by Team AllYourVideogames | Oct 26, 2022 | Credit Cards |

If you are planning to apply for an Americanas Card and you still don't know all the features, then sit back and follow this content that will show you the details of that credit card.

In this post you will learn about the advantages and disadvantages of the Americanas credit card, the benefits, the value of the fees, the limit, how to apply and some other very important information to keep you updated with every detail of this subject. In this way, using the information in this content as a basis, you need to analyze whether or not the Americanas card is worth requesting according to your demand.

Learn more: Online credit card approved instantly: discover the 7 best

How does the American Card work?

The Lojas Americanas Credit Card can be used throughout our country to make purchases in the company's stores and also in other establishments, it is issued in association with Banco Cetelem, and comes with the Visa flag.

To apply for this credit card, you must prove a minimum income of at least one minimum wage and be 18 years of age or older. Throughout this post will be shown in more detail how to apply for the card.

It is important to mention that until 2022 the Americanas card came with the Mastercard brand, and that is why it is possible to see customers with these cards today. Therefore, for those who already have the Americanas card, there is no obligation to exchange it.

Advantages of the American Card

The Americanas customer has many advantages when requesting the store card, especially when it comes to discounts on purchases. That way, the strengths are not just with cashback, there are other programs that are also good, as will be shown shortly.

Love Digital

AME Digital is B2W's cashback platform (the company responsible for Submarino, Shoptime and Americanas.com), that is, it is the program that returns part of the amount spent on a purchase to the consumer. However, it should be noted that not all products receive this benefit, and the return percentage varies. In this way, there are promotions that give 25% cashback, but the vast majority of the percentage is between 10% or 20%.

It is also important to inform you that the AME cashback balance does not have an expiration date, but can only be used in any store in the B2W Digital network or with companies that have signed partnerships. So, it is not allowed to use cashback to pay off any bill at your home, for example.

Learn more: How to supply with AME and get a discount?

More Smiles Program

Mais Sorrisos is Americanas' credit card loyalty program, and just like in other cases, here you can accumulate points for each purchase you make and then exchange them for discounts.

Thus, for every R$1 spent on purchases made at Americanas.com, the customer receives three points (smiles). Now, for every R$1 spent at any other establishment paid using the store card, the person will earn a smile.

When 7500 points are reached, it is possible to redeem a gift card worth R$ 50. When reaching 12 thousand points, the redemption goes up to R$ 100. And when reaching 25 thousand points, the redemption is R$ 250. , this gift must be used within Americanas.com to purchase any product, but is not valid for making payments with AME Digital.

In addition, the person does not need to spend the entire amount redeemed at once. For example, the customer redeemed R$50, of which he can buy something for R$40 and still keep R$10.

But stay tuned that there is a validity to this gift card. The accumulated smiles can only be used until the last day of the following year. For example, if you collected 9 points in 2022 (regardless of the month), they will be valid until December 31, 2022.

To redeem your accumulated points, follow these steps:

Step 1: enter the Americanas website, log in and access your account.

Step 2: Once inside your account, choose the option “Vales” and then the alternative “Vale-Sorrisos”.

Step 3: choose your Smile Voucher and click on “Unlock Vouchers”.

Step 4: Once this is done, your vouchers will be available to buy any product on Americanas.com

Step 5: when you choose the product you want to purchase, click on the “Buy” option

Step 6: In the checkout tab of your order, paste your Smiles Voucher code in the “Do you have a coupon or voucher?” space.

Step 7: click on the “apply” option and check if the voucher has been accepted. If any kind of problem has occurred, you need to contact Americanas through the following email: fidelity@cartaoamericanas.com

American Prime

Americanas Prime is a benefit that offers free shipping on several items from Americanas.com and from merchants who have a partnership with the e-commerce and sell through the marketplace. The customer who wants to use this advantage needs to pay an annual subscription in the amount of R$ 79,90. There is no monthly subscription option.

Those who have the Americanas Card and the Americanas Prime Card can pay for a product in up to 9 interest-free installments.

Learn more: Amazon Prime our country: what it is, how much it costs and 5 advantages

Other advantages of the Americanas Card

- Exclusive discounts on promotions with selected products

- Exclusive sitewide installment alternatives

- Extra limit for purchases in installments over BRL 50 on the website

- Accepted at all Visa or Mastercard accredited locations (older cards)

- Have access to the Vai de Visa program.

Benefits of the Vai de Visa

In addition to the advantages of Americanas itself, it is still possible to obtain benefits with the Visa Flag, which are:

Vai de Visa: this is the loyalty program that offers exclusive promotions and advantages for Visa customers who have registered on the site. Discounts can be redeemed at online stores, restaurants, hotels and other establishments. To see more of this program, click here.

Travel Assistance Service: advantage available to Visa customers who want to verify data about the places they want to visit, in addition to verifying information such as passport and visa required, mandatory vaccinations, health precautions, maps, exchange values and location of ATMs. It is worth mentioning that this service operates 24 hours a day and can be requested through the Visa Service Center.

