by Team AllYourVideogames | Dec 1, 2022 | Entrepreneurship |

The acronyms CAPEX and OPEX are common to be heard in meetings, especially corporate meetings. But what could they mean and what are the concepts and applications of both?

They are basically involved with ways of acquiring products, services and contracting, and can be considered categories for business expenses. In this way, CAPEX and OPEX become fundamental ideas if you want to monitor and have greater control of your expenses and your company.

However, these are just superficial explanations, and to be able to perfectly understand and apply CAPEX and OPEX in your company, you need to understand their differences, needs and detailed concepts of both.

Learn more: How to create a slogan for your company?

What is CAPEX and OPEX?

Next, we will explain more fully what CAPEX and OPEX are, so that you know the real definition of both and can apply them perfectly in your company.

CAPEX: what is it?

Also known as capital expenditure, CAPEX is a representation of disbursements in capital goods or investments. That is, the costs of materials that are used to make other products, such as building materials, equipment and several others. Put another way, CAPEX is the fund that will be used for the company to expand its ability to generate profits with the help of acquiring elements.

To make the explanation even simpler, we can say that it is directly related to purchases of goods. CAPEX expenses can also be used to purchase other services and items that will be useful, such as hardware for the company.

It is necessary to be aware that capital expenditures also include services, and not just materials and products. These assets that will be purchased need to be a service or product that further improves the capacity and work of a sector or the functioning of a company's machine.

But CAPEX does not work so simply, since capital expenditure will also be directly linked to the business segment. If the acquired asset has a fiscal year longer than its useful life, amortization should be the path used to capitalize expenses, only in the case of depreciation or intellectual property for tangible assets.

The main purpose of CAPEX will be to divide the cost of the element acquired by the expected useful life of the element, indicated by tax regulations. In the case of analysis of investments in projects, this same index will be used as a basis for calculating the return (ROI).

OPEX: What is it?

OPEX is also known as operational expenditure, and refers to operating expenses, being payments related to sales of products and services and business management activities.

As an example, we can mention a company that buys new computers for its employees. However, it ends up opting for a service that will not only deliver the machines, but also commit to monitoring, updating the system and training employees to use them. It is even possible to rent the machines from a company that also offers maintenance, if it is more economically advantageous.

In short, we can treat OPEX as a “rental” for the provision of services and goods. The main costs of operational expenditure are related to consumables, equipment maintenance and other operating expenses. OPEX expenses are made on a daily basis, usually involving outsourced services.

Another example that can further facilitate your understanding of OPEX spending, and show that you use it almost daily, is the case of streaming services.

In general, you need to pay a subscription to access the offered catalog of movies, series or music, depending on the streaming. You can continue to use the service as long as you make the payment, but the moment you stop paying, the service will stop.

Operational expenditures are also tax deductible, if they are incurred in the same year they were contracted. Thus, it is super important to have good expense management to try to reduce OPEX as much as possible, in a way that does not harm the company's level and quality of service.

In the case of companies, common examples of OPEX expenses that you may encounter are: maintenance and repairs; license fees; publicity; attorneys' fees; office expenses; safe; property fees and administration; spending on vehicles, leases, payroll, travel and raw materials.

Learn more: How do you know if a company name already exists?

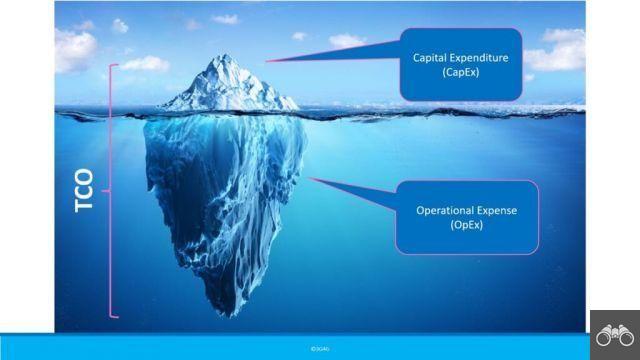

The differences between CAPEX and OPEX and TCO

Image: The 3G4G Blog

Another point that we must always take into account when we talk about CAPEX and OPEX is the total cost of ownership (TCO), which in Portuguese means “total cost of ownership”. TCO is a way of comparing indirect or direct costs over a given period of time.

