints and opinions of companies, in addition to receiving scores for reputation assessment.

In Reclame Aqui, taking into account information from May 2022 to October 2022, that is, six months, Bradescard has a reputation of 7.3, being considered a good company.

In addition, they responded to around 93,5% of complaints registered, with a problem resolution rate of 76,6%. Of the customers who registered a complaint, 60,5% stated that they would do business with Bradescard again.

So, what we can say about CeA Cards in general is that it's worth it, even with the negative points.

The positives and advantages can be very useful for some people. You just need to analyze if you will be one of these people and if the benefits received will be useful to you, thus compensating for the annuity payment and the other disadvantages.

Learn More: Losango Card: how it works and how to apply