by Team AllYourVideogames | Oct 5, 2022 | Technology |

A Alume Financing aims to provide financial solutions without bureaucracy and customized according to the reality of medical students.

For this, it uses technology and finance to offer products that are related to consumer planning, without putting financial health at risk, with practicality and transparency.

If you are in need of help in the final stretch of college or need extra help to pay tuition fees, keep reading this article.

From now on, we will explain how Alume Financing works, what are its features, benefits, among other issues.

Learn More: How to pay off a loan and pay less interest?

Alume Financing: how does it work?

Before finding out if Alume Financiamento is reliable, let's understand better what services are offered by the company:

1. Undergraduate funding

The first service on our list can be activated from the third semester.

It is suitable for students who seek more practicality and low interest rates.

The contract can be used by those people who are interested in placing the property as collateral.

There are several reasons why you should opt for undergraduate funding.

Discover the most important ones below:

- Tuition fees are set in such a way that the student's financial budget is not compromised. To give you an idea, the financing allows the student to pay tuition fees up to 80% lower during the course;

- The values of the installments do not change during the academic career. The student can pay the university fee within 15 years after completing the course;

- It is not necessary to renew the financing. The benefit is approved until the end of the course and the installments do not accumulate;

- The company serves students from educational institutions across the country. The most important thing is to check if the property can participate in the financing.

When the student places the property as collateral, he is able to acquire financing with lower values and that are related to his financial reality.

To get an idea, it is possible to include several properties as collateral.

Among the most common are: houses, apartments and commercial rooms.

Properties need to meet certain requirements to be included in student funding:

- Released properties: houses, apartments or commercial rooms;

- Properties located in municipalities with more than 50 thousand inhabitants;

- Properties located in the South, Southeast or Midwest regions;

- The property must be registered.

There are three steps that students must go through to be eligible for this benefit:

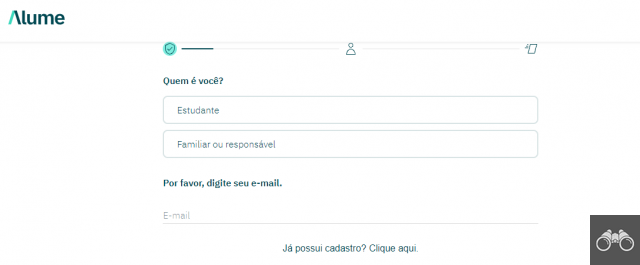

- Request: open your account on the official website of Alume Financiamento. Make a simulation (see image below) and ask for your financing;

- Analysis: A professional will contact the student to learn more about the order;

- Release of resources: the resources will be deposited in the student's current account, so that he can pay the educational institution more easily.

2. Internship Financing

Students can also take advantage of intern funding.

It is ideal for those people who seek more tranquility to concentrate on the final stretch of the course.

The service is offered with interest starting at 1,39% monthly.

This type of funding brings several benefits to students:

- The monthly fee is low. The company finances up to 80% of the amount;

- You can choose a two-month grace period and up to five years after completion of the course to complete the payment;

- Hiring is done online. There are no papers to sign and it can be requested at any time of the year;

- The startup serves all educational institutions in the country.

Financing can start at any time of the year.

It is suitable for students who attend at least the 9th period.

It is essential to make it clear that the student will need a guarantor to prove income.

The positive side is that the process is not bureaucratic, ensuring more flexibility for the consumer.

Find out below the steps required to hire this type of financing:

- Request: open an account on the official website of Alume Financiamento, make a request and ask for your financing;

- Analysis: a professional from the company will contact the student to clarify the main doubts;

- Release of resources: resources are automatically forwarded to the educational institution.

3. Financing allowances

You receive up to R$1.200 monthly to help you with the cost of living.

The student has up to three years to make the payment upon completion of the course.

The process of contracting the financing is practical and fast, without the absence of papers.

The company serves students from all financial institutions in the country.

The allowance is released to the medical student from the seventh semester.

Here, it is not necessary to have a guarantor and proof of income.

The amount is automatically forwarded to the student's account.

The contracting steps are similar to the previous alternatives: request, review and release of resources.

Alum Accounting also offers medical professionals the opening of a PJ account free of charge.

The startup manages the company's capital, giving more time available to take care of other important details, such as patients and career.

Is Alum Financing reliable?

Yes. The student finance platform does not act in any way.

It is authorized by the Central Bank of our country and acts as a correspondent bank.

The company does not ask the customer to send a deposit or payment by approximation to be entitled to benefits.

To ensure consumer safety, the platform does not forward email addresses with extensions, such as: @gmail, @yahoo and @hotmail.

So if you get an email in those patterns, ignore it.

Content can be a scam.

Give preference to messages that are sent with the following address: @alume.com.

It is never too much to remember that the page has an SSL certificate, the one that verifies that the site is safe and does not present risks to users.

According to the platform, all user data is stored securely.

Your personal information is not shared with others over the internet.

A negative point of the company is that it does not offer a telephone service for the student to ask the main questions about the platform.

If you have questions about technical issues with the page, you must send an email to the company.

The contact is: contato@alume.com.

The page does not inform the response time of the team of experts.

For users who have questions about personal information, please contact us at the following email address: privacy@alume.com.

What is the assessment of Alume Financing on Reclame Aqui?

Reclame Aqui is a great source to find out what a company's reputation is in the market.

As of September 2022, Alume Financiamento still did not have a score recorded on the platform.

So far, she's only had two customer complaints that have been resolved.

Therefore, it is possible to say that Alume Financiamento is reliable, since consumers are not in the habit of registering complaints in this tool.

Alume Financiamento is as efficient as other alternatives available on the market, such as: Sicredi Medicine financing, Santander Medicine financing and Medicine financing Bank of our country.

Conclusion

Alume Financiamento is one of the best options on the market to guarantee child financing.

The process is not bureaucratic and can be completed in a few minutes.

The most interesting thing is that the student can apply for funding in the comfort of their own residence.

All you need is a computer or cell phone connected to the internet.

The company has great solutions for students.

With the allowance service, for example, the student can have more peace of mind to finish their graduation, since the amount helps to deal with financial issues that can disrupt their routine.

The fact that the platform is regulated by the Central Bank of our country brings even more confidence in relation to the service, since the institution is a reference in the financial market.

About Alume Financing

The company was created in 2022.

A group of young entrepreneurs was responsible for introducing the platform to the market with the aim of simplifying the relationship between students and student finance in our country.

The startup won the 38th INSEAD Venture Competition.

To give you an idea, it won the dispute with 200 other companies in the world.

The event was built by the European business school, INSEAD.

She is one of the main references on the subject.

After discovering the main details about Alume Financing, learn how to simulate online vehicle financing.