The total cost of ownership carries out an assessment of expenses to identify the real value of a certain item, and can also identify what will be needed to keep it functioning.

TCO is often confused with CAPEX and OPEX, as the concepts can be very similar. The best way to understand the difference between the three concepts is through an example.

We are going to use an event company to exemplify the TCO, in many places that the events will be held end up not having the necessary electrical energy. In this way, the company will need to use a power generator, and the purchase of this equipment already fits as a capital expense.

In addition, the same generator will also cost employees labor so that it can run smoothly, taking into account operation, lubricants, maintenance parts, transportation to the event location and fuel. This all forms the TCO, which is nothing more, nothing less than the amount used for the operation of the device. Now, if the company decided to rent the generator, they would have the case of an OPEX.

Learn more: Group dynamics: 6 practical examples for your company

How to calculate each of the indices?

The ways to calculate CAPEX and OPEX can vary a lot, but the main rules for calculating each one can be found below.

Calculating CAPEX

In the case of CAPEX, the first thing you need to do is analyze the changes that happen every year in the assets. Likewise, you will also need to account for changes in liabilities in the same one-year period.

After that, you will subtract the change that occurred year by year to get the result of capital expenditure. If we put the calculation in a formula, the result would be:

CAPEX = change in assets — change in liabilities. This is an account that refers to the investment cost so that there can be an increase in the possibility of generating profit for the company.

Calculating OPEX

The calculation of OPEX tends to be simpler than that of CAPEX, since it consists only of the sum of all operating expenses that the company had in a period of one year. This is a more suitable account as an alternative for the company to be able to reduce costs and still generate an increase in productivity.

This analysis also results in some other positive points, which are: cost flexibility increases a lot; there is no need to decapitalize to maintain a cash value using the budget for other purposes; and we also have a decrease in the need for financing, as they end up being diluted over time.

Keep in mind that the other purpose of the OPEX calculation is to find a different form of payment on the bundled services. For this, the company needs to have a guarantee that it has all the necessary resources, such as deployment, monitoring and technical assistance.

difference calculation

It is not surprising in some situations that a company needs to calculate the difference between CAPEX and OPEX. A very common mistake in this account is the multiplication of the monthly amount disbursed in a certain service and the comparison to the value of the equipment. This type of calculation completely ignores indirect costs, so that there is no interference in the operation.

It must be kept in mind that in this type of situation, the entire infrastructure will be developed with growth as a perspective. Until reaching the expected result, the company will have idle capacity, needing to have an estimate of the values of possible profits in mind.

The situation can still be different if we are talking about an investment in IT, since it will be necessary to take into account an average time of depreciation of the equipment, which can vary between 3 and 5 years.

In this space of time, you will still have to spend on upgrade expansion, license renewal, the possibility of equipment discontinuation and device security. Thus, in the calculations it will be necessary to take into account the manpower of the support team, analysts and technicians.

Learn more: Porter's 5 Forces: Is Your Company Competitive?

What is the best methodology to choose?

To define the best methodology to choose between CAPEX and OPEX, it is necessary to take into account several information, such as the peculiarities of the project and the current scenario of your company. You need to know and adjust all your company's expenses, having a super in-depth knowledge of capital expenditures.

It is worth mentioning that it is also quite common for a company to be limited in relation to its total CAPEX that it can have access to, either by the market or by private creditors. This can happen especially if the market is going through some financial crisis.

Because of this, most organizations have the habit of directing their investments to other activities that can generate revenue for the company. Thus, it is common for there to be a greater preference for outsourcing or renting resources and equipment rather than purchasing. This is a way to avoid capital immobilization.