Learn more: The 18 best travel insurance to buy online

Disadvantages of the American Card

All the disadvantages of the Americanas Card are related to the issue of fees. Below you will see a summary of the negative points and further down the fees will be detailed.

- The Americanas Card has an annual fee of R$13,08 per month, totaling R$156,96 per year. But additional cards are not charged an annual fee.

- Fee of BRL 22 to request a duplicate card

- Fee of BRL 13,90 to make withdrawals at the 24-hour Bank

- Variable interest rates depending on the transaction.

American Card Fees

In addition to the fees already mentioned, there are others that are charged if you use the service, as will be shown below.

Learn more: No annual fee credit card: the best on the market

Emergency assessment request

Americanas has a service that can be useful, especially for those who have a low limit. In this way, if the customer needs to make a purchase and the price of the product exceeds the available limit, it is possible to request an emergency evaluation so that this specific purchase is approved. However, in the months in which this service is in effect, a fee of R$ 18,90 will be charged.

installment fees

For purchases in up to 12 installments, there is no interest. However, if purchases are divided into 18 to 24 installments, interest of 1,99% per month will be charged.

revolving credit

The customer has the option of making invoice payments in installments, but revolving credit interest of up to 18,99% will be charged monthly.

To check more American Credit Card rates, just access this page.

How to apply for an Americanas Card?

With everything you've seen so far, your interest in the card has been aroused, so learn how to apply, it's all very simple and fast. The first step is to go to the Americanas website, go down to the footer and click on “American card”. On the page that opened, click on “Request Card”. Now just log in to your account, then enter your details and finally confirm your order.

After completing the request, your order will undergo an analysis and within 10 days you will receive a message in your email if it has been approved or not. It is also possible to follow the process on the website in the customer space. And if you do not receive a response, you must contact the Relationship Center.

Only after approval will the card be sent and, on average, it takes up to 20 business days to arrive at your home. When you have it in your hands, you need to unlock it through the website in the client login tab.

Do the card advantages also apply to purchases made in physical stores?

The answer to this question to be simple and straightforward is: no. Despite this, it is possible to make purchases using the Americanas Card both on the website and in physical stores, but advantages such as cashback are only for the online store. Think that in physical stores the Americanas card was like any other.

This is because the physical Lojas Americanas and Americanas.com have separate operations, however they operate together. But, for example, you can buy a product on the website and pick it up in a physical store.

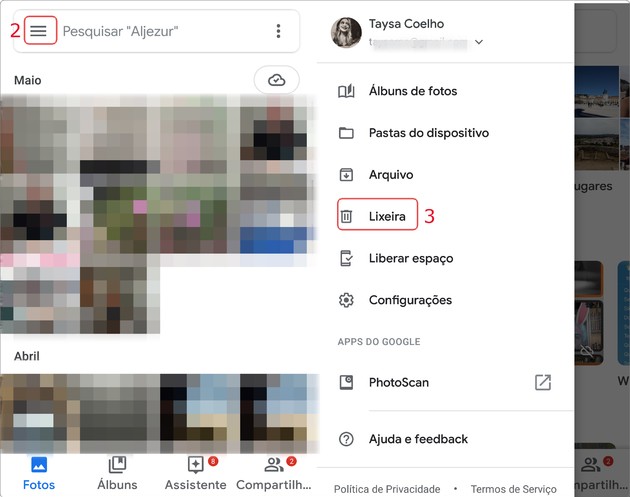

How to verify Americanas Card transactions?

In addition to the e-commerce app itself, Americanas.com has a partnership with the Cetelem bank, so all transactions made can be followed through Internet Banking (web) and in this bank's application, available for Android and IOS.

What is the Lojas Americanas credit card limit?

The Americanas Credit Card limit is established by Banco Cetelem individually for each request, and is based on the customer's credit history and seeks to offer a limit trying to reconcile the person's needs and their ability to make payments.

If your request is approved, but you consider that the limit released for your card was below your expectation, you can make a request to increase the amount available.

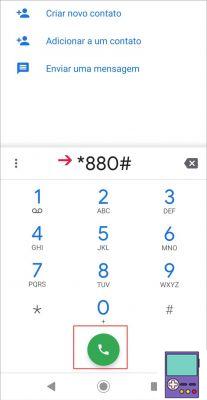

To start the process, you must send a message to the following e-mail address: limite@cartaoamericanas.com, enter your full name, CPF and a justification for the increase in your limit. There is also the option to call the Banco Cetelem Relationship Center at the numbers: 4004-7990 for capitals and metropolitan regions or 0800 704 1166 for other regions. However, to open this process of asking for more limit, you must have the card for at least four months since it was unlocked.

Additional Credit Cards

In addition to your main Americanas card, you can order up to three additional cards without increasing monthly fees. Therefore, this benefit has the following rules:

- People who will receive the additional cards must be at least 16 years old

- Everything paid using the additional cards will appear on the holder's monthly bill, that is, multiple slips are not generated.

To request an additional credit card, you must contact the same numbers or email address as in the previous topic. Remembering that the opening hours are from Monday to Saturday, from 08:22 to XNUMX:XNUMX.