An example of this type of situation is the Infrastructure as a Service (IaaS) format, which is often adopted by companies. In it, all the infrastructures of your business are inserted in the hybrid cloud or in the common cloud, however the first option tends to be more secure. Also, all features are paid for as services and not as products.

This model provides the elimination of expenses with local servers, as they are now operated through the cloud. Among the greatest benefits of this practice we can highlight: ease of maintenance, greater scalability, increased portability and flexibility and reduced expenses. In the Iaas model, all capital expenditures are transformed into operational expenditures, as they refer to cloud services.

Based on this, we can see that the differences between CAPEX and OPEX are many, and the choice for your company should be made taking into account the evaluation of each expense as to how they fit into the objectives and goals for the company's future growth. There are three essential points that can help you make your choice, they are:

- Check if there is the possibility of carrying out the necessary project with or without the fixed investment. The objective will be to define the possibility of using third-party services or whether investments will be necessary;

- In order to assess the ability to generate profit, it will be necessary to make a projection of the project's profits, income and expenses. This projection shall include manufacturing expenses and taxes, service delivery expenses, and purchasing or operating expenses;

- You should have a forecast of how long the investment made will last. For this, our tip is to question the organizational goal of the company.

Learn more: ISO 9000: Know what business quality management is

When you carry out the evaluation with cost and revenue data, together with your projections, you also end up linking these three points mentioned. Due to this, it will be possible to quantify the Internal Rate of Return (IRR) and the Net Present Value (NPV) of CAPEX and OPEX. In the end, you will also need to consider the payback time, called payback.

Summarizing all the points about CAPEX and OPEX discussed so far, the main factors you should keep in mind when making your decision are: cash flow; operational, opportunity and financial costs; fiscal economy; contractual links; and project life cycle.

To analyze each of these factors in the best possible way, it is necessary to evaluate the capital structure, know the market requirements for each type of organization, enterprise risk, indebtedness, tax situation, capital immobilization and relationship with suppliers. When we speak practically, the impacts of the modalities will occur because of: cash flow, equity, tax savings and profit.

Before making your choice, you will need to be careful with the possible linking of data to EBITDA – Earnings Before Interest, Taxes, Depreciation and Amortization, which in Portuguese means “Profit Before Interest, Taxes, Depreciation and Amortization”. It is through this index that we will be able to assess how much the company is able to generate in its operating activities, without taking into account financial investments, loans and taxes.

Going further, EBITDA also allows for the assessment of organizational competitiveness and efficiency in comparison with the competition, especially in a one-year period. That is why you should not add CAPEX in the flow calculation, as this will end up artificially raising the indicator.

In closing, you need to know that all operating expenses need to be treated as investment outlays, and thus not factored into EBITDA. This will ensure that you have a fair and correct value, being able to correctly choose between CAPEX and OPEX without risks of losing money and opportunities with a wrong choice.

Learn more: Offshore what is it and how does it work?

And in the case of the IT sector?

When we compare with other sectors of the company, the IT sector has a difference. Usually, the infrastructure needed in this sector is bigger, and we still have the possibility of cloud computing and OPEX ends up becoming more and more important in some IT functionality.

Speaking of migrating to the cloud, we know that the company will spend less on the purchase of hardware and other traditional software, and this considerably reduces investments in physical assets that are less expenses in the short term and in the long term. This practice offers the advantages of no depreciation of the capital asset.

As a characteristic of the cloud, we have scalability and elasticity, which offers greater agility to increase IT's capacity to meet the necessary demands in the business. On the other hand, it is also always necessary to carry out an analysis of the risks and impacts that a company runs on a daily basis.

Despite all these factors, the choice between CAPEX and OPEX will vary from company to company and project to project, so we should not analyze the numbers individually. The fact is that, depending on the situation, you will need to choose differently between CAPEX and OPEX in this case of the IT sector. But again, this will depend on your analysis and scenarios, not being a rule

Learn more: Upcycling: What is it and how to use it to be more sustainable